A Look At trivago's (NASDAQ:TRVG) Share Price Returns

As every investor would know, not every swing hits the sweet spot. But really bad investments should be rare. So consider, for a moment, the misfortune of trivago N.V. (NASDAQ:TRVG) investors who have held the stock for three years as it declined a whopping 84%. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. The more recent news is of little comfort, with the share price down 63% in a year. The falls have accelerated recently, with the share price down 29% in the last three months.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

View our latest analysis for trivago

Because trivago made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last three years trivago saw its revenue shrink by 13% per year. That is not a good result. The share price fall of 23% (per year, over three years) is a stern reminder that money-losing companies are expected to grow revenue. We're generally averse to companies with declining revenues, but we're not alone in that. Don't let a share price decline ruin your calm. You make better decisions when you're calm.

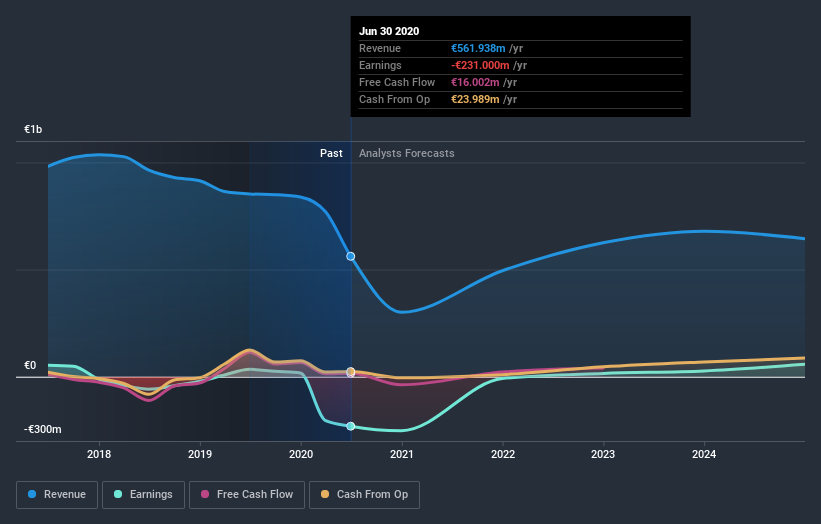

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. If you are thinking of buying or selling trivago stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Over the last year, trivago shareholders took a loss of 63%. In contrast the market gained about 14%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. The three-year loss of 23% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. It's always interesting to track share price performance over the longer term. But to understand trivago better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with trivago .

We will like trivago better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo News

Yahoo News