Hammerson unveils rental shake up as losses widen to £1bn

Shopping centre firm Hammerson is plotting a shake-up of rent charges as it battles to survive after plunging to a £1bn loss.

The Birmingham Bull Ring owner could tie rent to the sales which shops make, as part of a bid to help tenants cope with a catastrophic slump in footfall while ensuring it does not miss out financially.

Chief executive David Atkins unveiled the overhaul as Hammerson posted dismal half-year results including an 8pc slump in the value of its portfolio.

He also announced a £551.7m rights issue fundraising and £274m sale of its stake in VIA Outlets, a chain of designer sites on the Continent. Hammerson is fighting to pay down debts of £3bn.

The company already allows some shops to pay rent based on their turnover, but is considering a wider expansion of this system to replace the old fixed quarterly costs. It could also link payments to click-and-collect sales to ensure a cut of internet revenue.

Stores have repeatedly called for a change in how rents are collected, claiming that they struggle to pay bills which date from the pre-internet age because sales have been hoovered up by online rivals.

Mr Atkins said: “The UK’s historic leasing model has served its time. It is outdated, inflexible and needs to change.

"We are introducing a new UK leasing approach - one that is simpler, reflects an omnichannel retail environment and rewards positive performance on both sides.

"It will deliver a sustainable, growing income stream and we are in initial discussions with retailers and anticipate introducing the first of the new leases later this year.”

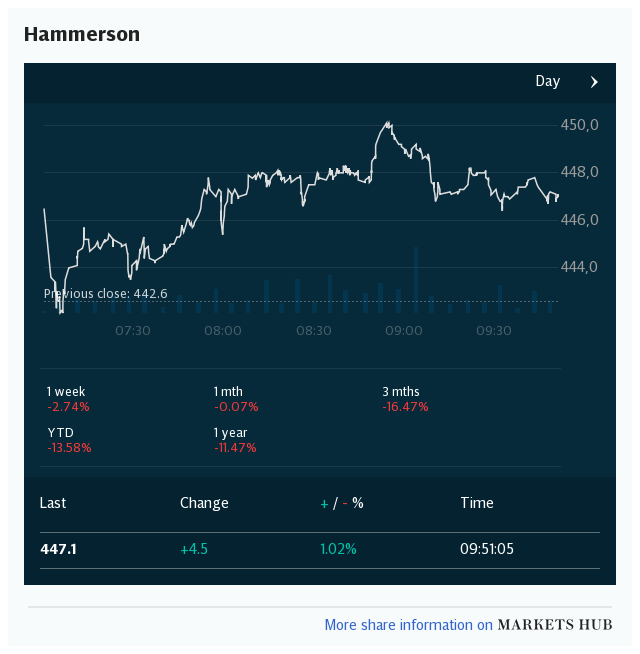

Shares sank 10.26pc to 50.22p in early trading, valuing the company at £384m.

It means shares have fallen 83pc since the start of the year, in a boost for a string of short-sellers betting on a slump in the value of the business.

Shopping centre owners have been hit hard by the pandemic after tenants were forced to close, starving landlords of rental income. Hammerson's rival Intu went bust last month.

Remit Consulting estimates commercial landlords have not been paid about £1.5bn owed between April and June, and are on track for similar pain this quarter.

Hammerson revealed it had collected just 34pc of rent owned on its June collection date, and 46pc of that due in March.

On a more positive note, occupancy remains relatively strong at 94pc across the portfolio, and 93pc in UK flagship destinations.

Hammerson said that the rights issue is backed by its two largest shareholders, APG and the activist Lighthouse Capital.

It hopes those funds - along with proceeds from the sale of VIA to APG Asset Management - can bring its debt down to £2.2bn.

Colm Lauder, real estate analyst at Goodbody, said he expects Hammerson to sell off more assets.

He added: "We are intrigued by the proposal for a 'new UK leasing approach' which will move shopping centre and presumably retail park leases to more of a turnover-based model, with the aim of stabilising rents at more sustainable levels."

Yahoo News

Yahoo News