Leisure Stocks' Aug 10 Q2 Earnings Roster: MAR, RCL & More

The leisure industry is likely to have borne the brunt of the coronavirus pandemic in second-quarter 2020. It is to be noted that the country’s unemployment has increased sharply. This has led to sinking consumer confidence and dwindling household income, which severely impacted spending activities. Consequently, this might get reflected in the leisure industry’s second-quarter performance. In fact, the rising macroeconomic uncertainties and bare minimum revenue prospects compelled the industry participants to withdraw their guidance.

The cruise industry has been driven to a standstill by the coronavirus-induced crisis. Furthermore, the leisure services industry is weighed down by high cost burden. The industry players generally work through multiple business models. In order to mitigate the same, most of the industry players have been resorting to pay cuts and furloughing employees. The industry participants are also suspending share repurchase programs and dividend payouts in an effort to improve liquidity. Moreover, supply chain disruptions due the pandemic are likely to continue hurting the industry in the near term.

Let’s take a sneak peek into how the following leisure stocks are poised prior to their second-quarter earnings on Aug 10.

According to the proven Zacks model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Marriott International, Inc. MAR is scheduled to report results before the opening bell. Marriot’s second-quarter results are likely to reflect the impact of the coronavirus pandemic. The company anticipates to witness a sharp decline in RevPAR and occupancy rate.

Although the company is witnessing steady recovery in the U.S. and China markets, RevPAR and occupancy rate is still well below the pre-pandemic era. Per the reports, occupancy rates in China have increased from a low of 7% in February to approximately 40% in late May, while occupancy rates in the United States have crossed the 20% threshold. Earlier in April, the company had an occupancy rate of about 12% in North America, out of which 16% of hotels were temporarily closed. Even though the occupancy rates are improving, CEO Arne Sorenson stated that it might take a while for the company to reach its 2019 global occupancy levels of 71%. (Read more: Dismal Occupancy to Hurt Marriott's Earnings in Q2)

Marriott International, Inc. Price and EPS Surprise

Marriott International, Inc. price-eps-surprise | Marriott International, Inc. Quote

The company has a Zacks Rank #4 (Sell) and an Earnings ESP of -0.52%.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Royal Caribbean Cruises Ltd. RCL is likely to register a sharp decline in the top and bottom lines when it reports second-quarter results. In the last reported quarter, the company delivered a negative earnings surprise of 82.7%.

Royal Caribbean’s second-quarter results are likely to reflect sharp decline owing to cruise cancellations. Notably, the company had suspended global cruise operation beginning Mar 13, 2020 on account of the pandemic. Due to the ongoing crisis scenario, bookings for 2020 have declined significantly. The company is anticipated to report net loss on both a GAAP and adjusted basis for the second quarter and 2020 fiscal year.

Further, increase in expenses might get reflected in the second-quarter results. Earlier, the company had announced that during suspension of operations, it estimates cash burn between $250 million to $275 million per month. This includes ongoing ship operating expenses, administrative expenses, debt service, hedging costs and anticipated necessary CapEx. (Read more: What's in the Cards for Royal Caribbean Q2 Earnings?)

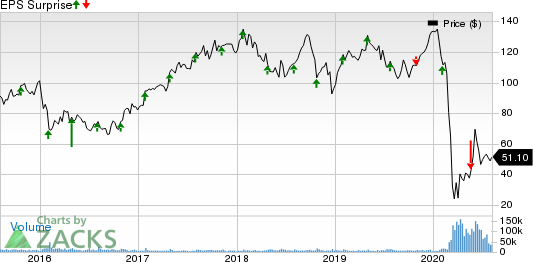

Royal Caribbean Cruises Ltd. Price and EPS Surprise

Royal Caribbean Cruises Ltd. price-eps-surprise | Royal Caribbean Cruises Ltd. Quote

The company has a Zacks Rank #4 and an Earnings ESP of -1.06%.

Extended Stay America, Inc. STAY is scheduled to report financial numbers after the closing bell. In the last reported quarter, the company’s earnings surpassed the Zacks Consensus Estimate by 75%.

For the quarter to be reported, the Zacks Consensus Estimate for the bottom line is pegged at a loss of 4 cents per share, against earnings of 32 cents reported in the prior-year quarter. Revenues are anticipated at $227.3 million, suggesting a decline of 29.8% from $323.7 million reported in the year-ago quarter.

Decline in RevPAR and occupancy rate are likely to have weighed on the company’s performance in the quarter to be reported. Moreover, high operating costs due to the coronavirus pandemic are likely to have acted as headwinds in the second quarter.

Extended Stay America, Inc. Price and EPS Surprise

Extended Stay America, Inc. price-eps-surprise | Extended Stay America, Inc. Quote

The company has a Zacks Rank #3 and an Earnings ESP of +41.67%.

SeaWorld Entertainment, Inc. SEAS is scheduled financial numbers before the opening bell. In the last reported quarter, the company’s earnings beat the Zacks Consensus Estimate by 26.5%.

The Zacks Consensus Estimate for first-quarter bottom line is pegged at a loss of $1.00, against earnings of 64 cents reported in the prior-year quarter. Meanwhile, the consensus mark for revenues stands at $24 million, suggesting a decline of 94.1% from the prior-year quarter.

SeaWorld Entertainment, Inc. Price and EPS Surprise

SeaWorld Entertainment, Inc. price-eps-surprise | SeaWorld Entertainment, Inc. Quote

The company has a Zacks Rank #3 and an Earnings ESP of -29.44%.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.3% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marriott International, Inc. (MAR) : Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Extended Stay America, Inc. (STAY) : Free Stock Analysis Report

SeaWorld Entertainment, Inc. (SEAS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo News

Yahoo News