Holidaymakers being 'ripped off' by 20 per cent VAT on Covid tests

Holidaymakers are being "ripped off" by being forced to pay 20 per cent VAT imposed on PCR tests, The Telegraph can reveal.

The Treasury is raking in hundreds of thousands of pounds from taxing PCR tests conducted by Government-approved private testing firms on travellers coming into the UK.

The charge has been introduced by the Treasury despite an EU recommendation last year that testing kits should be exempt from VAT, as is the case with personal protective equipment.

In the EU, the average cost of PCR tests is less than half the price in the UK, where they average around £130 apiece compared with just £60 in most EU countries.

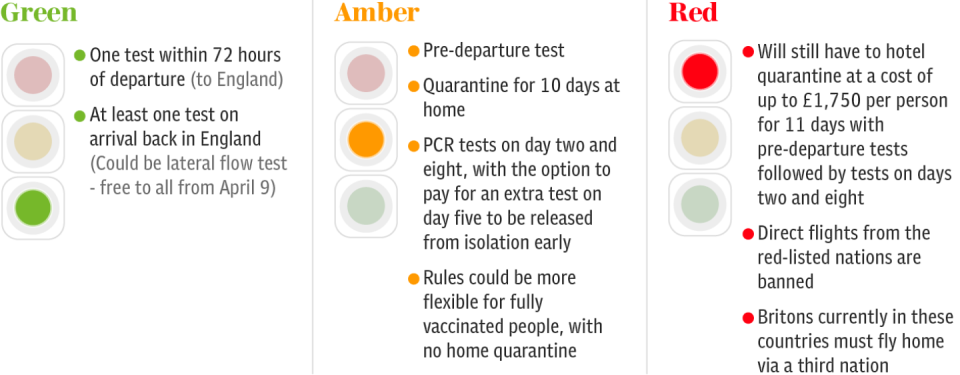

The disclosure follows the Government's decision to require every holidaymaker returning to the UK to pay for a "gold standard" PCR test on or before day two of their arrival even if they have been to a "green list" country and have been fully vaccinated.

An investigation by The Telegraph found some companies registered as official providers by the Government are charging between £200 and £300 for a single PCR test.

That would potentially add more than £1,200 to the cost of a family of four's holiday – of which the Treasury would take a cut of £240, or 20 per cent.

Paul Charles, the chief executive of travel consultancy The PC Agency and the co-founder of the Save our Summer campaign, said: "It is not out of choice that people are having to buy these tests. Testing is a requirement and therefore should not have VAT applied.

"It doesn't help the travel sector to recover when tests are 20 per cent more expensive. The Chancellor urgently needs to look at this because it will choke any recovery, especially from green countries, due to the onerous testing that is needed."

David Evans, the joint chief executive of Collinson, one of the UK's biggest testing companies, said: "The very first thing the Government can do to make testing more affordable is to remove VAT right across the supply chain."

He also pointed out that the NHS itself was charging travellers more for its tests than firms like his despite Grant Shapps, the Transport Secretary, pledging to drive down "rip-off" test prices and remove profiteering companies from the Government's register.

"The NHS price for an amber test package [of two tests] is £210, significantly more expensive than Collinson and several other private testing providers' prices," added Mr Evans.

Another travel industry chief said: "The Transport Secretary's demand to the private testing sector to slash prices is in danger of backfiring unless he gets the Treasury to sort out its 'rip-off' VAT rates on testing."

The Government faced a backlash when it announced that it was ditching quarantine for holidaymakers returning from "green list" countries but would still require all travellers to pay for a PCR test on their return.

On Sunday, The Telegraph revealed profiteering by some companies charging up to five times as much as the cheapest, which charge just £60 per PCR test.

A Government spokesman said VAT was a broad-based tax on consumption and the standard rate of 20 per cent normally applies to most goods and services, such as testing kits. "We keep all taxes under review," he said.

"We recognise the cost of tests can be high, which is why we're working with the travel industry and private testing providers to see how we can further reduce the cost of travel for the British public, while ensuring travel is as safe as possible."

Yahoo News

Yahoo News