The Inspire Medical Systems (NYSE:INSP) Share Price Has Gained 49% And Shareholders Are Hoping For More

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But you can significantly boost your returns by picking above-average stocks. To wit, the Inspire Medical Systems, Inc. (NYSE:INSP) share price is 49% higher than it was a year ago, much better than the market return of around 24% (not including dividends) in the same period. So that should have shareholders smiling. We'll need to follow Inspire Medical Systems for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

See our latest analysis for Inspire Medical Systems

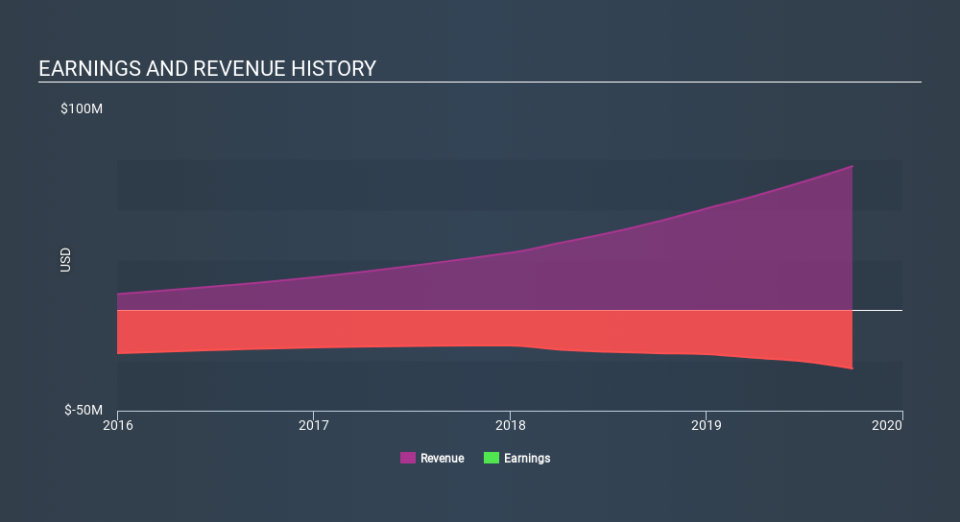

Given that Inspire Medical Systems didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Inspire Medical Systems grew its revenue by 63% last year. That's stonking growth even when compared to other loss-making stocks. The solid 49% share price gain goes down pretty well, but it's not necessarily as good as you might expect given the top notch revenue growth. If that's the case, now might be the time to take a close look at Inspire Medical Systems. Since we evolved from monkeys, we think in linear terms by nature. So if growth goes exponential, opportunity may exist for the enlightened.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Inspire Medical Systems stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Inspire Medical Systems boasts a total shareholder return of 49% for the last year. A substantial portion of that gain has come in the last three months, with the stock up 46% in that time. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Be aware that Inspire Medical Systems is showing 3 warning signs in our investment analysis , and 1 of those can't be ignored...

We will like Inspire Medical Systems better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo News

Yahoo News