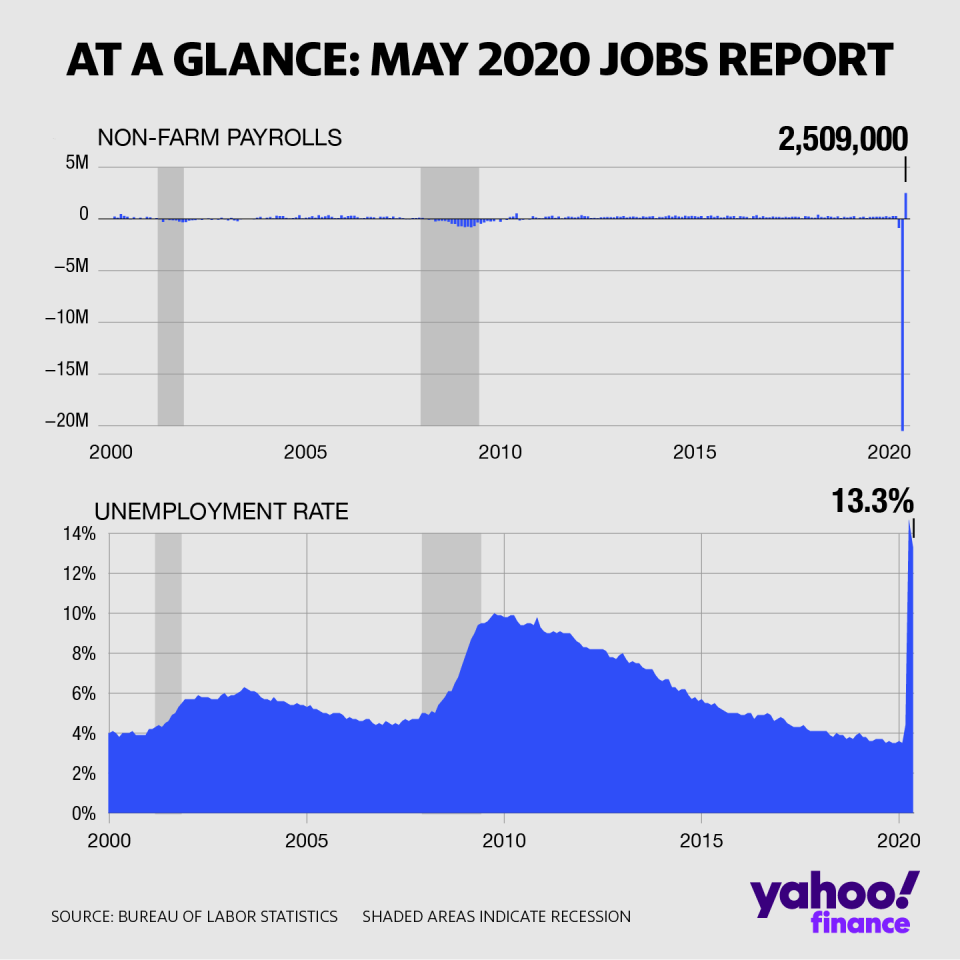

May jobs report: US economy unexpectedly adds 2.5 million payrolls, unemployment rate falls to 13.3%

The May jobs report showed an unexpected rise in non-farm payrolls across the economy and a drop in the unemployment rate from April, averting what economists expected would be a rise in the jobless rate to the highest level since the Great Depression amid the coronavirus pandemic.

The Labor Department released the May jobs report Friday at 8:30 a.m. ET. Here were the main results from the report, compared to Bloomberg consensus data:

Change in non-farm payrolls: +2.509 million vs. -7.5 million expected and -20.687 million in April

Unemployment rate: 13.3% vs. 19.0% expected and 14.7% in April

Average hourly earnings month on month: -1.0% vs. +1.0% expected and +4.7% in April

Average hourly earnings year on year: +6.7% vs. +8.5% expected and +8.0% in April

The Labor Department’s surveys captured the period including the 12th of the month, meaning the May report included the very early stages of reopening in some parts of the U.S. amid the coronavirus outbreak. But the rise in non-farm payrolls still exceeded all economist expectations, with no economists included in Bloomberg’s survey having predicted a rise in jobs during the month of May. Stocks rallied strongly following the report.

“Total nonfarm payroll employment increased by 2.5 million in May, reflecting a limited resumption of economic activity that had been curtailed due to the coronavirus pandemic and efforts to contain it,” the BLS said in its statement Friday.

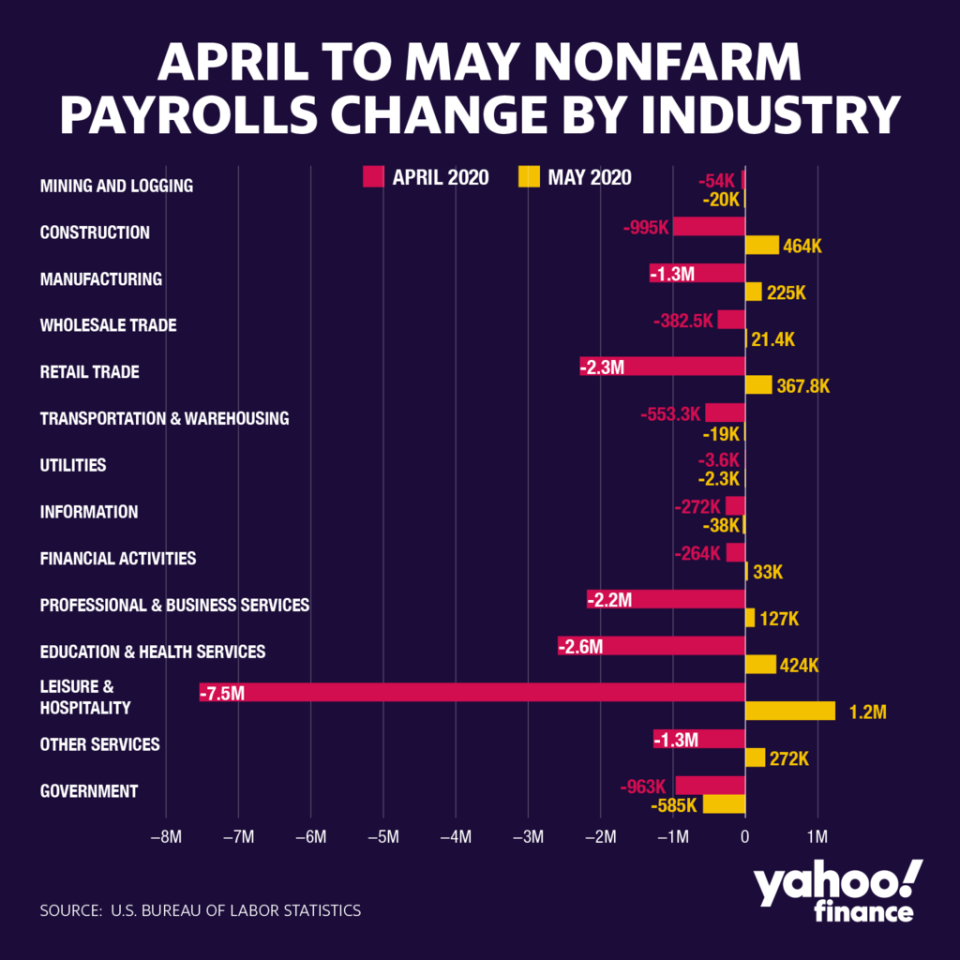

The private services sector recovered 2.425 million payrolls in May after shedding 17.351 million in April. Leisure and hospitality – far and away the hardest-hit industry group in April, with more than 7.5 million jobs lost – saw the largest rebound, with 1.24 million positions added in May.

Education and health services industries added 424,000 payrolls in May after shedding 2.59 million in April. Retail trade, wholesale trade, financial activities, and professional and business services also added jobs for the month.

Within the services sector, only the transportation and warehousing, utilities, and information industries extended job losses from April.

The goods-producing sector also added jobs, with these rising 669,000 after declining by 2.373 million in April. Manufacturing payrolls rose by 225,000, recovering some of the 1.324 million payrolls lost during the prior month.

Government payrolls, however, extended declines, with these falling by 585,000 after a drop of 963,000 in April.

The broad-based gains in payroll employment “indicates that the process of rehiring began sooner than the jobless claims figures suggested,” said Michael Pearce, senior U.S. economist for Capital Economics. “With more states moving to loosen their lockdowns in the coming weeks, particularly in the populous Northeast, employment looks set to continue rebounding in June and beyond, although we still think it will be a long time before the labor market is anywhere near back to its pre-virus state.”

Friday’s jobs report also included an unexpected improvement in the unemployment rate to 13.3%, after hitting the highest level in BLS monthly survey history in April at 14.7%. Most economists expected the jobless rate would climb further to nearly 20% in May, reflecting those still unemployed amid ongoing virus-related business disruptions. The monthly unemployment rate was estimated to have peaked at about 25% during the Great Depression in 1933.

Still, the Labor Department noted inconsistent classifications of workers due to pandemic-related effects meant the unemployment rate would have been about 3 percentage points higher than was actually reported.

“As was the case in March and April, household survey interviewers were instructed to classify employed persons absent from work due to coronavirus-related business closures as unemployed on temporary layoff,” the Labor Department said in the report. “However, it is apparent that not all such workers were so classified. BLS and the Census Bureau are investigating why this misclassification error continues to occur and are taking additional steps to address the issue.”

“If workers who were recorded as employed but absent from work due to ‘other reasons’ (over and above the number absent for other reasons in a typical May) had been classified as unemployed on temporary layoff, the overall unemployment rate would have been about 3 percentage points higher than reported (on a not seasonally adjusted basis).”

The share of unemployed individuals on temporary layoff eased slightly to 73% after hitting a record high of 78.3% in April. The labor force participation rate rose to 60.8% – a modest improvement from April’s 60.2%, but still at the lowest level since the early 1970s in data preceding the pandemic. And the broader U-6 unemployment rate including discouraged individuals no longer looking for work held above 21% in May, after hovering around 7% in 2019.

Ahead of the May jobs report, some other surveys showed encouraging drops in new job cuts relative to April, offering some hope for a further easing in payroll declines in the BLS report. The closely watched ADP report on private payrolls released Wednesday showed private employers cut 2.76 million jobs in May, or less than one-third the 9 million expected, and just a fraction of the 19.6 million from April.

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Read more from Emily:

What we can learn from the 17 stock market crashes since 1870

April jobs report: Employers cut a record 20.5 million payrolls, unemployment rate jumps to 14.7%

Disney earnings fall as coronavirus ‘significantly’ impacts parks, but ESPN, Disney+ shine

Warren Buffett: The American economic miracle 'has always prevailed and it will do so again'

Nike 3Q revenue tops expectations as surge in China digital sales helps offset store closures

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Yahoo News

Yahoo News