Investors Who Bought Green Landscaping Group (STO:GREEN) Shares A Year Ago Are Now Up 19%

There's no doubt that investing in the stock market is a truly brilliant way to build wealth. But if you choose that path, you're going to buy some stocks that fall short of the market. Over the last year the Green Landscaping Group AB (publ) (STO:GREEN) share price is up 19%, but that's less than the broader market return. Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

Check out our latest analysis for Green Landscaping Group

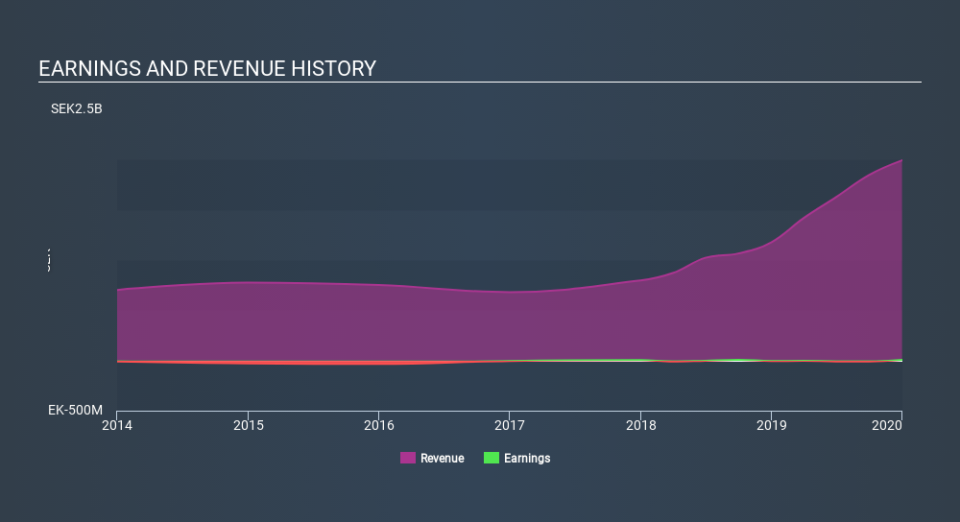

While Green Landscaping Group made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Green Landscaping Group grew its revenue by 69% last year. That's a head and shoulders above most loss-making companies. Let's face it the 19% share price gain in that time is underwhelming compared to the growth. When revenue spikes but the share price doesn't we can't help wondering if the market is missing something. It could be that the stock was previously over-hyped, or that losses are causing concern for the market, but this could be an opportunity.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that Green Landscaping Group has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on Green Landscaping Group

A Different Perspective

We're happy to report that Green Landscaping Group are up 19% over the year. The bad news is that's no better than the average market return, which was roughly 27%. Unfortunately the share price is down 0.6% over the last quarter. It may simply be that the share price got ahead of itself, and its quite possible it will keep moving in the right direction, especially if the business continues to deliver good financial results. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Green Landscaping Group (1 is concerning!) that you should be aware of before investing here.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo News

Yahoo News