Intel Can’t Take Off Another Round in Chip Battle

(Bloomberg Opinion) -- Intel Inc. closed out 2019 learning the hard lesson that making cutting-edge semiconductors is truly difficult.

Like a prizefighter who refuses to admit he just hit the mat, the world’s biggest chipmaker is coming out swinging. And it should, because how it gets through 2020 could decide the company’s fate.

Once the most advanced supplier of semiconductors, Intel struggled last year to ramp up production of chips that use its latest 14-nanometer process node, “letting customers down,” as CEO Bob Swan said in October. Its full-year results released Thursday showed that revenue climbed 2% and that net income was flat — hiding the fact that Intel dodged a bullet when it wasn’t able to supply enough of its most advanced products when clients needed them most.

It tried to offer some reassurance three months ago by noting that it would increase 14-nanometer capacity 25% this year while raising capital spending to nose-bleed levels. To help overcome that slip-up, executives are keen to tell investors how many customers have signed up for its latest offerings, including a chip dubbed Ice Lake and an upgrade to its Comet Lake mobile processor, which use the next-generation 10-nanometer process.

In reality, Intel is badly lagging behind both contract manufacturer Taiwan Semiconductor Manufacturing Co. and South Korea’s Samsung Electronics Co. TSMC, for example, started selling its 10-nanometer chip technology in mid-2017 and last year boosted revenue from its more advanced 7-nanometer offerings by more than 200%. When Intel eventually hits 7 nanometers in 2021, it will be almost three years behind.

Intel’s rebuttal is that so-called process-node technology isn’t the only thing. It’s right, and clients should look at total system performance to see how all the parts — the processor, memory and controllers — all slot together. No other company in the world can offer the breadth and depth that Intel can.

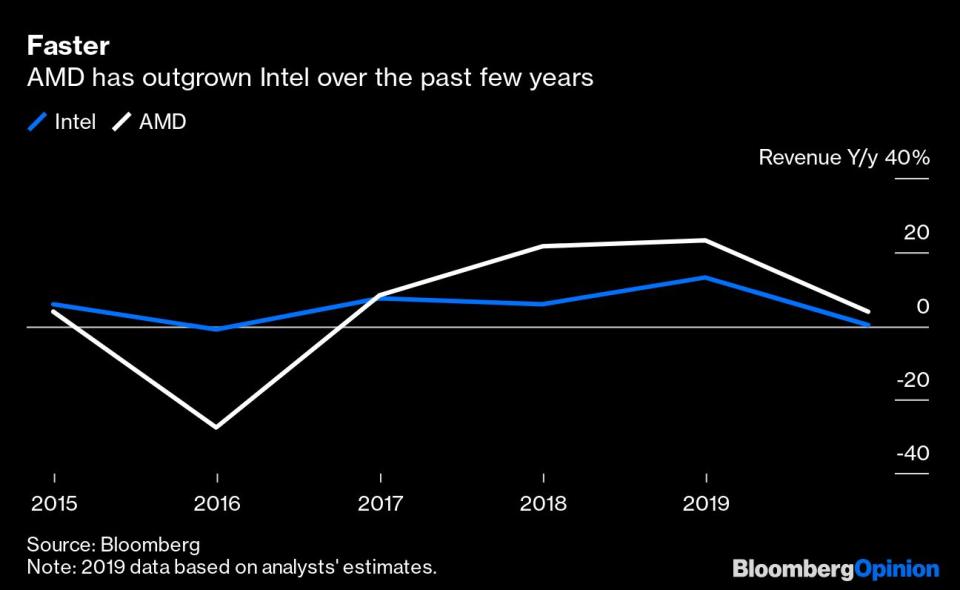

But with Advanced Micro Devices Inc. back in the game after a decade in the wilderness and a raft of chip designers ready to tap TSMC’s technology advantage, Intel would be foolish to rest on the belief that it can stay ahead of the game while lagging behind on technology. It knows this and has committed to speeding up its migration from the pace of a new node every five to seven quarters to as little as four quarters.

Yet investors ought to also note that the introduction of a new node compresses margins during the early stages before better yields provide economies of scale later. A quicker timetable won’t allow as much time to enjoy the upside before the next margin crunch comes.

Intel’s strategy to offset this squeeze is to tap continued growth in the data-center market. Cloud providers like Amazon.com Inc., Alphabet Inc.’s Google and Alibaba Group Holding Ltd. are among customers for its 14-nanometer Cascade Lake products, while the global 5G rollout is expected to provide a couple of solid growth years. Its Data Center Group accounts for 32.6% of revenue but 46.4% of operating income, making it Intel’s most lucrative business unit by operating margin.

But that business relies on Intel’s ability to churn out leading-edge chips that, even if not equivalent to what TSMC can offer clients, won’t be too far behind. A data center operator might be willing to forgive a single-generation lag, reasoning that the broader platform integration Intel offers can provide the cost-benefit metrics it needs. A two-generation delay is hard to overlook, though.

Intel’s size and strength means it won’t be easily knocked out. But it needs to get through this year unscathed if it’s to remain the undisputed heavyweight champ.

(Updates with details about Intel’s 10-nanometer offerings in the fourth paragraph.)

To contact the author of this story: Tim Culpan at tculpan1@bloomberg.net

To contact the editor responsible for this story: Daniel Niemi at dniemi1@bloomberg.net

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

Tim Culpan is a Bloomberg Opinion columnist covering technology. He previously covered technology for Bloomberg News.

For more articles like this, please visit us at bloomberg.com/opinion

Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.

Yahoo News

Yahoo News