Investors Who Bought ICON (NASDAQ:ICLR) Shares Five Years Ago Are Now Up 122%

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. One great example is ICON Public Limited Company (NASDAQ:ICLR) which saw its share price drive 122% higher over five years. Better yet, the share price has risen 17% in the last week. But this might be partly because the broader market had a good week last week, gaining 9.4%.

See our latest analysis for ICON

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

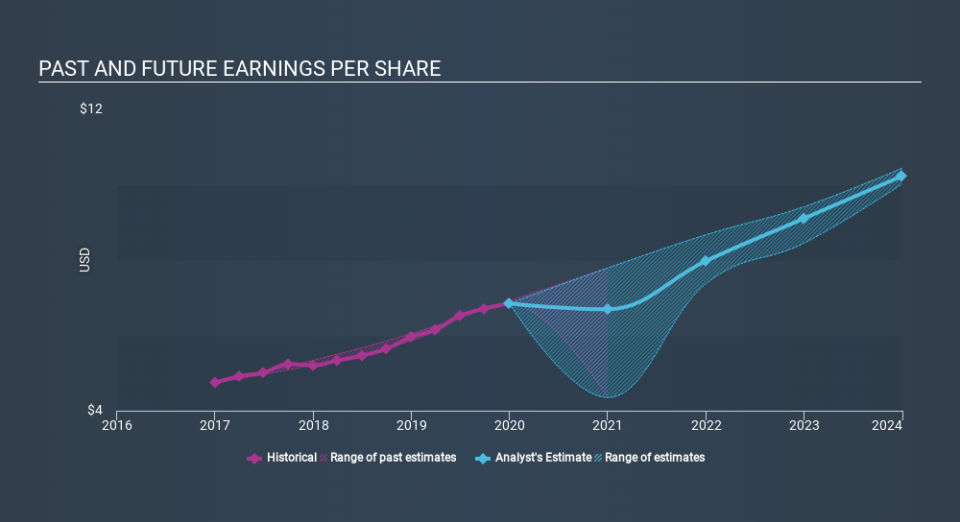

During five years of share price growth, ICON achieved compound earnings per share (EPS) growth of 20% per year. This EPS growth is reasonably close to the 17% average annual increase in the share price. Therefore one could conclude that sentiment towards the shares hasn't morphed very much. In fact, the share price seems to largely reflect the EPS growth.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that ICON has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

A Different Perspective

It's nice to see that ICON shareholders have received a total shareholder return of 12% over the last year. Having said that, the five-year TSR of 17% a year, is even better. The pessimistic view would be that be that the stock has its best days behind it, but on the other hand the price might simply be moderating while the business itself continues to execute. Is ICON cheap compared to other companies? These 3 valuation measures might help you decide.

We will like ICON better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo News

Yahoo News