Imagine Owning Omni-Lite Industries Canada (CVE:OML) While The Price Tanked 52%

Omni-Lite Industries Canada Inc. (CVE:OML) shareholders should be happy to see the share price up 10% in the last week. But that can't change the reality that over the longer term (five years), the returns have been really quite dismal. The share price has failed to impress anyone , down a sizable 52% during that time. Some might say the recent bounce is to be expected after such a bad drop. We'd err towards caution given the long term under-performance.

See our latest analysis for Omni-Lite Industries Canada

Omni-Lite Industries Canada isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over five years, Omni-Lite Industries Canada grew its revenue at 4.5% per year. That's not a very high growth rate considering it doesn't make profits. This lacklustre growth has no doubt fueled the loss of 14% per year, in that time. We'd want to see proof that future revenue growth is likely to be significantly stronger before getting too interested in Omni-Lite Industries Canada. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term).

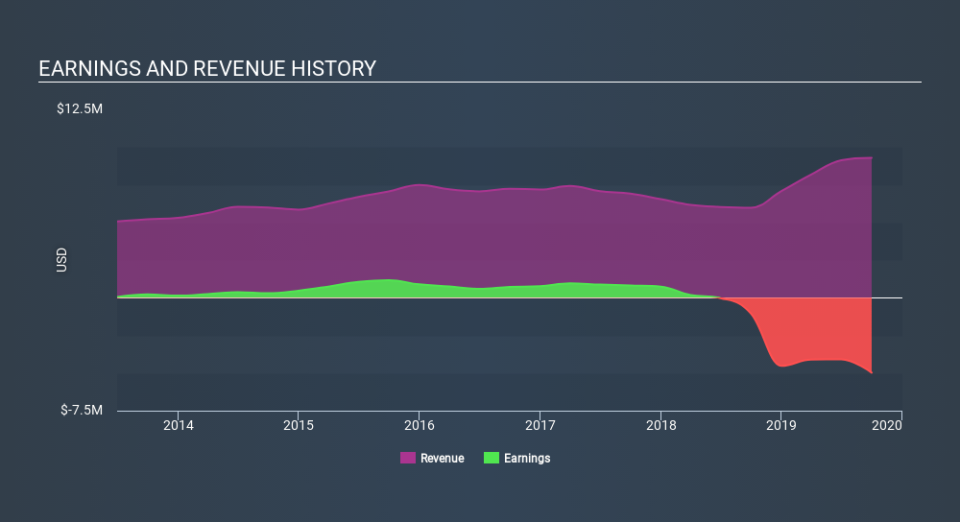

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Omni-Lite Industries Canada shareholders are down 22% over twelve months, which isn't far from the market return of -21%. So last year was actually even worse than the last five years, which cost shareholders 14% per year. Weak performance over the long term usually destroys market confidence in a stock, but bargain hunters may want to take a closer look for signs of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 6 warning signs we've spotted with Omni-Lite Industries Canada (including 3 which is can't be ignored) .

We will like Omni-Lite Industries Canada better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo News

Yahoo News