Keysight (KEYS) Q2 Earnings Miss Estimates, Shares Down

Keysight Technologies, Inc. KEYS delivered second-quarter fiscal 2020 non-GAAP earnings of 78 cents per share, missing the Zacks Consensus Estimate by 22%. The bottom line also declined 36.1% from the year-ago quarter.

Non-GAAP revenues declined 18% year over year to $895 million. Non-GAAP core revenues (excluding the impact of currency and revenues from acquisitions in a year’s time) fell 18% on a year-over-year basis to $892 million. Moreover, GAAP revenues slumped 18% from the prior-year quarter to $895 million. The Zacks Consensus Estimate for revenues was pegged at $1.02 billion.

The coronavirus crisis-induced supply chain disruption and shutdown of production facilities affected Keysight’s fiscal second-quarter results.

Coming to price performance, shares of the company were down more than 7% in after-hours trading on May 26. This can primarily be attributed to drab fiscal second-quarter results. Notably, the company's stock has gained 0.8% year to date, against the industry’s decline of 1.6%.

Quarter in Detail

Orders fell 3% on a year-over-year basis to $1.089 billion during the reported quarter. Notably, core orders declined 3%.

Beginning first-quarter fiscal 2020, the company’s financial reporting comprises two segments — Electronic Industrial Solutions Group (EISG) and Communications Solutions Group (CSG). Ixia Solutions Group (ISG) segment reporting has been aligned with the CGS segment.

CSG includes commercial communications (CC) and aerospace, defense & government (ADG) end markets. CSG revenues of $653 million declined 18% on year-over-year and core basis. CSG contributed 73% to total non-GAAP revenues in the fiscal second quarter.

CC revenues of $468 million were down 15% year over year due to coronavirus crisis-induced supply chain disruption. However, management noted robust 5G order growth primarily fueled by 5G investments.

ADG revenues came in at $185 million, down 25% year over year, due to lower international spending. However, higher government spending and momentum in investments aimed at technology modernization, across the United States, was a positive.

EISG revenues declined 19% to $242 million. Challenges pertaining to automotive sector weighed on revenues. However, management noted momentum in first-to-market solutions, and demand for the company’s solutions in process node technology testing, considering semiconductor vertical. EISG contributed 27% to total non-GAAP revenues in second-quarter fiscal 2020.

Non-GAAP revenues from Americas came in at $330 million, down 23% year over year. Non-GAAP revenues from Europe and Asia Pacific of $145 million and $420 million declined 19% and 14%, respectively, on a year-over-year basis. Americas, Europe and Asia Pacific contributed 36.9%, 16.2% and 46.9%, respectively, to total non-GAAP revenues in the reported quarter.

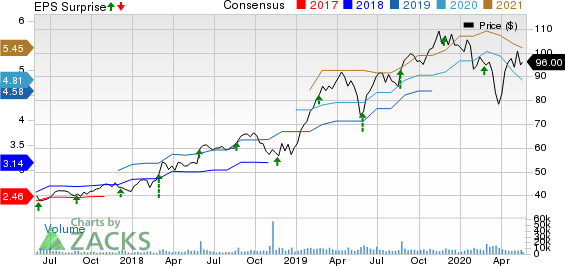

Keysight Technologies Inc. Price, Consensus and EPS Surprise

Keysight Technologies Inc. price-consensus-eps-surprise-chart | Keysight Technologies Inc. Quote

Margin Highlights

Non-GAAP gross margin contracted 90 basis points (bps) to 62.8% during the reported quarter. CSG gross margin of 63.1% contracted 150 bps, while EISG’s gross margin of 61.1% expanded 70 bps on a year-over-year basis.

Non-GAAP operating expenses fell 9.1% to $389 million. As a percentage of revenues, the figure expanded 430 bps to 43.5%.

Consequently, non-GAAP operating margin contracted 520 bps to 19.4%.

Balance Sheet & Cash Flow

As of Apr 30, 2020, Keysight had cash & cash equivalents of $1.841 billion, up from $1.691 billion as of Jan 31, 2020.

As on Apr 30, 2020, the company reported long-term debt of $1.788 billion, which remained unchanged sequentially.

Cash flow from operations during the quarter came in at $298 million compared with $197 million reported in the prior quarter.

Free cash flow was $275 million compared with the previous quarter’s $165 million.

During the first half of the reported quarter, the company repurchased approximately 1.3 million shares for $120 million.

Guidance

Keysight did not provide a specific quantitative guidance for third-quarter fiscal 2020. The company expects fiscal third-quarter revenues, earnings, and operating margin to be in line with or better than fiscal second quarter.

The company is improving production and services operations and anticipates returning to 100% capacity by the end of the fiscal third quarter amid persistent supply chain challenges.

Conclusion

Keysight is well poised to capitalize on rising demand of its semiconductor measurement solutions on the back of allegiance of semiconductor companies to develop chips on next-generation process technologies. Markedly, management noted “less supply chain disruption” across semiconductor domain, which contributed to revenue growth for the company’s semiconductor measurement solutions in the fiscal second quarter.

Moreover, incremental adoption of the company’s latest LoadCore offering, a 5G core network testing solution, that simulates complicated real-world subscriber models, holds promise.

Nevertheless, the coronavirus outbreak led global supply chain disruptions and macroeconomic challenges are expected to impede Keysight’s near-term growth prospects.

Zacks Rank & Stocks to Consider

Keysight currently carries a Zacks Rank #3 (Hold).

Coupa Software COUP, Workday WDAY and Okta OKTA are some better-ranked stocks worth considering in the broader computer and technology sector. All the three stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Workday, Okta and Coupa Software, are set to report quarterly results on May 27, May 28 and Jun 8, respectively.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2021.

Click here for the 6 trades >>

Click to get this free report

Workday, Inc. (WDAY) : Free Stock Analysis Report

Coupa Software, Inc. (COUP) : Free Stock Analysis Report

Keysight Technologies Inc. (KEYS) : Free Stock Analysis Report

Okta, Inc. (OKTA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo News

Yahoo News