Hibbett's (HIBB) Q1 Earnings Miss Estimates, Sales Down Y/Y

Hibbett Sports Inc. HIBB posted first-quarter fiscal 2021 results, wherein the bottom line lagged the Zacks Consensus Estimate. Further, both bottom and top lines declined year over year. Although both store and online comps were gaining traction, the onset of the ongoing COVID-19 pandemic hurt sales to a large extent. Moreover, it withdrew its fiscal 2021 view citing the unprecedented impacts of COVID-19. However, management highlighted that second-quarter sales remain positive.

Q1 Highlights

Hibbett’s adjusted earnings of 31 cents per share missed the Zacks Consensus Estimate of 43 cents and plunged 80.7% from $1.61 reported in the year-ago quarter.

Net sales declined 21.4% year over year to $269.8 million in the quarter under review. The downside can be attributed to majority of stores being closed or open for limited hours in a bid to fulfill online orders and curbside pick-up. E-commerce sales accounted for 22.3% of total sales in the fiscal fourth quarter. Moreover, digital sales surged 110.5%. However, the company started reopening Hibbett Sports and City Gear stores toward the end of April.

Comparable store sales (comps) fell 19.4% in the quarter due to weak performance in the brick-and-mortar stores. Prior to the coronavirus outbreak, it witnessed sturdy growth in men’s apparel, with the women and kid’s categories making a comeback. Moreover, the footwear unit was in good shape, particularly women’s footwear.

However, sales were largely affected as the majority of stores were closed due to the emergence of the coronavirus. Nonetheless, comps got back on track toward the end of the quarter, despite few stores being opened. The company also noted that this positive momentum has continued in May as a few more stores have started to reopen.

Gross profit slumped 37.5% to $74.1 million in the reported quarter. However, adjusted gross margin contracted 540 basis points (bps) to 29.4% on account of store closures.

Operating loss was $22.1 million against operating income of $37.3 million in the prior-year quarter. Adjusted store operating, selling and administrative (SG&A) expenses expanded 280 bps to 23.9%, as a percentage of sales.

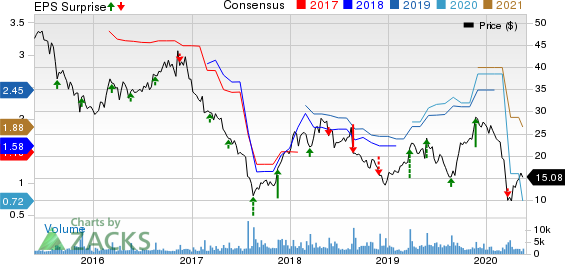

Hibbett Sports, Inc. Price, Consensus and EPS Surprise

Hibbett Sports, Inc. price-consensus-eps-surprise-chart | Hibbett Sports, Inc. Quote

Other Financial Aspects

Hibbett ended the quarter with $106.2 million in cash and cash equivalents and $25 million available under its credit facilities. Total stockholders’ investment, as of May 2, was $304.6 million.

Further, Hibbett repurchased 458,913 shares for $10.2 million in the fiscal first quarter. As of Feb 1, it had $143.3 million remaining under its authorization for share repurchase through Jan 29, 2022. Capital expenditures came in at $4.1 million during the reported quarter.

Store Update

In first-quarter fiscal 2021, the company introduced three stores and rebranded two Hibbett stores to City Gear. However, it shut eight underperforming outlets. Hence, it ended the quarter with 1,078 stores across 35 states.

Price Performance

In the past six months, this Zacks Rank #4 (Sell) stock has slumped 33.6% compared with the industry’s 12% decline.

3 Stocks to Watch in the Retail Space

The Kroger Co. KR has an impressive long-term earnings growth rate of 4.9% and a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Office Depot ODP, also a Zacks Rank #2 stock, has an impressive long-term earnings growth rate of 6.8%.

Lowes Companies LOW, which presently carries a Zacks Rank #2, has an expected long-term earnings growth rate of 15.2%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2021.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lowes Companies, Inc. (LOW) : Free Stock Analysis Report

Hibbett Sports, Inc. (HIBB) : Free Stock Analysis Report

Office Depot, Inc. (ODP) : Free Stock Analysis Report

The Kroger Co. (KR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo News

Yahoo News