Investors Who Bought Itway (BIT:ITW) Shares Five Years Ago Are Now Down 73%

Itway S.p.A. (BIT:ITW) shareholders are doubtless heartened to see the share price bounce 60% in just one week. But will that repair the damage for the weary investors who have owned this stock as it declined over half a decade? Probably not. Like a ship taking on water, the share price has sunk 73% in that time. So we don't gain too much confidence from the recent recovery. The real question is whether the business can leave its past behind and improve itself over the years ahead.

Check out our latest analysis for Itway

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Itway became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

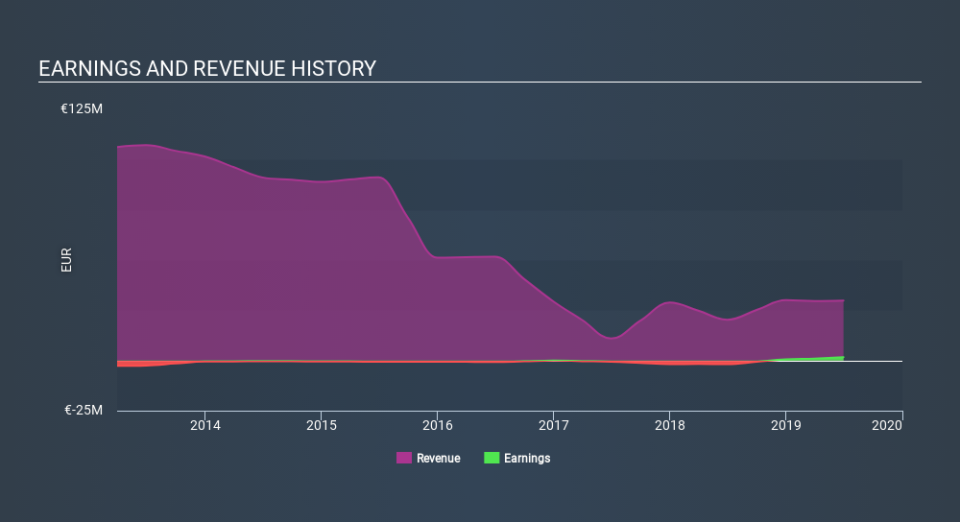

Arguably, the revenue drop of 34% a year for half a decade suggests that the company can't grow in the long term. This has probably encouraged some shareholders to sell down the stock.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

The total return of 21% received by Itway shareholders over the last year isn't far from the market return of -21%. Worse still, the company has lost shareholders 23% per year over five years. It could well be that the business has begun to stabilize, although we'd be hesitant to buy without clear information suggesting the company will grow. It's always interesting to track share price performance over the longer term. But to understand Itway better, we need to consider many other factors. Even so, be aware that Itway is showing 4 warning signs in our investment analysis , and 1 of those is potentially serious...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IT exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo News

Yahoo News