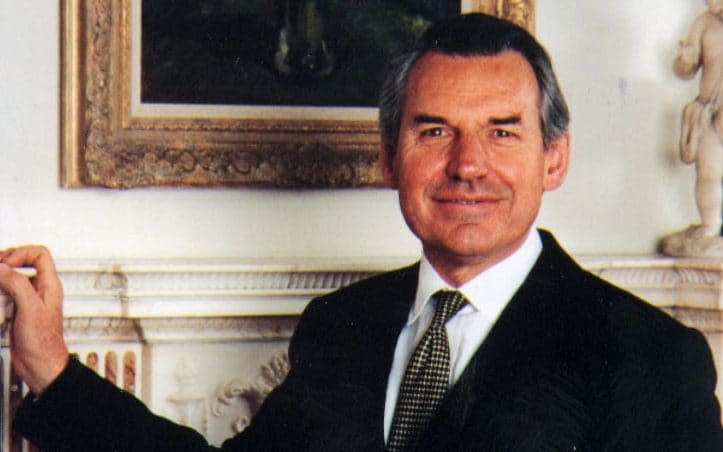

Hugh Jenkins, formidable investor of the National Coal Board’s pension funds – obituary

Hugh Jenkins, who has died aged 90, was one of the City of London’s most powerful investors as director-general of the National Coal Board’s pension funds and chairman of the Prudential’s investment arm.

Originally a property specialist, Jenkins – sometimes known in the Square Mile as “Hugh the Coal” for his Welsh origins – was not yet 40 when he was promoted in 1973 to take charge of the portfolio of equities, bonds and real estate interests that funded miners’ pensions.

As markets crashed later that year, he was the youngest key player in the drama of Wednesday December 19, when bankers and investment institutions were closeted overnight in the Bank of England under orders from Governor Gordon Richardson to save Cedar Holdings – a “secondary bank’ in which NCB held shares but whose imminent failure threatened a domino collapse across the City.

Acutely conscious of his duty to protect pensioners’ interests, Jenkins had “an overwhelming feeling that we should not be putting good money after bad”. But in the early hours, after stormy negotiations, he agreed to join a £72 million support package to which Barclays and other lenders had committed.

Buoyed by that breakthrough, Richardson and his deputy Jasper Hollom – whom Jenkins described as “remarkable for their sangfroid” – went on to launch the Bank of England’s successful “lifeboat” scheme, marshalling City forces to sustain other vulnerable lenders through the crisis.

An observer of the Cedar episode noted Jenkins’s “dark Celtic good looks”, describing him as “formidable, strong-minded… and endowed with native wisdom; woe betide any person who disagreed with him without having done his homework… and woe betide any person who attempted to persuade or dissuade him without solid argument.”

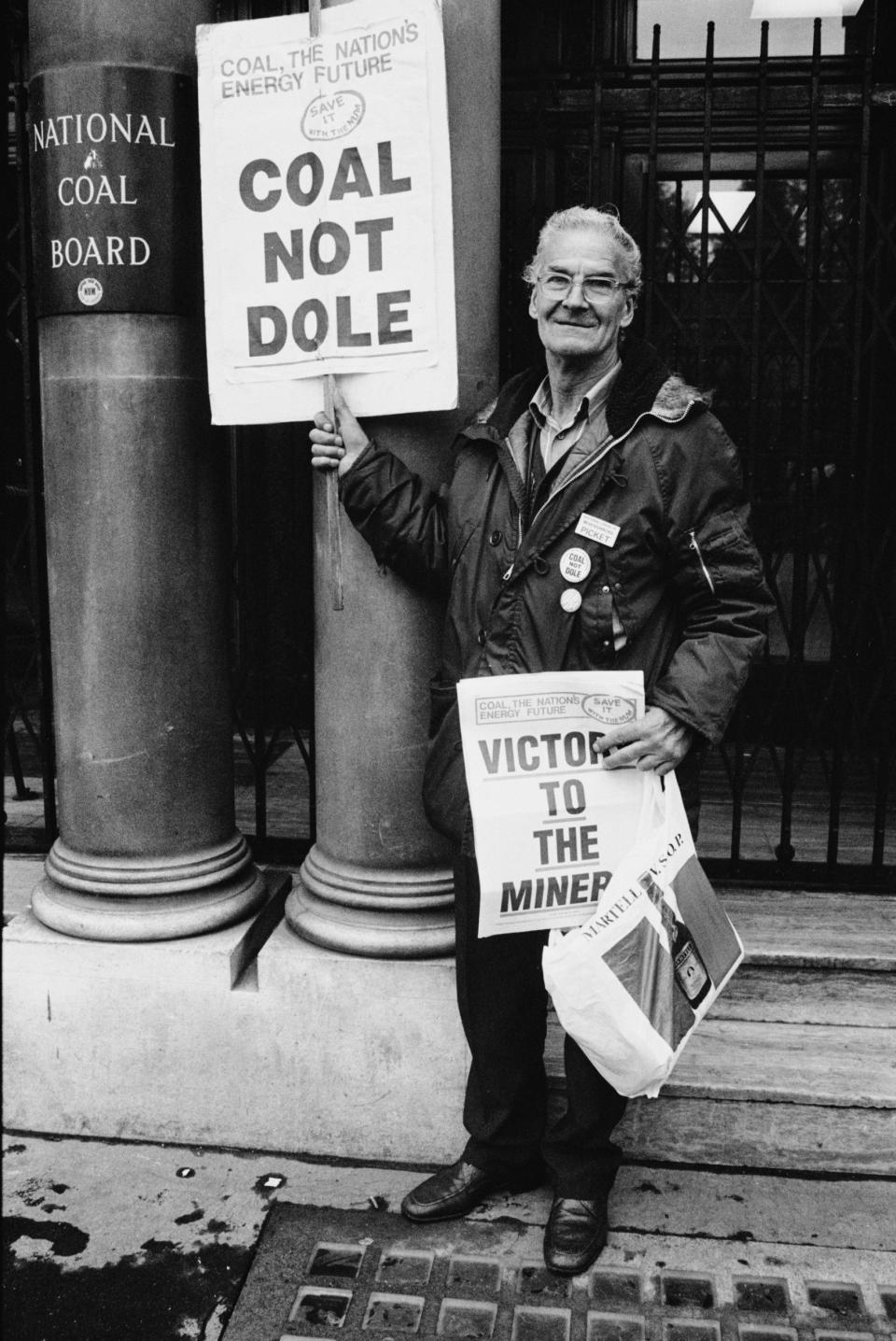

That reputation made Jenkins a force to be reckoned with in innumerable corporate deals in which NCB had an interest. It also helped him defeat a campaign by Arthur Scargill, the president of the National Union of Mineworkers, to prevent the pension funds investing in overseas companies and oil and gas ventures that might compete with coal.

A 1984 High Court ruling confirmed that the fund managers’ duty was to maximise returns for their beneficiaries rather than follow any political agenda. Scargill and other union officials duly stood down as trustees of the funds.

By the time Jenkins left the NCB in 1985 its funds had grown under his stewardship to £6.4 billion – and no City investor carried more personal clout.

Hugh Royston Jenkins was born in Port Talbot on November 9 1933 to Hubert Jenkins, a railway worker, and his wife Violet, née Aston. Educated at Llanelli grammar school, he qualified as a chartered surveyor and did national service with the Royal Artillery before starting his professional career as a valuer for London County Council. He became assistant controller of the Coal Board’s property interests in 1962, rising to managing director in 1968.

Jenkins denied that the row with Scargill had been a factor in his surprising decision, after resigning from NCB, to take charge in Los Angeles of the US interests of Heron Corporation, the property and financial services empire of his friend Gerald Ronson. But he did admit that distance from London soon made him feel like “a remittance man”: he returned in 1986 to become investment director of Allied Dunbar and, from 1989 to 1995, chairman of Prudential Portfolio Investors.

He was also chairman of the electrical manufacturer Thorn, and a director of Rank Organisation, Johnson Matthey and the pension funds of IBM and Unilever.

Hugh Jenkins was appointed CBE in 1996. He married first, in 1956, Jennifer Hawkins; the marriage was dissolved and he married secondly, in 1988, Beryl Kirk, née Barnes, who survives him.

Hugh Jenkins, born November 9 1933, died March 7 2024

Yahoo News

Yahoo News