If You Had Bought Opiant Pharmaceuticals (NASDAQ:OPNT) Stock Five Years Ago, You Could Pocket A 63% Gain Today

Opiant Pharmaceuticals, Inc. (NASDAQ:OPNT) shareholders might understandably be very concerned that the share price has dropped 32% in the last quarter. But that doesn't change the fact that the returns over the last five years have been pleasing. It has returned a market beating 63% in that time.

Check out our latest analysis for Opiant Pharmaceuticals

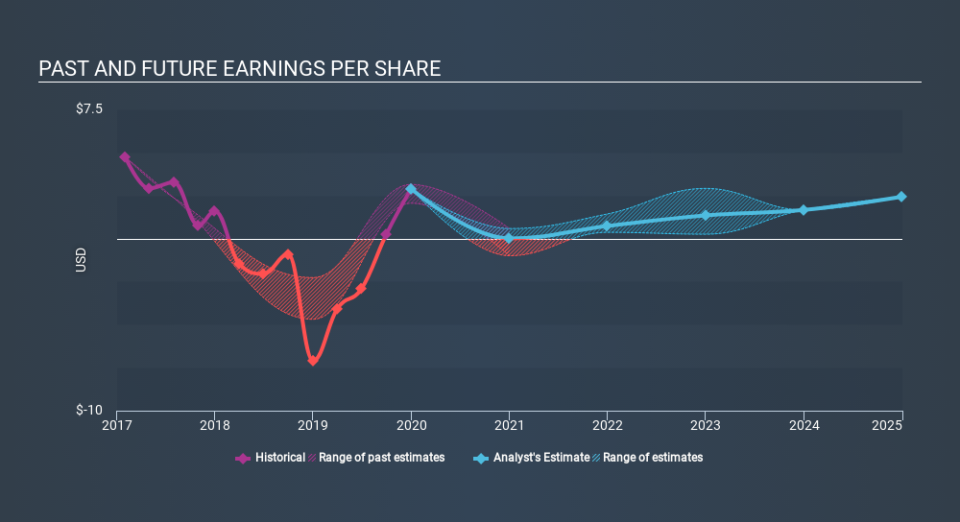

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last half decade, Opiant Pharmaceuticals became profitable. That's generally thought to be a genuine positive, so we would expect to see an increasing share price.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. Dive deeper into the earnings by checking this interactive graph of Opiant Pharmaceuticals's earnings, revenue and cash flow.

A Different Perspective

We regret to report that Opiant Pharmaceuticals shareholders are down 25% for the year. Unfortunately, that's worse than the broader market decline of 11%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. On the bright side, long term shareholders have made money, with a gain of 10% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for Opiant Pharmaceuticals you should know about.

Opiant Pharmaceuticals is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo News

Yahoo News