How Realistic Was The Big Short?

‘The Big Short’ was a star-studded film that showed how four traders made a fortune from the financial crash of 2008. Starring the likes of Steve Carell, Ryan Gosling, Christian Bale and Brad Pitt, it attempted to explain the complex economics behind the causes of the so-called ‘Great Recession’ and show us what life was really like on Wall Street.

The film was nominated for five Oscars and won rave reviews, but how realistic was it? We investigated…

The A-list cast looked similar-ish to their real life counterparts

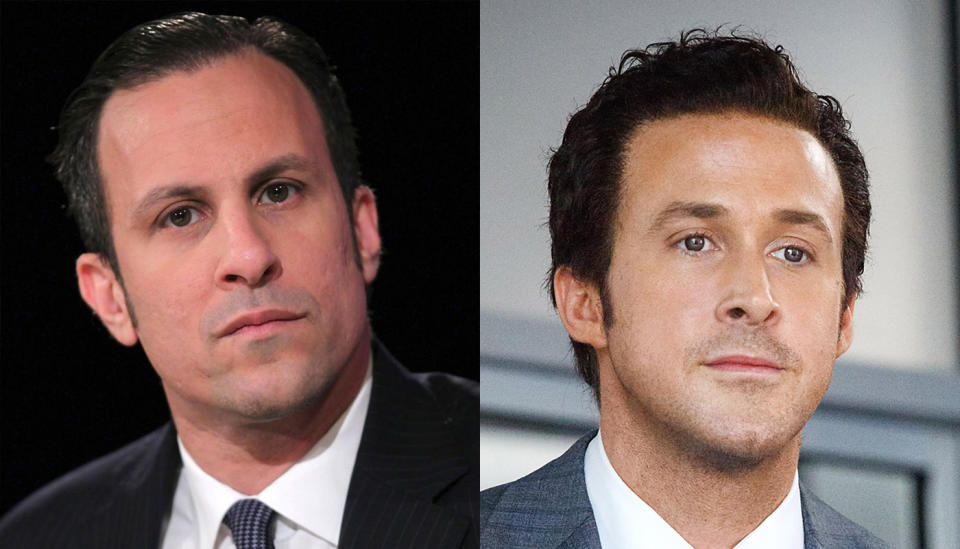

Ryan Gosling’s arrogant trader Jared Vennet really looked like this:

The character was based on a real life top trader at Deutsche Bank called Greg Lippmann.

According to Michael Lewis, the author of ‘The Big Short’, Lipman modeled his hair on Gordon Gekko, Michael Douglas’ amoral protagonist in ‘Wall Street’. He left Deutsche in 2010 to start his own hedge fund, LibreMax Capital.

Steve Carrell’s principled Hedge fund manager Mark Baum was based on Steve Eisman, below, left.

In 2011 he left FrontPoint, the fund featured in the film, after a colleague was accused of insider trading, and started his own fund. Talking about his portrayal in the film to the Boston Globe, he said: “It’s not 100%. What I would say is: Eliminate my sense of humour and make me angry all the time, and that’s the portrayal. It’s accurate enough, but it’s not really me.”

And Christian Bale’s quirky hedge fund manager Michael Burry looks like this.

Not that close a match, though Bale did wear Burry’s real life shorts and t-shirt in the film. In real life Dr. Burry is still CEO of Scion Asset Management, the company that made billions in the film and he really did invest in water after the financial crash.

The film did a good job explaining the economics

‘The Big Short’ is filled with complicated concepts, such as credit default swaps, collateralized debt obligations, residential mortgage-backed securities and so on. The film explains these concepts with amusing celebrity cameos, such as Margot Robbie in a bath or Selena Gomez in a casino, but despite the flippant trappings the economics are sound, according to expert in Wall Street history Annaline Dinkelmann.

She said: “The film got it right. They explained very complicated events/systems in easy to understand language.”

Celebrated economist Paul Krugman agrees, writing in the New York Times that the film “does a terrific job of making Wall Street skulduggery entertaining, of exploiting the inherent black humour of how it went down… [did] the movie got the underlying economic, financial and political story right? The answer is yes, in all the ways that matter.”

Key scenes such as the Baum’s team flying to Florida to investigate abandoned cul de sacs, or Burry persuading sniggering investment firms to buy insurance against the defaults of Residential mortgage-backed securities did actually happen. The script also does a good job of telling you when something didn’t happen the way they portray it in the film, such as when young investors Charlie Geller (John Magaro) and Jamie Shipley (Finn Wittrock) accidentally discover Vennet’s prospectus, but the film then pauses to tell us that in real life they heard about it from a friend.

But there’s stuff that got left out

For understandable reasons of length, ‘The Big Short’ omitted many key players and events in the story. One key element that is touched on in the film, but not expanded on, is the collapse of Lehman Brothers, the financial services firm that declared bankruptcy after its involvement in the sub-prime mortgage crisis.

“In the aftermath of Lehman filing for bankruptcy, several other banks folded. It would be too much to also include that in the movie. That is a movie in its own right,” says Dinkelmann.

Another aspect that the film only mentions is the alleged corruption of mortgage financiers Fannie Mae and Freddie Mac and the role they played in the collapse.

In his article, Krugman also said that the characters we see in the Big Short were not the only people who saw the upcoming problems. “The group of people who recognized that we were experiencing the mother of all housing bubbles, and that this posed big dangers to the real economy, was bigger than the film might lead you to believe. It even included a few (cough) mainstream economists.

“But it is true that many influential, seemingly authoritative players, from Alan Greenspan on down, insisted not only that there was no bubble, but that no bubble was even possible.”

He goes on: “While the movie gets the essentials of the financial crisis right, the true story of what happened is deeply inconvenient to some very rich and powerful people.”

Watch an extended clip from ‘The Big Short’ below.

The Big Short is available on Digital on 16th May and Blu-ray & DVD 23rd May.

Read more:

The Star Wars Prequel Moments That Annoyed Fans The Most

Who Are The Most Successful X-Men Stars?

10 Film Posters That Were Banned

Yahoo News

Yahoo News