Is Imagion Biosystems' (ASX:IBX) 102% Share Price Increase Well Justified?

Unless you borrow money to invest, the potential losses are limited. But if you pick the right stock, you can make a lot more than 100%. For example, the Imagion Biosystems Limited (ASX:IBX) share price has soared 102% return in just a single year. Shareholders are also celebrating an even better 371% rise, over the last three months. On the other hand, longer term shareholders have had a tougher run, with the stock falling 32% in three years.

Check out our latest analysis for Imagion Biosystems

Because Imagion Biosystems made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last twelve months, Imagion Biosystems' revenue grew by 570%. That's well above most other pre-profit companies. And the share price has responded, gaining 102% as we previously mentioned. That sort of revenue growth is bound to attract attention, even if the company doesn't turn a profit. Given the positive sentiment around the stock we're cautious, but there's no doubt its worth watching.

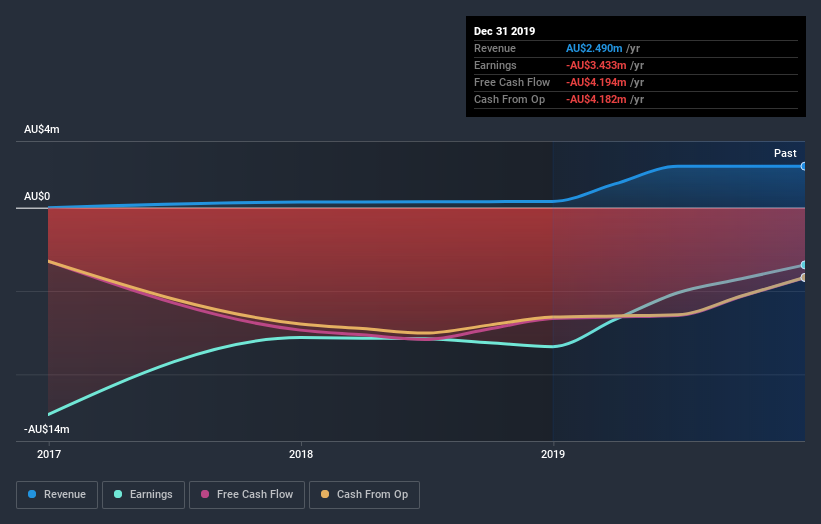

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Imagion Biosystems stock, you should check out this FREE detailed report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Imagion Biosystems' total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. We note that Imagion Biosystems' TSR, at 114% is higher than its share price return of 102%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

We're pleased to report that Imagion Biosystems rewarded shareholders with a total shareholder return of 114% over the last year. That certainly beats the loss of about 5.8% per year over three years. The optimist would say this is evidence that the stock has bottomed, and better days lie ahead. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 6 warning signs for Imagion Biosystems (3 shouldn't be ignored) that you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo News

Yahoo News