What We Learned About Duke Energy's (NYSE:DUK) CEO Compensation

Lynn Good has been the CEO of Duke Energy Corporation (NYSE:DUK) since 2013, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also assess whether Duke Energy pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

View our latest analysis for Duke Energy

How Does Total Compensation For Lynn Good Compare With Other Companies In The Industry?

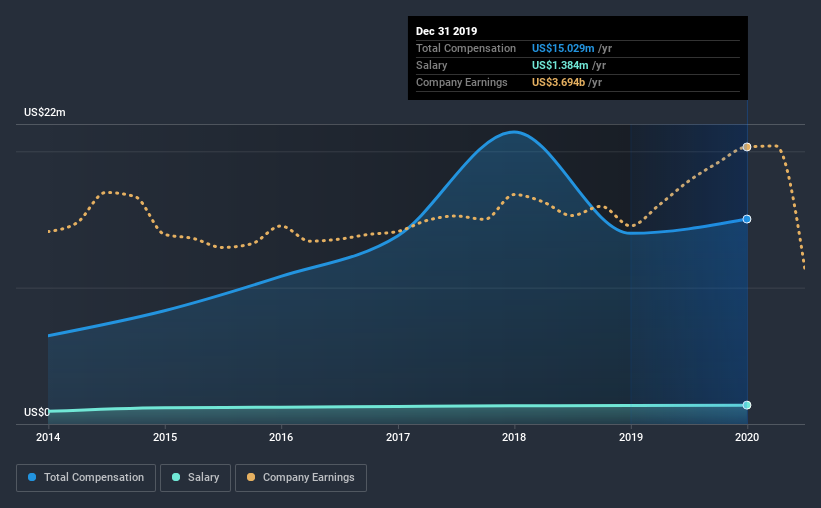

According to our data, Duke Energy Corporation has a market capitalization of US$62b, and paid its CEO total annual compensation worth US$15m over the year to December 2019. That's a modest increase of 7.5% on the prior year. While we always look at total compensation first, our analysis shows that the salary component is less, at US$1.4m.

In comparison with other companies in the industry with market capitalizations over US$8.0b , the reported median total CEO compensation was US$14m. So it looks like Duke Energy compensates Lynn Good in line with the median for the industry. Furthermore, Lynn Good directly owns US$23m worth of shares in the company, implying that they are deeply invested in the company's success.

Component | 2019 | 2018 | Proportion (2019) |

Salary | US$1.4m | US$1.4m | 9% |

Other | US$14m | US$13m | 91% |

Total Compensation | US$15m | US$14m | 100% |

On an industry level, around 14% of total compensation represents salary and 86% is other remuneration. Duke Energy sets aside a smaller share of compensation for salary, in comparison to the overall industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Duke Energy Corporation's Growth Numbers

Over the last three years, Duke Energy Corporation has shrunk its earnings per share by 11% per year. It saw its revenue drop 1.6% over the last year.

Overall this is not a very positive result for shareholders. This is compounded by the fact revenue is actually down on last year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Duke Energy Corporation Been A Good Investment?

Duke Energy Corporation has served shareholders reasonably well, with a total return of 12% over three years. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

To Conclude...

As we noted earlier, Duke Energy pays its CEO in line with similar-sized companies belonging to the same industry. Duke Energy has had a tough time in recent years, with declining earnings growth, and although shareholder returns are stable, they are hardly worth celebrating. This doesn't compare well with CEO compensation, which is close to the industry median. We would stop short of the compensation is inappropriate, but we can't say the executive is underpaid.

CEO pay is simply one of the many factors that need to be considered while examining business performance. In our study, we found 4 warning signs for Duke Energy you should be aware of, and 1 of them is a bit concerning.

Important note: Duke Energy is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo News

Yahoo News