Such Is Life: How Xperi (NASDAQ:XPER) Shareholders Saw Their Shares Drop 59%

The truth is that if you invest for long enough, you're going to end up with some losing stocks. But long term Xperi Corporation (NASDAQ:XPER) shareholders have had a particularly rough ride in the last three year. So they might be feeling emotional about the 59% share price collapse, in that time. Furthermore, it's down 10% in about a quarter. That's not much fun for holders.

See our latest analysis for Xperi

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, Xperi moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. So given the share price is down it's worth checking some other metrics too.

Given the healthiness of the dividend payments, we doubt that they've concerned the market. It's good to see that Xperi has increased its revenue over the last three years. But it's not clear to us why the share price is down. It might be worth diving deeper into the fundamentals, lest an opportunity goes begging.

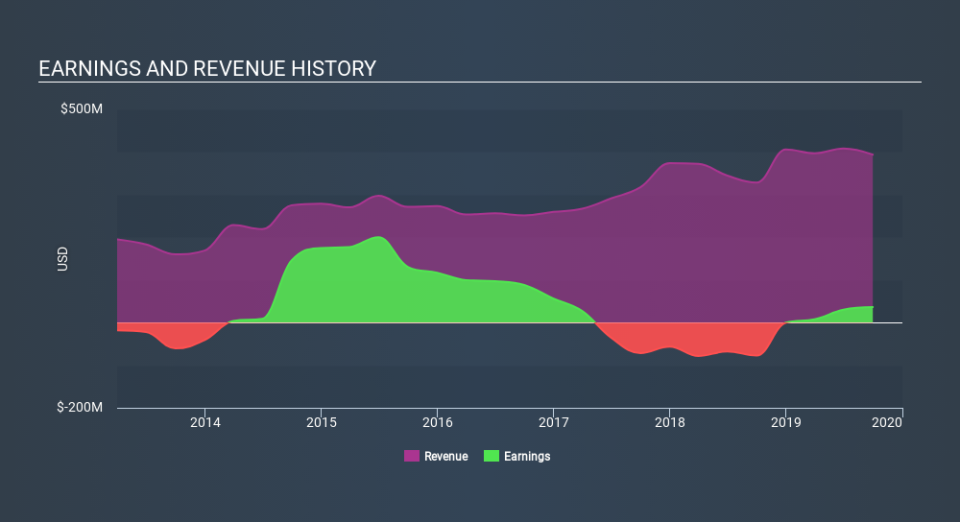

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We know that Xperi has improved its bottom line lately, but what does the future have in store? If you are thinking of buying or selling Xperi stock, you should check out this free report showing analyst profit forecasts.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Xperi, it has a TSR of -54% for the last 3 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

While the broader market gained around 28% in the last year, Xperi shareholders lost 6.3% (even including dividends) . However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 10% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It's always interesting to track share price performance over the longer term. But to understand Xperi better, we need to consider many other factors. For example, we've discovered 4 warning signs for Xperi (1 is potentially serious!) that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo News

Yahoo News