Investors Who Bought Luzhou Xinglu Water (Group) (HKG:2281) Shares Three Years Ago Are Now Down 46%

As an investor its worth striving to ensure your overall portfolio beats the market average. But the risk of stock picking is that you will likely buy under-performing companies. We regret to report that long term Luzhou Xinglu Water (Group) Co., Ltd. (HKG:2281) shareholders have had that experience, with the share price dropping 46% in three years, versus a market return of about -3.2%.

View our latest analysis for Luzhou Xinglu Water (Group)

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the unfortunate three years of share price decline, Luzhou Xinglu Water (Group) actually saw its earnings per share (EPS) improve by 3.7% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

After considering the numbers, we'd posit that the the market had higher expectations of EPS growth, three years back. Looking to other metrics might better explain the share price change.

We note that the dividend has declined - a likely contributor to the share price drop. In contrast it does not seem particularly likely that the revenue levels are a concern for investors.

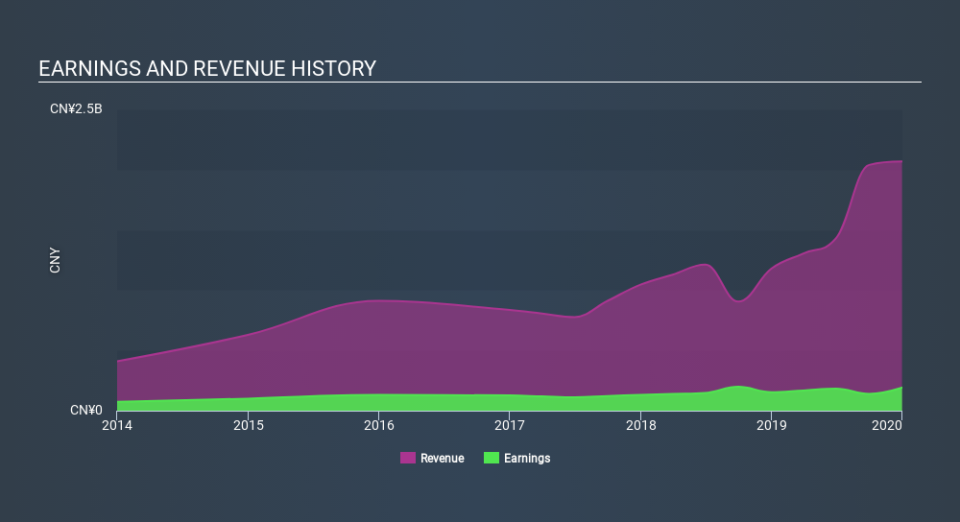

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Luzhou Xinglu Water (Group)'s earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Luzhou Xinglu Water (Group), it has a TSR of -39% for the last 3 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Luzhou Xinglu Water (Group) shareholders may not have made money over the last year, but their total loss of 7.1% ( including dividends) isn't as bad as the market loss of around 7.1%. The one-year return is also not as bad as the 15% per annum loss investors have suffered over the last three years. It could well be that the business has begun to stabilize, though the recent returns are hardly impressive. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Luzhou Xinglu Water (Group) (1 is concerning!) that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo News

Yahoo News