If You Had Bought NN's (NASDAQ:NNBR) Shares Three Years Ago You Would Be Down 83%

Every investor on earth makes bad calls sometimes. But really big losses can really drag down an overall portfolio. So consider, for a moment, the misfortune of NN, Inc. (NASDAQ:NNBR) investors who have held the stock for three years as it declined a whopping 83%. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. And over the last year the share price fell 41%, so we doubt many shareholders are delighted. More recently, the share price has dropped a further 26% in a month.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

View our latest analysis for NN

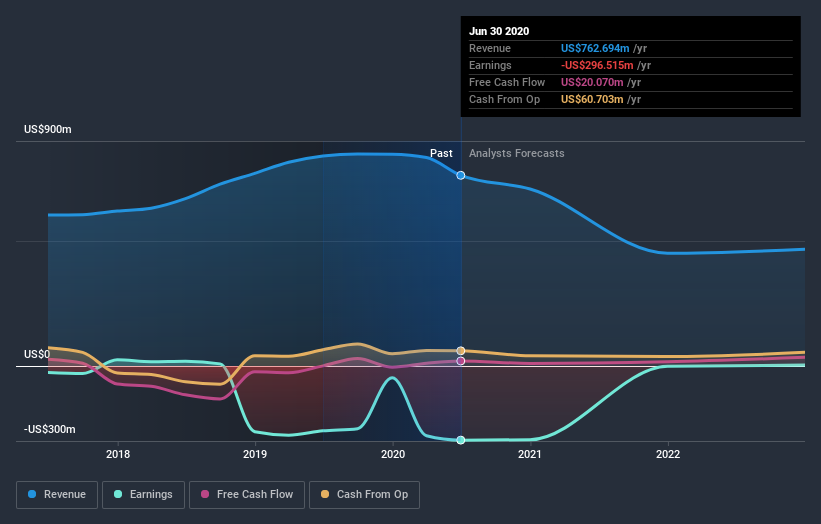

Because NN made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, NN saw its revenue grow by 12% per year, compound. That's a pretty good rate of top-line growth. So it seems unlikely the 22% share price drop (each year) is entirely about the revenue. More likely, the market was spooked by the cost of that revenue. If you buy into companies that lose money then you always risk losing money yourself. Just don't lose the lesson.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at NN's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market gained around 19% in the last year, NN shareholders lost 41%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 12% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with NN , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo News

Yahoo News