If You Had Bought Harrow Health (NASDAQ:HROW) Shares Three Years Ago You'd Have Earned119% Returns

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But if you buy shares in a really great company, you can more than double your money. For instance the Harrow Health, Inc. (NASDAQ:HROW) share price is 119% higher than it was three years ago. That sort of return is as solid as granite. It's also good to see the share price up 23% over the last quarter. But this could be related to the strong market, which is up 17% in the last three months.

View our latest analysis for Harrow Health

Harrow Health isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over the last three years Harrow Health has grown its revenue at 30% annually. That's well above most pre-profit companies. Along the way, the share price gained 30% per year, a solid pop by our standards. This suggests the market has recognized the progress the business has made, at least to a significant degree. That's not to say we think the share price is too high. In fact, it might be worth keeping an eye on this one.

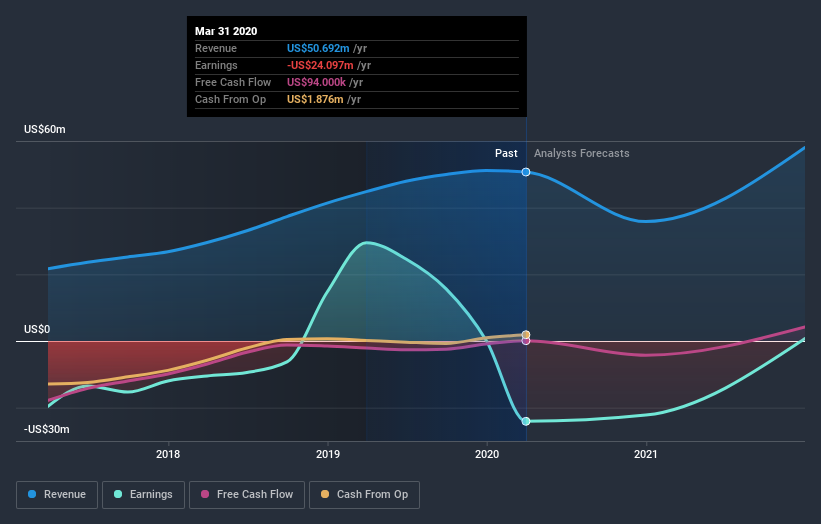

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market gained around 9.7% in the last year, Harrow Health shareholders lost 28%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 5.2% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Harrow Health better, we need to consider many other factors. For example, we've discovered 3 warning signs for Harrow Health that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo News

Yahoo News