Instagram's advertiser count tops 1 million (FB)

BI Intelligence

This story was delivered to BI Intelligence "Digital Media Briefing" subscribers. To learn more and subscribe, please click here.

Instagram announced that its monthly active advertiser count has reached 1 million, double September's total and five times more than it had last February.

This is an important milestone as the social platform continues to convert business profiles into paying active customers at a rapid clip. Instagram also announced a new appointment-booking tool that will roll out over the next few months, as the company looks for new ways to monetize their engaged and growing audience.

User growth is accelerating over time. It took Instagram over two years to reach their first 100 million users. Since then, the pace at which the company adds another 100 million users has quickened. In their most recent milestone, Instagram reached 600 million MAU’s in December 2016, taking just 6 months to add 100 million users. The 400 and 500 million milestones each took 9 months to reach. Of Instagram’s 600 million users, 80% follow a business.

Massive opportunity to on-board more advertisers. Last year, Instagram began pushing business-specific profile adoption, which provides companies tools to gain insights about their followers and posts, and to easily promote posts. Instagram business profiles are used by 8 million businesses, an increase versus 5 million announced in May. This means that Instagram has converted only 13% of the 8 million business profiles into monthly active advertisers, implying massive room for more growth.

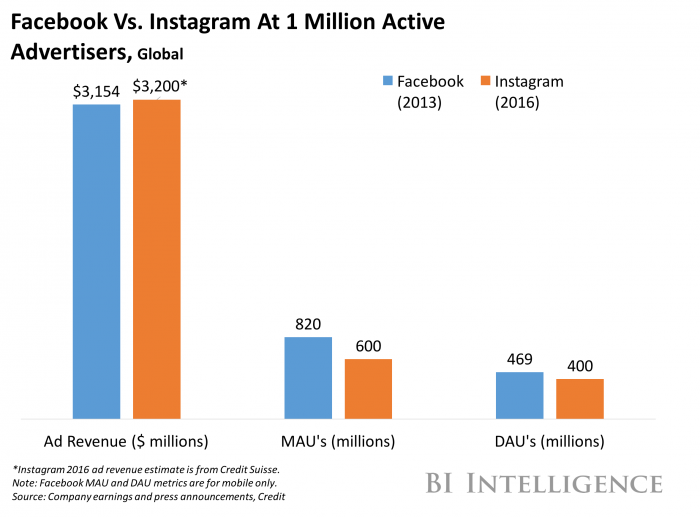

Facebook hit the 1 million advertiser milestone in June 2013. At the time, Facebook had 820 million mobile monthly active users (MAUs), versus Instagram’s 600 million MAUs announced in December.

There is overlap between Facebook and Instagram advertisers. As of Q1 2017, Facebook had 4 million active advertisers, which represents 7% of the over 60 million businesses using Pages. Instagram revenue is a combination of incremental new revenue and re-purposed budget from Facebook to Instagram. Even so, assuming 100% advertiser overlap, Facebook’s 3 million accounts not advertising on Instagram could be an easy up-sell for the company.

Providing new tools for advertiser accounts. Instagram is rolling out a feature that will allow user to book an appointment through the app, according to Bloomberg. Not only does this increase the utility for users, but businesses will be able to accurately track sales generated via Instagram. Additional tools in the pipeline include business reviews and other call-to-action capabilities.

There's no question that consumers are increasing the amount of time they spend consuming digital media, while advertisers are increasing their ad budgets into digital channels. What may come as a surprise, however, is the complexity of the interconnected web of companies involved in the process of delivering digital advertisements to end users. Collectively, these companies are known as “advertising technology,” or “ad tech” for short.

Ad tech companies are intermediaries between advertisers and publishers, and add value to the ad delivery process by consolidating inventory, automating workflows, and offering precise targeting capabilities at scale. The automation of ad buying is also known as “programmatic advertising” — that is, using technology and software to buy digital ads. Programmatic ad spend in the US is quickly ramping up: It will top $20 billion this year and reach $38.5 billion by year-end 2020.

But ad tech's ascendancy isn’t without its drawbacks. The advertising industry in the US is dominated by two main players: Facebook and Google. As a result, ad tech players are fighting for a pretty small piece of revenue pie, one of the many drivers of increased consolidation in the space.

Kevin Gallagher, research analyst for BI Intelligence, Business Insider's premium research service, has compiled a detailed report on ad tech that examines the different players involved in the process of delivering ads, the formats that are driving growth (notably mobile and video), and the factors that are driving increased consolidation over the coming years.

Here are some key points from the report:

By 2020, mobile will be the biggest online advertising market, and video the fastest growing.

So-called "walled gardens" Google and Facebook lead a relatively small group of players that attract the vast majority of digital-ad spending in the US today.

Growth can be challenging for players outside the walled-garden duopoly, and many companies are reaching a level of maturity that may prompt investors to push for an exit.

Ad tech is poised for consolidation, and the number of companies in the industry will decline significantly over the next few years.

Companies specializing in certain ad formats like mobile, video, and TV are attractive targets. They are well positioned to take advantage of the fastest growing segments of digital media.

In full, the report:

Forecasts US programmatic revenue through 2020.

Highlights the factors driving consolidation, and identifies new acquirers and attractive targets.

Explores the challenges ad tech companies face including the dominance of walled gardens, ad blocking and measurement.

Outlines emerging technologies that will help propel ad growth in the next decade.

Interested in getting the full report? Here are two ways to access it:

Subscribe to an All-Access pass to BI Intelligence and gain immediate access to this report and over 100 other expertly researched reports. As an added bonus, you'll also gain access to all future reports and daily newsletters to ensure you stay ahead of the curve and benefit personally and professionally. » START A MEMBERSHIP

Purchase & download the full report from our research store.» BUY THE REPORT

See Also:

Yahoo News

Yahoo News