Low-income households in UK living in ‘year of financial fear’ says charity

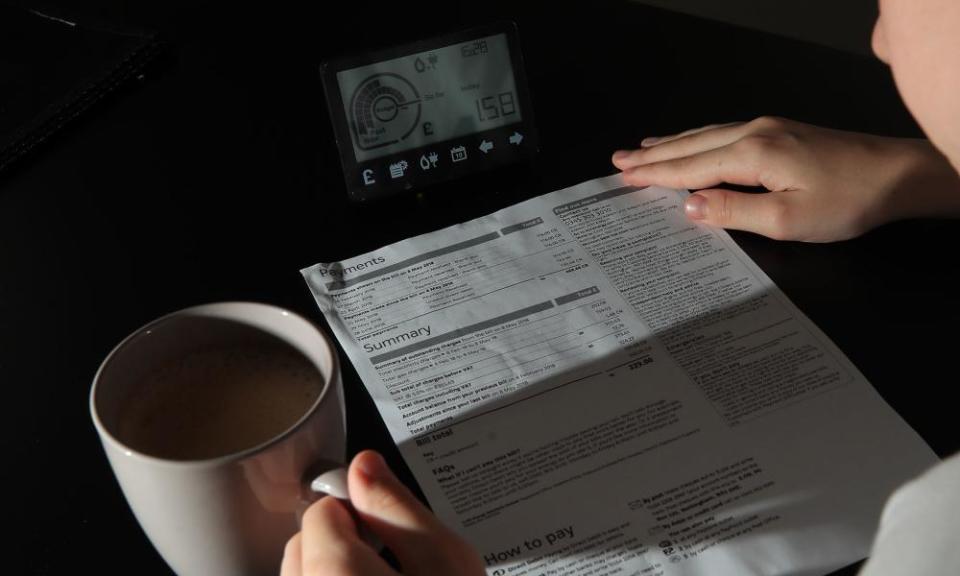

About 7 million struggling families in the UK are living through a “frightening year of financial fear”, going without food, heating, toiletries and even showering as they try to cope with the cost of living crisis, a leading charity has said.

Many people are falling deep into debt as they try to stay afloat, using credit cards or cash from loan sharks to pay for food and other basics and building up arrears on energy bills, according to the Joseph Rowntree Foundation (JRF), an anti-poverty charity.

The extent of the crisis facing low-income households was so serious that more than 2 million households were no longer choosing between “heating or eating” because they had already gone without both, the charity said.

Although it welcomed the government’s cost of living support package announced last month, JRF said the chancellor’s £15bn intervention “didn’t even touch the sides” when it came to addressing the financial difficulties faced by the poorest households.

The charity also criticised the government for “making an already bad situation far worse” by using the benefit system to collect debts. Nearly half of all universal credit claimants had an average of £61 deducted from their benefits each month.

Some households were having up to £130 a month, or a quarter of their entitlement, deducted from their benefits – often for historical tax credit overpayments or advance loans issued to tide them over the five-week waiting period for new claims.

“Our research illustrates the frightening year of financial fear low-income families are living through. Families up and down the country have been faced with options that are simple but grim: fall behind on bills, go without essentials like enough food, or take on expensive debt at high interest. In some cases they had to do all three,” said Katie Schmuecker, JRF’s principal policy adviser.

“No one should be put in this precarious position. The hardship families are facing now builds on the foundations of a decade of cuts and freezes to social security. The chancellor’s cost of living support package will offer some temporary relief but rather than lurching from emergency to emergency, government must get ahead of this problem.”

She added: “The way government collects debts is making an already bad situation far worse, by making an already low basic rate of social security even lower still. It leaves too little to cover the essentials at the best of times, let alone during the biggest cost of living crisis in a generation – a crisis which shows no signs of abating.”

The JRF’s estimates were based on a survey of more than 4,000 people in the bottom 40% of UK household incomes – equivalent to a joint income of under £25,000 for a couple with no children or £37,900 for a couple with two children. The poll was carried out in May and June.

Its findings include:

Debt is increasingly taking the strain for low-income households, which have borrowed £12.5bn of new debt in 2022, including £3.5bn from doorstep lenders and illegal loan sharks.

Arrears on all personal debt have more than doubled from £1.8bn to £3.8bn since October last year. As interest rates continue to rise, JRF expects this figure to soar.

Average household arrears across all bills were £1,600. An estimated 2 million low-income families were currently in arrears on energy bills, a rise of more than a quarter since October.

The government support package unveiled in May included a £400 discount on energy bills for all households and a cost of living payment of £650 for households on means-tested benefits. Pensioners qualify for a £300 payment and those on disability benefits can receive £150.

A government spokesperson said: “We’re providing targeted help of at least £1,200 to 8 million low income families – welcomed by the JRF – while supporting people to earn more, including a £300 a year tax cut in July and allowing Universal Credit claimants to keep £1,000 more of what they earn.”

Yahoo News

Yahoo News