Hospitality sector faces £9bn bill for reopening delay

The delayed reopening of hospitality will cost the sector £9bn, bosses have warned, as MPs demanded the Chancellor ramp up support for businesses at the Budget on Wednesday.

In a letter sent to Rishi Sunak, a group of 80 MPs warned that pubs, restaurants and hotels have been “ravaged” by the coronavirus crisis and urged the Chancellor to invest in the sector to support the recovery.

New figures by trade body UKHospitality revealed that the delayed reopening of businesses would cost £9bn in lost sales and other costs compared with reopening from April 1 and lifting all restrictions by June 21.

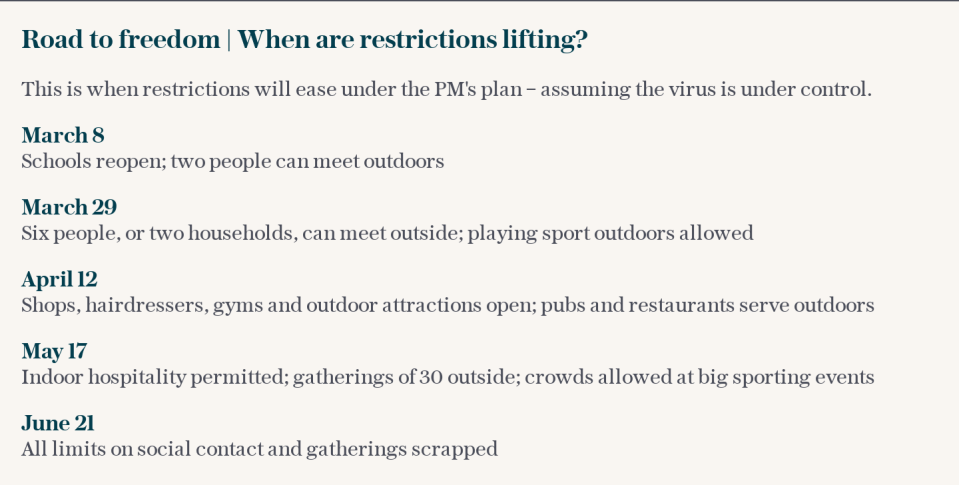

Under the PM’s roadmap out of lockdown, pubs and restaurants in England could be allowed to serve customers outside from as early as April 12 but will have to wait until May 17 to reopen indoors. Hotels and B&Bs will also be required to wait until May to reopen.

UKHospitality warned the staggered reopening plan puts at risk a further 99,000 jobs unless the Government’s furlough scheme is extended beyond April. The sector has lost an estimated 660,000 jobs since the crisis hit.

The Treasury has already confirmed the Budget will include a £5bn scheme to provide grants of up to £18,000 for high street and hospitality firms. However, the all-party parliamentary group for hospitality and tourism called on Mr Sunak to also extend the temporary VAT cut for a further year and to apply the relief to alcoholic drinks sold on-premise, as well as extending it to the broader leisure sector and weddings.

They urged Mr Sunak to replace the scrapped job retention bonus, extend business rates relief and introduce improved loan repayment terms and HMRC tax deferrals.

“These sectors have proved historically, and even in the last twelve months, that they can drive economic growth,” the letter said.

“Following the last financial crisis, hospitality drove the ‘jobs miracle’ boosting its workforce by half a million in a decade.”

It came as a group of almost 400 firms called for Mr Sunak to scrap repayments on Government-backed loans to prevent a wave of insolvencies.

In an open letter last week, business leaders urged the Chancellor to write off debt accumulated by small and medium-sized firms that took on business interruption loans and bounce back loans. It estimates the cost of writing off loan repayments would cost the Treasury roughly £68bn.

“SMEs need a lifeline and writing off Government-backed loans would give companies the best possible opportunity to keep trading long into the future,” it read.

It comes despite Mr Sunak recently extending the repayment time for the 1.4m small firms who took on bounce back loans to 10 years, rather than six, reducing monthly payments which are due to start in May. Businesses can also choose to make interest-only payments for six months, or pause repayments for up to six months.

Yahoo News

Yahoo News