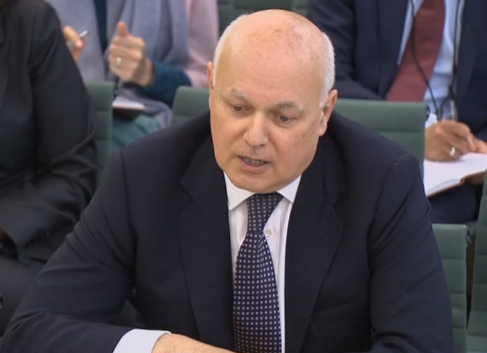

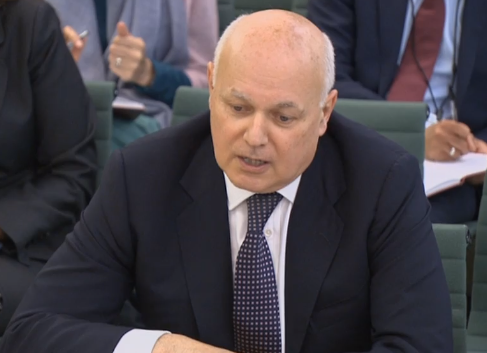

Iain Duncan Smith says Theresa May should invest a further £2bn into universal credit roll-out

Iain Duncan Smith has said Theresa May should invest a further £2bn into the roll-out of universal credit, saying it would enable the system to run more efficiently.

The former work and pensions secretary said the government had gone “halfway” to restoring the benefit, but urged the prime minister to finish the job of reversing £4bn a year in cuts to the new system.

Speaking to the Work and Pensions Committee, Mr Duncan Smith said he had originally set out the figures because he felt they provided the best balance of a requirement to both run it “efficiently” and set the levels of incentive at the right position.

“I’m pleased the government has gone halfway towards it now, which is a major step – the changes they’ve made are ones I would have personally recommended and therefore I’m keen to see,” Mr Duncan Smith said.

But he continued: “Do I continue to argue or believe that further moves towards that would be welcome? The answer is yes, categorically yes.”

When asked by the chair of the committee, Frank Field, what he would suggest a hypothetical extra £2bn should be spent on, he said: “I would first and foremost like to see the money restored to universal credit in its entirety. I ultimately would love to see the whole lot go in.”

The former cabinet minister, who was in charge of welfare between 2010 and 2016 before quitting over disability benefit cuts, was also accused of painting a “utopian” vision of the universal credit system.

Heidi Allen disputed Mr Duncan Smith’s suggestion that claimants were offered a “human element” by having the same work coach throughout the process, saying: “The image of the work coach holding your hand throughout the process is of course utopian.

“Unfortunately the evidence we’re taking suggests that it isn’t universally what people experience, and there’s a lot more work that needs to be done there.”

Chief executive of the charity Trussell Trust, Emma Reve, who was also giving evidence in the hearing, later said: “It would be great if universal support looked exactly like it was just described. But that really isn’t the experience on the ground.”

Also raised during the session were concerns around people transitioning to universal credits being confronted with past debts – which can lead to their benefits being dramatically reduced, leaving them with “almost no money” – by the Department for Work and Pensions (DWP).

Mr Field told the committee: “I have been shocked by the department managing, from its records, to see what past debt claimants owe them, and to charge that debt on claimants so that they lose hundreds of pounds of their benefit when they are in real problems.

“I’m not against them repaying, but it’s the extent and intensity of this payment that leaves people with almost no money.”

Mr Duncan Smith conceded that one of the arrangements around the universal credit roll-out was that the DWP would have to restore that non-reconciled debt as it came across, saying: “Often people were overpaid, a lot of that was then not pursued or dealt with at the time.”

Universal credit – which rolls six major working-age benefits, including job seeker’s allowance, tax credit and housing benefit into one payment – has been beset with problems since the start of the roll-out.

Analysis by the Trussell Trust of foodbanks that have been in full universal credit roll-out areas for a year or more shows they saw an average increase of 52 per cent in the 12 months after the full roll-out date in their area, compared to 12 months before.

Yahoo News

Yahoo News