Key Auto Q3 Earnings Lined Up for Next Week: CMI, F & More

The third-quarter earnings season for the Auto-Tires-Trucks sector has just kicked off. So far this earnings season, just two S&P stocks from the Auto-Tires-Trucks sector, namely PACCAR PCAR and Genuine Parts GPC, have come up with quarterly numbers. Encouragingly, both the companies have managed to deliver earnings beat. A host of auto biggies are slated to release quarterly numbers next week.

In the last reported quarter, the auto sector’s earnings plummeted 123.5% year over year on a 49.7% revenue decline amid coronavirus woes. For the third quarter, the declines are expected to be much less severe. Overall earnings and revenues for the sector are projected to be down 27.3% and 4% year over year, per the latest Earnings Trend Report.

Let’s take a look at the factors that are likely to have impacted auto stocks during the to-be-reported quarter.

Factors Shaping Auto Sector in Q3

The pandemic significantly transformed the auto industry. With social distancing becoming the new normal, people are avoiding public transportation, which makes private transportation the need of the hour. After taking a nasty hit during the second quarter, vehicle sales across the globe are gradually on the mend. As the demand for new vehicles has been rising following the gradual reopening of the economy, U.S. auto sales are showing signs of recovery. Though third-quarter U.S. new vehicle sales dropped year over year, the same increased sequentially. In fact, sales for September grew year over year. Easier credit conditions with super low auto loan interests boosted retail sales. Ramp up of e-commerce initiatives to stock sales also seems to have paid off.Robust consumer demand for pick-up trucks and sport-utility vehicles, as well as low interest rates fueled sales. The rising demand for vehicles is likely to have boosted revenues for auto manufacturers and auto parts suppliers alike.

CMI, F, ORLY & LKQ in Spotlight

Let’s take a glance at how these four auto players are placed ahead of their quarterly results, scheduled to be released next week.

Cummins Inc. CMI:ThisIndiana-based engine manufacturer is slated to report quarterly results on Oct 27, before the opening bell.The Zacks Consensus Estimate for the quarter’s earnings and revenues is pegged at $2.40 per share and $4.48 billion, respectively.

Our proven model suggests that the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

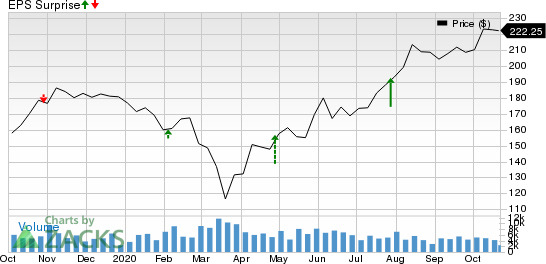

In the last reported quarter, Cummins came up with better-than-expected results on the back of higher-than-anticipated contribution from Distribution, Engine and Power Systems segments. Over the trailing four quarters, the firm topped earnings estimates on three occasions and missed once, with the average surprise being 45.2%.

Cummins Inc. Price and EPS Surprise

Cummins Inc. price-eps-surprise | Cummins Inc. Quote

Our model predicts an earnings beat for Cummins in the quarter to be reported, as it has an Earnings ESP of +4.60% and currently carries a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Amid gradual recovery of the industry during the third quarter, things are looking up for Cummins this earnings season. The Zacks Consensus Estimate for the engine segment’s net sales is pegged at $1,844 million, indicating an increase from the previous quarter’s $1,423 million. The consensus mark for distribution and components segments’ sales is pegged at $1,786 million and $1,262 million, implying sequential growth of 11.2% and 9.7%, respectively. In addition to higher sales, solid cost-containment efforts are anticipated to have aided margins.

Ford F: This U.S. auto giant is set to report quarterly results on Oct 28, after the closing bell.The Zacks Consensus Estimate for the quarter’s earnings and revenues is pegged at 96 cents per share and $4.23 billion, respectively.

In the last reported quarter, Ford posted narrower-than-expected loss on higher-than-anticipated automotive sales in North America and Europe. The firm topped earnings estimates in two of the last four quarters and missed on the other two others, with the average negative surprise being 14.2%.

Ford Motor Company Price and EPS Surprise

Ford Motor Company price-eps-surprise | Ford Motor Company Quote

Ford currently sports a Zacks Rank #1 and has an Earnings ESP of +19.51%. High demand of vehicles in China and United States is likely to have aided the firm’s quarterly sales. It sold 551,796 vehicles in the United States during the to-be-reported quarter, down 4.9% on a yearly basis but up 27.2% sequentially. The company sold 164,352 vehicles in China, marking 25.4% and 3.6% growth on a yearly and sequential basis, respectively. Robust demand of commercial vehicles including pickup trucks is expected to have boosted the firm’s sales and earnings during the quarter.

O’Reilly Automotive ORLY: This specialty retailer of automotive aftermarket parts is slated to unveil quarterly results on Oct 28, after the closing bell. The Zacks Consensus Estimate for the quarter’s earnings and revenues is pegged at $6.31 per share and $2.97 billion, respectively.

In the last reported quarter, O’Reilly posted an earnings beat on remarkable comparable store sales growth. Over the trailing four quarters, the firm topped earnings estimates on three occasions and missed once, with the average surprise being 20.5%.

OReilly Automotive, Inc. Price and EPS Surprise

OReilly Automotive, Inc. price-eps-surprise | OReilly Automotive, Inc. Quote

O’Reilly currently holds a Zacks Rank #3 and has an Earnings ESP of +4.18%. It is anticipated to have gained from store openings and distribution centers in profitable regions during the second quarter. The Zacks Consensus Estimate for the number of stores during the September-end quarter is pegged at 5,603, indicating an increase from 5,420 and 5,583 recorded in the year-ago period and the prior quarter, respectively. Increasing e-commerce initiatives like curbside pick-up for Buy Online and Pick Up In-Store orders are also likely to have stoked sales during the quarter.

LKQ Corp LKQ: Auto parts supplier LKQ Corp. is scheduled to post quarterly results on Oct 29, before the closing bell. The Zacks Consensus Estimate for the quarter’s earnings and revenues is pegged at 51 cents a share and $2.93 billion, respectively.

In the last reported quarter, LKQ Corp. surpassed both earnings and revenue estimates. The firm topped earnings estimates in each of trailing four quarters, with the average being 77.1%

LKQ Corporation Price and EPS Surprise

LKQ Corporation price-eps-surprise | LKQ Corporation Quote

LKQ Corp. currently sports a Zacks Rank #1 and has an Earnings ESP of -1.32%. Rising vehicle sales are expected to have improved demand for parts, components and systems. While sales from the North American and European segments are expected to have improved sequentially, the same is likely to have declined from the year-ago levels. The consensus estimate for revenues from the North American and European units is pegged at $994 million and $1,408 million, suggesting a decline from the year-ago levels of $1,302 million and $1,451 million, respectively. Meanwhile, the consensus mark for revenues from the Specialty segment is pegged at $414 million, suggesting growth from $404 million and $395 million recorded in the prior quarter and the year-ago period, respectively.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

Cummins Inc. (CMI) : Free Stock Analysis Report

PACCAR Inc. (PCAR) : Free Stock Analysis Report

OReilly Automotive, Inc. (ORLY) : Free Stock Analysis Report

Genuine Parts Company (GPC) : Free Stock Analysis Report

LKQ Corporation (LKQ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo News

Yahoo News