ImmunoGen (IMGN) Q2 Earnings and Sales Beat, Shares Down

ImmunoGen, Inc. IMGN reported loss of 14 cents per share for the second quarter of 2020, narrower than the Zacks Consensus Estimate of a loss of 18 cents and the year-ago loss of 29 cents. The bottom-line figure includes a restructuring charge of $0.7 million.

Revenues came in at $15 million, which also beat the Zacks Consensus Estimate of $14 million. Revenues, however, decreased from the year-ago quarter figure of $15.5 million.

ImmunoGen’s shares were down 6% on Jul 31, possibly due to a delay in anticipated top-line data readout from a pivotal study evaluating its lead candidate. The company’s stock has lost 26.6% so far this year compared with the industry’s decrease of 13%.

Quarter in Details

For the second quarter, Immunogen reported license and milestone fees of $0.9 million compared with $5.1 million in the year-ago period. The company had recorded a milestone payment of a $5 million from a partner.

Second-quarter revenues included $14.1 million in non-cash royalty revenues, up 35.2% year over year.

During the quarter, research and development expenses decreased 19.7% from the year-ago level to $22.9 million due to restructuring initiatives, partially offset by higher expenses related to clinical studies. General and administrative expenses increased 12.3% to $9.8 million in the second quarter of 2020.

ImmunoGen’s cash and cash equivalents increased to $219.5 million at the end of June 2020 compared with $247.3 million at the end of March 2020.

Pipeline Update

ImmunoGen is enrolling patients in the confirmatory phase III MIRASOL study, which compared its lead pipeline candidate, mirvetuximab soravtansine, head-to-head with single agent chemotherapy in platinum-resistant ovarian cancer patients with high folate receptor alpha expression.

It is also evaluating the candidate in a pivotal study — SORAYA — in platinum-resistant ovarian cancer patients. The company expects the data from this study to form the basis of the candidate’s regulatory filing under accelerated pathway for ovarian cancer. Data from the MIRASOL study will support its continued approval in the indication.

The company is also evaluating multiple combination regimens of mirvetuximab soravtansine in a phase Ib FORWARD II study for treating platinum-resistant ovarian cancer. It plans to provide initial data from a combination cohort of the study, evaluating the candidate in combination with Roche’s RHHBY Avastin (bevacizumab) in May. It is also planning to provide updated data from a triple combination cohort of the study, evaluating the candidate in combination with Avastin and carboplatin later this year.

Enrollment in the SORAYA and MIRASOL studies had been slow due to COVID-19 related restrictions, which are expected to delay data from these studies by six to eight weeks. However, with improvement in the situation in Europe, the company plans to accelerate the study’s progress in the remainder of 2020 and continues to anticipate to file the biologics license application (BLA) for mirvetuximab in the second half of 2021.

ImmunoGen is also planning to initiate an investigator sponsored clinical study to evaluate mirvetuximab plus carboplatin versus standard platinum-based therapy in recurrent platinum-sensitive ovarian cancer in the fourth quarter.

The company has another promising candidate, IMGN632, in its pipeline. It is being developed in clinical studies as monotherapy or in combination with Celgene’s (now a part of Bristol-Myers) Vidaza or AbbVie ABBV/Roche’s Venclexta for treating acute myeloid leukemia (“AML”). It is also developing IMGN632 monotherapy in early-stage studies in patients with blastic plasmacytoid dendritic cell neoplasm and acute lymphocytic leukemia.

The company plans to initiate a phase I study on IMGC936 to evaluate it in solid tumors in the fourth quarter of 2020. The company will co-develop the candidate with MacroGenics MGNX.

2020 Guidance Maintained

ImmunoGen maintained its guidance for 2020, provided on the second-quarter earnings call. The company expects revenues for the full year to be between $60 million and $65 million. It expects operating expense to be in the range of $165-$170 million. The company expects cash and cash equivalents to be between $170 million and $175 million at 2020 end.

It expects cash resources to be enough to fund its operations through the second quarter of 2022.

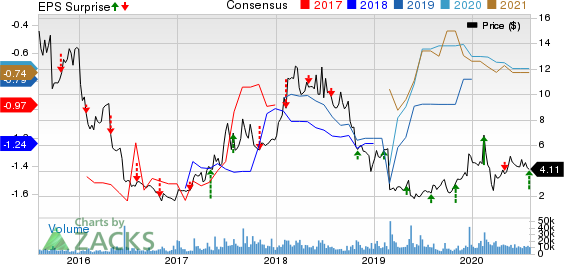

ImmunoGen, Inc. Price, Consensus and EPS Surprise

ImmunoGen, Inc. price-consensus-eps-surprise-chart | ImmunoGen, Inc. Quote

Zacks Rank

Currently, Immunogen is a Zacks Rank #3 (Hold) stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

ImmunoGen, Inc. (IMGN) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

MacroGenics, Inc. (MGNX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo News

Yahoo News