If You Had Bought Synertec (ASX:SOP) Stock A Year Ago, You'd Be Sitting On A 11% Loss, Today

It's easy to match the overall market return by buying an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. Investors in Synertec Corporation Limited (ASX:SOP) have tasted that bitter downside in the last year, as the share price dropped 11%. That's disappointing when you consider the market returned 25%. Synertec hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. It's down 17% in about a quarter.

Check out our latest analysis for Synertec

Synertec wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Synertec saw its revenue grow by 111%. That's well above most other pre-profit companies. Given the revenue growth, the share price drop of 11% seems quite harsh. Our sympathies to shareholders who are now underwater. Prima facie, revenue growth like that should be a good thing, so it's worth checking whether losses have stabilized. Our brains have evolved to think in linear fashion, so there's value in learning to recognize exponential growth. We are, in some ways, simply the wisest of the monkeys.

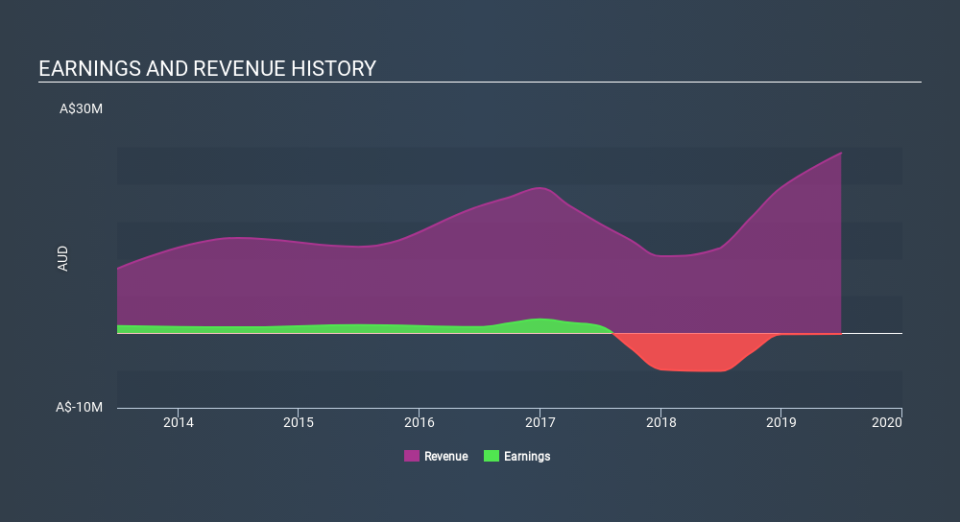

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Synertec's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Given that the market gained 25% in the last year, Synertec shareholders might be miffed that they lost 11%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. It's worth noting that the last three months did the real damage, with a 17% decline. So it seems like some holders have been dumping the stock of late - and that's not bullish. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Synertec has 5 warning signs (and 2 which are concerning) we think you should know about.

But note: Synertec may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo News

Yahoo News