Mini-budget latest LIVE: Kwasi Kwarteng scraps 45% top rate of income tax as Chancellor slashes stamp duty

Kwasi Kwarteng has unveiled a mini-budget that delivers billions of pound worth of tax cuts - including a surprise move to scrap the 45% top rate of income tax paid by the UK’s wealthiest.

The Chancellor announced sweeping moves intended to rev up the economy in the eagerly-awaited “fiscal event” on Friday morning.

The Government is dubbing it a “growth plan” at a time when the UK faces a cost-of-living crisis, recession, soaring inflation and climbing interest rates.

The Chancellor told MPs the planned rise to corporation tax would be cancelled as he announced the cap on banker bonuses would be scrapped.

He also announced that the basic rate of income tax would be cut to 19p in the pound from April 2023. And he said the 45% higher rate of income tax will be “abolished”.

Mr Kwarteng said his economic vision would “turn the vicious cycle of stagnation into a virtuous cycle of growth”.

But shadow chancellor Rachel Reeves said the strategy amounts to an “admission of 12 years of economic failure” under successive Conservative governments.

The Labour MP described the Prime Minister and Mr Kwarteng as “two desperate gamblers in a casino chasing a losing run”.

When will mini-budget be held?

07:15 , Josh Salisbury

The mini-budget is to be held at 9.30am with a statement from Chancellor Kwasi Kwarteng in the House of Commons.

An official Treasury briefing will then follow.

Among the key measures already confirmed in the package is the £13bn reversal of the increase in national insurance contributions, introduced in April to fund the health and social care levy.

This will come into force on November 6.

What measures could we see in mini budget?

07:28 , Josh Salisbury

Kwasi Kwarteng is set to unveil a package of over 30 measures as part of the Treasury’s “Growth Plan” to kickstart the UK economy, including relief for households facing high energy bills and the delivery of around 100 major infrastructure projects.

While not all measures have been confirmed, several have been heavily trailed in advance, or speculated upon.

Among the measures which could be in package: -

- Reveral of decision to raise corporation tax from 19 per cent to 25 per cent from next April

- A confirmed reversal of 1.25 percentage point rise in National Insurance from November 6

- A potential cut in stamp duty, according to reports in the Times

- Slashing business levies in new “investment zones”, which have been dubbed “full fat freeports”.

- Scrapping the cap on bankers’ bonuses

Minister rejects suggestion budget measures are ‘gamble'

07:29 , Josh Salisbury

Simon Clarke, the Levelling Up Secretary, has rejected the suggestion that the economic plan due to be set out by the Chancellor later was a “gamble".

Some economic analysts have been sceptical about the sustainability of some of the tax-cutting measures that Kwasi Kwarteng will announce in the Commons on Friday, the biggest since the 1980s.

Calling it a “game-changing financial statement", he said the measures were designed to return the UK to the level of growth seen before the financial crash in 2008.

He told Sky News that Mr Kwarteng would “tackle what is a record high tax burden on families and businesses, reflecting clearly the fact we've gone through some extraordinarily difficult years but setting out a fundamentally new approach to go for growth to make sure that we we win the argument that a more successful enterprise economy is good for the whole of this country”.

Mini budget is not ‘trickle down economics’, insists minister

07:31 , Josh Salisbury

Simon Clarke, the Levelling Up Secretary, has also rejected as “nonsense" the suggestion that Liz Truss and Kwasi Kwarteng are engaging in "trickle-down economics".

"This whole term trickle-down is such a nonsense and is itself a centre-left mischaracterisation of what this Government is all about. We need to grow the economy because a more successful economy is good for everybody," he told Sky News.

He instead called it a "virtuous circle".

A former chief secretary to the Treasury, he also defended his decision to now support a reversal of the rise in national insurance, saying the NHS would get investment through general taxation rather than a specific levy.

No ‘top down’ imposition of ‘investment zones’ with relaxed planning rules, says minister

07:39 , Josh Salisbury

In further comments on his broadcast round, Levelling Up Secretary Simon Clarke promised there would be no “top-down" approach to new local investment zones.

The Chancellor will announce that it is in talks with local authorities in the West Midlands, Tees Valley, Somerset and other regions to establish new investment zones - areas with lower taxation and planning rules.

He told Sky News: “These zones will only happen where there is local consent and we've been very clear about that in the discussions we've been having with local authorities and mayors over recent days."

He said he hoped to see progress in the coming weeks about where the zones will be created.

“They will only happen where there is a local appetite for them to occur. There will be no top-down imposition of these zones."

‘We face really tough times’, warns Truss ahead of mini budget

07:50 , Josh Salisbury

In a joint video with Chancellor Kwasi Kwarteng, Prime Minister Liz Truss has vowed the measures will help grow the economy and tackle the “really tough times” Britain faces.

She said: “We do face really tough times. We’ve got the appalling war in Ukraine perpatrated by Putin which has raised energy prices.

“We have the aftermath of Covid which caused a huge economic shock to the global economy. And that’s why it’s so important that we act with urgency to get things moving in Britain, to get those jobs and growth into communities up and down the country”.

The Chancellor @KwasiKwarteng and I know what a great country this is.

Our Growth Plan will unleash our potential and deliver better jobs, more funding for public services and higher wages for the British people.

The action starts now. 🇬🇧 pic.twitter.com/UWJQ6wChaP— Liz Truss (@trussliz) September 23, 2022

Budget will lead to growth, vows Truss

07:55 , Josh Salisbury

Liz Truss has vowed that her and her Chancellor’s plans would boost growth and ultimately lead to higher wages and better public services.

“What this is about is making sure the United Kingdom is a successful economy where we’re getting more jobs, more investment and more opportunities for people across the country,” Ms Truss said.

“And what that ultimately means is that people will be earning higher wages, that we’ll see more successful businesses and we’ll see more money going into our public services.

“This is a fantastic country with huge reserves of talent, energy and enterprise. And what this is all about is unleashing those talents, that energy, for the betterment of our country.”

Kwarteng: We cannot tax ourselves to growth

08:00 , Josh Salisbury

Chancellor Kwasi Kwarteng has said the country cannot tax itself to prosperity ahead of his mini budget later today.

“We want to grow the British economy, and that’s not just growth for the sake of growth, as the prime minister said, growth means better jobs, higher wages, and also more tax revenue for our public services so that we can protect the most vulnerable in our society,” said Mr Kwarteng in a video released by No 10.

“What we can’t do is simply tax ourselves to prosperity and keep raising taxes indefinitely.

“I’m really excited, I’m really, really excited. I think it’s an ambitious programme, I think it’s a dynamic programme, I think it’ll deliver, it is delivering, and I’m really looking forward to the statement.”

Labour: Tory plan is not plan for growth and is enormous gamble

08:03 , Josh Salisbury

Labour’s Pat McFadden, the shadow chief secretary to the Treasury, said that what the Government is due to announce on Friday is not in reality a plan for growth.

“What today looks like is the Government taking an enormous gamble with the public finances by taking a series of measures and putting it all on borrowing, and calling it a plan for growth,” he said.

He said it does not appear as if the Government is going to try to raise any revenue, as he repeated Labour's call for a further windfall tax on oil and gas companies.

“This isn't really a plan for growth, it is a return to some very old-style Tory polices based on the belief that if you make those who are already wealthy even wealthier it will trickle down to the rest of us,” he told BBC Breakfast.

He added that what he called “flip-flopping and chaos" was a threat to stability, saying: “It will be the third change in national insurance in six months. It is the legislative equivalent of digging a hole and filling it back in again."

‘Budget for growth’ will help pay down debt from borrowing, insists minister

08:12 , Josh Salisbury

Pressed about who will pay for UK debt, ahead of the Chancellor's fiscal event, Levelling Up Secretary Simon Clarke said: “The prescription here is that we get a better underlying growth that unleashes the tax receipts that will allow us to both grow the economy and also to get on top of that debt."

Mr Clarke said that stagnating growth makes it “very hard to manage the burden of our debt and the challenge of funding our public service".

He told BBC Breakfast that the UK was facing “major inflationary pressures", making it more even important to deliver growth.

It comes after the Bank of England warned that the UK may already be in a recession.

Pound slumps to weakest against dollar since 1985 ahead of mini budget

08:37 , Josh Salisbury

The pound has fallen $1.12 for first time since 198 ahead of the mini-budget.

Meanwhile, the euro has also dropped to its lowest against the dollar since 2002.

1980s ‘proves’ tax cuts lead to growth, says minister

08:53 , Josh Salisbury

Continuing in his broadcast round ahead of Kwasi Kwarteng’s statement at 9.30am, Levelling Up Secretary Simon Clarke said it was an “absolute conviction" that the measures to be announced by the Treasury would deliver growth.

“It is also the proven experience of the 1980s and the 1990s, that a lower tax burden stimulates better growth," he told BBC Radio 4's Today programme.

Put to him that former prime minister Margaret Thatcher did not have to cope with soaring inflation, he said: “The Bank of England has a very clear mandate to tackle inflation and we have total confidence in their ability to honour their commitments to keep inflation down."

“Clearly the action this Government is taking is designed to ensure that mission is supported."

Pointing to what he said would be the anti-inflationary impact of the Government's energy package, he said: “We want the rate of economic growth to outstrip that of inflation."

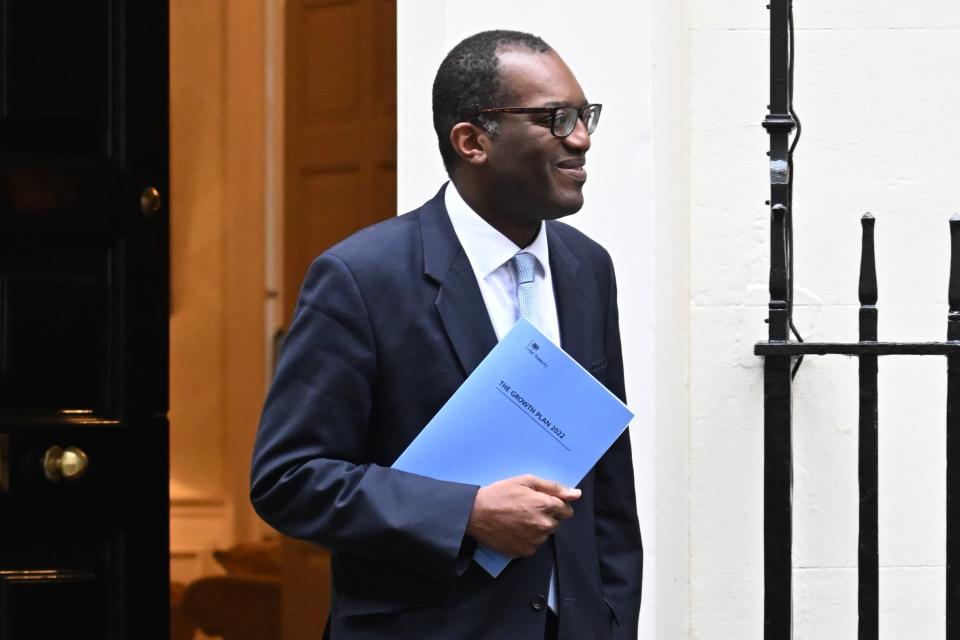

Kwarteng departs No11 on way to deliver ‘mini budget'

09:11 , Josh Salisbury

Kwasi Kwarteng departs No11 for the House of Commons to deliver statement.

The mini-budget is expected at 9.30am.

PM Truss heads to Commons ahead of mini budget

09:19 , Josh Salisbury

Liz Truss has also been pictured departing No10 and heading for the Commons, where Chancellor Kwasi Kwarteng is due to give his ‘mini budget’ shortly.

Kwasi Kwarteng to begin mini budget shortly

09:25 , Josh Salisbury

Chancellor Kwasi Kwarteng is shortly to begin his mini budget just after 9.30am.

The Commons starts sitting at 9.30am, with Mr Kwarteng beginning his statement a few minutes later.

Kwasi Kwarteng starts mini budget ‘statement for growth'

09:38 , Josh Salisbury

Chancellor Kwasi Kwarteng has begun his mini budget in a statement to the Commons, saying “help is coming” for households and businesses with soaring energy costs.

Our aim is to reach growth of 2.5% - Kwarteng

09:42 , Josh Salisbury

Kwasi Kwarteng says the Government aims to reach an annual rate of 2.5% for growth,

“We need a new approach for a new era, focused on growth. Our aim, over the medium term, is to reach a trend rate of growth of 2.5%.” he said.

“And our plan is to expand the supply side of the economy through tax incentives and reform.”

He says this will be focussed on three priorities, maintaining responsible public finances, reforming the supply-side of the economy and cutting taxes to boost growth.

Energy package will cost £60 billion for the six months - Kwarteng

09:45 , Josh Salisbury

Mr Kwarteng tells MPs Government’s energy support scheme will cost £6bn for six months.

He said: “The House should note that the estimated costs of our energy plans are particularly uncertain, given volatile energy prices.

“But based on recent prices, the total cost of the energy package, for the six months from October, is expected to be around £60bn. We expect the cost to come down as we negotiate new, long term energy contracts with suppliers.”

Kwarteng: Planning reform to help infrastructure projects off the ground

09:47 , Josh Salisbury

Mr Kwarteng pledges an overhaul of planning rules surrounding nationally important infrastructure projects to get them off the ground.

He announces a new bill “to unpick the complex patchwork of planning restrictions and EU-derived laws that constrain our growth”.

He tells MPs: “Today, we are publishing a list of infrastructure projects that will be prioritised for acceleration, in sectors like transport, energy, and telecoms.

“And, to increase housing supply and enable forthcoming planning reforms, we will also increase the disposal of surplus government land to build new homes”.

Kwarteng: Govt will toughen rules to stop ‘militant’ trade unions closing down transport networks

09:50 , Josh Salisbury

The Chancellor tells MPs that the Government will introduce “minimum service levels” in a bid to stop “militant” trade unions closing down transport networks.

He also says that the Government will legislate “require unions to put pay offers to a member vote, to ensure strikes can only be called once negotiations have genuinely broken down.”

Kwarteng confirms scrapping of bankers’ bonus cap

09:52 , Josh Salisbury

The Chancellor has confirmed trailed plans to scrap a cap on bankers’ bonus.

He tells MPs the cap only pushed up the basic salaries of bankers and scrapping it will encourage global banks to invest in the UK.

“All the bonus cap did was to push up the basic salaries of bankers, or drive activity outside Europe. It never capped total remuneration, so let’s not sit here and pretend otherwise,” he said. “So we’re going to get rid of it”.

Kwarteng confirms cancellation of planned increase in Corporation Tax

09:54 , Josh Salisbury

Mr Kwarteng confirms the Government will drop a planned increase in corportation tax to 25%, meaning it will instead stay at 19%.

He said: “Every additional tax on business is ultimately passed through to families through higher prices, lower pay, or lower returns on savings.”

VAT-free shopping for tourists, says Chancellor

09:56 , Josh Salisbury

Mr Kwarteng tells MPs that overseas visitors will have VAT-free shopping.

“Britain welcomes millions of tourists every year, and I want our high streets and airports, our ports and our shopping centres, to feel the economic benefit,” he said. “So we have decided to introduce VAT-free shopping for overseas visitors.”

Planned alcohol duty rises will be cancelled

09:58 , Josh Salisbury

The Chancellor says planned increases on wine, beer, and other alcohol duties will be cancelled.

“At this difficult time, we are not going to let alcohol duty rates rise in line with RPI [inflation]”, he says.

“So I can announce that the planned increases in the duty rates for beer, for cider, for wine, and for spirits will all be cancelled.”

Kwarteng confirms reversal of national insurance increase

10:00 , Josh Salisbury

The Chancellor has repeated his confirmation that the national insurance rise will be reversed.

He estimates that this will save people on average, £330 every year, a tax cut for 28 million people.

Stamp duty will be cut

10:03 , Josh Salisbury

The Chancellor confirms cuts to stamp duty.

“Home ownership is the most common route for people to own an asset, giving them a stake in the success of our economy and society,” he said.

“So to support growth, increase confidence, and help families aspiring to own their own home, I can announce that we are cutting stamp duty.”

This will bring the amount of which there is no stamp duty to pay from £125,000 to £250,000. First time buyers currently pay no stamp duty on the first £300,000, which will now change to £425,000.

Top rate of income tax of 45% to be abolished

10:05 , Josh Salisbury

Another eye-catching measure announced by Mr Kwarteng is abolishing the top rate of income tax of 45%.

From April 2023, the rate will be reduced to 40%.

“At 45%, its currently higher than the headline top rate in G7 countries like the US and Italy,” he said.

“And it is higher even than social democracies like Norway. But I’m not going to cut the additional rate of tax today, Mr Speaker. I’m going to abolish it altogether.”

“This will simplify the tax system and make Britain more competitive”.

Cut in basic rate of income tax from April 2023

10:07 , Josh Salisbury

Mr Kwarteng also said the basic rate of income tax would be cut to 19p by April 2023, a year earlier than planned.

“That means a tax cut for over 31m people in just a few months’ time,” he said. “That means we will have one of the most competitive and pro-growth income tax systems in the world.”

Kwarteng concludes speech vowing to deliver growth in a ‘new era'

10:09 , Josh Salisbury

Concluding his speech, Mr Kwarteng says: “For too long in this country, we have indulged in a fight over redistribution. Now, we need to focus on growth, not just how we tax and spend.

“We won’t apologise for managing the economy in a way that increases prosperity and living standards. Our entire focus is on making Britain more globally competitive - not losing out to our competitors abroad.

He added: “We promised to prioritise growth. We promised a new approach for a new era. We promised to release the enormous potential of this country. Our growth plan has delivered all those promises and more.”

Labour: Chancellor’s mini budget ‘demolishes’ Tory record in office

10:11 , Josh Salisbury

Labour shadow chancellor Rachel Reeves said Kwasi Kwarteng had provided a “comprehensive demolition” of the last 12 years of Tory government.

Responding in the Commons to the Chancellor’s statement on the economy, Ms Reeves said: “Can I thank the Chancellor on his comprehensive demolition of the record of that last 12 years. Their record, their failure, their vicious circle of stagnation.”

She slammed the mini budget as a “menu with prices”, saying there was no indepedent forecast backing up the Government’s figures.

She said: “The Chancellor has confirmed that the costs of the energy price cap will be funded by borrowing, leaving the eye-watering windfall profits of the energy giants untaxed.

“The oil and gas producers will be toasting the Chancellor in the boardrooms as we speak while working people are left to pick up the bill.

“Borrowing higher than it needs to be, just as interest rates rise. And yet the Chancellor refuses to allow independent economic forecasts to be published, which would show the impact of this borrowing on our public finances and growth, and on inflation.

“It is a budget without figures, a menu without prices. What has the Chancellor got to hide?”

Labour: Government’s plan is based on outdated ideology of ‘trickle down'

10:14 , Josh Salisbury

Labour’s shadow chancellor Rachel Reeves accuses the Government of replacing levelling up with “trickle down”.

She tells the Commons that the Conservatives’ plan is “based on an outdated ideology that says if we simply reward those who are already wealthy, the whole of society will benefit”.

“They have decided to replace levelling up with trickle down,” she said.

“As President Biden said this week, he is is sick and tired of trickle-down economics. And he is right to be. It is discredited, it is inadequate and it will not unleash the wave of investment that we need.”

Treasury Committee chair: ‘Vast void’ at centre of statement without independent forecast

10:24 , Josh Salisbury

The Treasury Select Committee chair, Mel Stride, has said there is a “massive void” in the centre of the Chancellor’s mini budget because of a lack of an independent forecast.

The Office for Budget Responsibility (OBR), normally produces a forecast alongside Government’s budgets - but as today is a “fiscal statement,” one is not being produced, to criticism by the opposition.

Mr Stride, a Conservative MP, said while he welcomed much of the statement, “there is a vast void at the centre of the announcements that have been made this morning”.

“And that is the lack of an independent OBR forecast”.

Martin Lewis calls mini-budget ‘staggering'

10:28 , Josh Salisbury

Consumer money expert Martin Lewis described the Government’s financial plan as “staggering” after the so-called mini-budget from Chancellor Kwasi Kwarteng was announced.

Lewis, founder of Money Saving Expert, tweeted: “That really was quite a staggering statement from a Conservative Party government.

“Huge new borrowing at the same time as cutting taxes.

“It’s all aimed at growing the economy. I really hope it works. I really worry what happens if it doesn’t.”

That really was quite a staggering statement from a Conservative party government

Huge new borrowing at the same time as cutting taxes.

It's all aimed at growing the economy. I really hope it works. I really worry what happens if it doesn't.#MiniBudget— Martin Lewis (@MartinSLewis) September 23, 2022

‘Extraordinary’ mini budget is biggest tax cutting package ‘since 1972’

10:32 , Josh Salisbury

Paul Johnson, from the respected Institute for Fiscal Studies think tank, called the Chancellor’s announcement the “biggest tax-cutting event since 1972”.

Mr Johnson called it a “quite extraordinary” statement.

“It was like having an entirely new Government.

“This was the biggest tax-cutting event since 1972, it is not very mini. It is half a century since we have seen tax cuts announced on this scale.”

In 1972, the then Government’ ‘dash for growth’ then “ended in disaster,” said Mr Johnson.

“That Budget is now known as the worst of modern times. Genuinely, I hope this one works very much better.”

Changes to tax ‘barking up wrong tree’, says children’s charity

10:45 , Josh Salisbury

Changes to the tax system right now are “barking up the wrong tree” and fails to meet the needs of those on the lowest incomes, a children’s charity has said.

“We need to see far more direct support for families bearing the brunt of the cost-of-living crisis,” said Mark Russell, Chief Executive at The Children’s Society charity.

“What is glaringly absent from today’s announcement is any targeted support for the hardest hit families.”

Pounds sinks to new 37-year low

10:52 , Josh Salisbury

The pound sank to a fresh 37-year low as the Chancellor unveiled tens of billions of pounds of tax cuts and spending on Wednesday morning.

The FTSE 100 plunged to its lowest level in two months.

Sterling declined by as much as 0.89% to 1.115 US dollars as Kwasi Kwarteng spoke to Parliament at 9.30am on Friday.

It has since stabilised at around 1.119 dollars, but this remains below the previous 37-year low struck earlier this week after concerns over surging interest rates hit the currency.

Chancellor fails to say when foreign aid spending will return to 0.7% GDP

11:07 , Josh Salisbury

The Chancellor failed to say precisely when the UK’s aid spending will return to 0.7% after he was pressed by Tory former international development secretary Andrew Mitchell.

Mr Mitchell told the Commons: “Can I remind him of the importance of the UK investment in tackling international problems, whether it’s pandemics, illegal migration or climate change?

“That’s about British expertise but also it’s about British money. Can he confirm to the House we are on track to restore what was a manifesto promise of bringing back the 0.7% in 2024?”

Mr Kwarteng replied: “We’re always looking at our manifesto commitments and given our leadership in this I hope we can come to the 0.7% as is practicable and the public finances allow.”

The government reduced overseas aid from 0.7% to 0.5% of GDP in 2021 in order to free up more cash for domestic spending during Covid.

Sturgeon: Rich will be ‘laughing to the bank'

11:20 , Josh Salisbury

Reacting to the Chancellor’s tax cuts, Scotland’s First Minister, Nicola Sturgeon, said it would leave the rich “laughing all the way to the actual bank”.

Mr Kwarteng announced an unexpected cut in the top rate of income tax from 45% to 40%, although he noted that it was at this level for many of the years of the last Labour government.

Ms Sturgeon tweeted: “The super wealthy laughing all the way to the actual bank (tho I suspect many of them will also be appalled by the moral bankruptcy of the Tories) while increasing numbers of the rest relying on food banks - all thanks to the incompetence and recklessness of this failed UK gov”.

The super wealthy laughing all the way to the actual bank (tho I suspect many of them will also be appalled by the moral bankruptcy of the Tories) while increasing numbers of the rest relying on food banks - all thanks to the incompetence and recklessness of this failed UK gov

— Nicola Sturgeon (@NicolaSturgeon) September 23, 2022

Government has ‘no understanding of economic reality’, says poverty charity

11:27 , Josh Salisbury

Rebecca McDonald, chief economist at the Joseph Rowntree Foundation, said the Chancellor’s mini-budget proves the Government has “no understanding of the economic reality facing millions across the UK”.

Ms McDonald said: “This is a budget that has wilfully ignored families struggling through a cost-of-living emergency and instead targeted its action at the richest. It leaves those on the lowest incomes out in the cold with no extra help to get them through the winter.

“Families on low incomes can’t wait for the promised benefits of economic growth to trickle down into their pockets. The energy price cap fixes bills at a level already unaffordable for many and was never going to be enough to solve the problem for those on the lowest incomes.

“With food prices rising more sharply than inflation, and no action today, it will be a bitter winter ahead.”

Business group largely welcomes mini budget tax cuts

11:35 , Josh Salisbury

The CBI, which represents British business, has largely welcomed the plans announced by the Chancellor, labelling them a “turning point for our economy”.

Tony Danker, CBI director-general, said: “Like Covid, the energy crisis has meant Government has had to spend massively to protect people and businesses. That means we have no choice but to go for growth to afford it.

“Today is day one of a new UK growth approach. We must now use this opportunity to make it count and bring growth to every corner of the UK. Fifteen years of anaemic growth cannot be repeated.

“Taking action to get Britain’s economy moving again by beginning construction on transport and green infrastructure projects shows immediate delivery. Planning reform is long overdue.

“A simpler, smarter approach to tax can pay dividends and firms will be keen to make the most of the investment incentives on offer.

“It’s not perfect - it’s just the beginning - but there’s plenty business can work with. The Chancellor signalled more proposals to come this autumn and these will be vital to sustain momentum on growth.”

Cutting top rate of income tax to cost £2bn

11:58 , Josh Salisbury

Cutting the top rate of income tax from 45% to 40% will cost the Treasury £2bn, according to its figures.

It means that all annual income above £50,270 will be taxed at 40%, the current higher rate of Income Tax.

There are an estimated 629,000 higher-rate taxpayers set to benefit from the cut.

Kwarteng: I’m happy to engage on calls for cuts to fuel duty

12:15 , Josh Salisbury

Kwasi Kwarteng said he is happy to “engage” with a call to cut fuel duty as MPs sought a steer from the Chancellor on a wide range of tax and spend questions.

Following his first significant set of fiscal announcements in the Commons as Chancellor, Conservative backbenchers looked to test Mr Kwarteng’s instincts and draw his attention to a number of policy issues, including aid spending, business rates, and Sunday opening hours.

Conservative MP Robert Halfon, a long-time campaigner for lowering fuel duty, said petrol and diesel prices have been at “historic highs”.

He asked the Chancellor if at the next budget he could “please do everything he can to cut fuel duty”.

Mr Kwarteng replied: “I’d be very happy to engage my right honourable friend on that.”

Government borrowing to increase by £72bn

12:29 , Lydia Chantler-Hicks

Government borrowing will increase by £72 billion as a result of Chancellor Kwasi Kwarteng’s mini-budget, according to Treasury documents.

The Debt Management Office’s net financing requirement has been revised upwards from £161.7 billion in April to £234.1 billion.

It will be funded through additional gilt sales of £62.4 billion and net Treasury bill sales of £10 billion.

Nursing union says Government has ‘wrong priorities’, urges strike action

12:34 , Lydia Chantler-Hicks

The Royal College of Nursing has described the mini-budget as giving “billions to bankers and nothing to nurses”.

General secretary and chief executive Pat Cullen said it is a clear sign the Government has “the wrong priorities”.

“Nursing will be dismayed by the decision to prioritise well-off bankers over NHS and social care staff, some of whom are using food banks and live on a financial knife-edge,” she said.

“Ministers have taken advantage of the good will of nursing staff for far too long and we’re urging our members to vote in favour of strike action when our ballot opens on October 6.”

Changes will benefit those on highest incomes, says Mayor of London

12:53 , Lydia Chantler-Hicks

Mayor of London Sadiq Khan has criticised the Government’s mini-budget, suggesting the new economic plan will benefit the wrong sectors.

During the worst cost of living crisis in a generation, this government thinks those most in need of help are:

✅ Those on the highest incomes

✅ Top bankers in line for multi-million pound bonuses

✅ Fossil fuel companies— Sadiq Khan (@SadiqKhan) September 23, 2022

Welsh finance minister warns mini-budget will ‘embed fairness across UK’

13:02 , Lydia Chantler-Hicks

Wales’ finance minister says she believes the Chancellor’s mini-budget will “embed unfairness” across the country.

Rebecca Evans MS said: “Today’s announcements show the UK Government is heading in a deeply worrying direction, with misplaced priorities leading to a regressive statement that will embed unfairness across the United Kingdom.

“Instead of delivering meaningful, targeted support to those who need help the most, the Chancellor is prioritising funding for tax cuts for the rich, unlimited bonuses for bankers and protecting the profits of big energy companies.”

Tax rises or spending cuts will be needed in future, warns think tank

13:42 , Josh Salisbury

The Institute for Fiscal Studies has warned future tax rises or spending cuts will be needed to pay for increasing debt.

Deputy director Carl Emmerson estimated that even once the energy support package expires in two years, the Government will be borrowing £110 billion a year, meaning debt continuing to rise.

He told the BBC Radio 4’s The World at One: “It could be that the Government gets lucky and the growth comes along ... but at the moment where we’re standing it looks like these tax cuts won’t be sustainable and that other tax rises or spending cuts will be needed to pay for them.

“These tax cuts alone will not deliver sufficient increases in growth to make them self financing.”

The Government argues that the growth the tax cuts will foster will lead to greater tax revenues in the long run.

Conservative donor and entrepreneur welcomes tax cuts

13:49 , Josh Salisbury

Sir Rocco Forte, a Conservative donor and chairman of Rocco Forte Hotels, welcomed Chancellor Kwasi Kwarteng's raft of tax cuts.

He told BBC Radio 4's World At One programme: “I think it's terrific. I've never seen a government hit the ground running as fast as this one in coming to power.

“This is going to be a huge boost to the economy and it's only the beginning I think of what the Government intends to do.

”I'm very, very encouraged by this. It's a budget which will help enterprise, it will allow individuals to reap the rewards of their efforts and hard work."

Renewable energy industry cautiously welcomes plans to make it easier to build wind turbines

14:09 , Josh Salisbury

The renewable industry has tentatively welcomed the Government’s plan to make it easier for developers to build wind turbines in England for the first time in seven years.

The Government said that it would bring rules for onshore wind farms in line with other developments.

Rules that were put in place in 2015 have effectively stopped the construction of any onshore wind farms in the UK since then.

Jess Ralston, senior analyst at the Energy and Climate Intelligence Unit, said: "Around eight in 10 people support onshore wind, so the ban has been a major anomaly in British energy policy given it's both cheap and popular with the public.

"So a decision to lift the ban suggests the new Government has listened to the experts and understands building more British renewables reduces our reliance on costly gas and so brings down bills."

But energy insiders also warned that more detail will be needed, and rules will have to be changed, before they know how significant the move will be.

Truss: Our vision sets out how we’re going to rebuild our economy

14:37 , Josh Salisbury

Liz Truss said that the Government’s economic vision would set out “how we are going to rebuild our economy and deliver for the British people”.

She tweeted: “Growth is key to delivering more jobs, higher pay and more money to fund public services, like schools and the NHS.

“Our Growth Plan sets out how we are going to rebuild our economy and deliver for the British people.”

Growth is key to delivering more jobs, higher pay and more money to fund public services, like schools and the NHS.

Our Growth Plan sets out how we are going to rebuild our economy and deliver for the British people. https://t.co/15vVMAl2qT— Liz Truss (@trussliz) September 23, 2022

West End welcomes return of VAT-free shopping for tourists

14:54 , Josh Salisbury

West End business leaders have hailed the return of VAT free shopping for foreign visitors as “a great victory” for London.

Chancellor Kwasi Kwarteng said he would reverse the axeing of the perk which had made shopping in the capital 20 per cent cheaper for overseas tourists.

Dee Corsi, interim CEO at business group New West End Company, said: “Today’s decision to reintroduce tax-free shopping for overseas visitors is a great victory for London’s International Centres.

“Now the West End can compete on a level playing field with Paris, Milan and Madrid as one of the world’s top shopping and leisure destinations.”

Linda Ellett, UK head of consumer markets, retail and leisure at consultants KPMG, added: “The return of VAT-free shopping for tourists increases the London’s competitiveness when it comes to attracting the spending power of international visitors.”

Read our full story here.

IFS: Chancellor is ‘betting the house’ on risky high borrowing strategy

15:03 , Josh Salisbury

The Institute for Fiscal Studies (IFS) think tank has analysed the Chancellor’s statement and said he is “betting the house” on a risky strategy.

Director Paul Johnson said: “Injecting demand into this high-inflation economy leaves the government pulling in the exact opposite direction to the Bank of England, who are likely to raise rates in response.

“Early signs are that the markets - who will have to lend the money required to plug the gap in the government's fiscal plans - aren't impressed. This is worrying”.

He said Cabinet members could be forgiven for having whiplash, such is the sudden change of the Government’s change of economic policy.

“Mr Kwarteng is not just gambling on a new strategy, he is betting the house,” he said.

Drinks industry welcomes duty freeze

15:23 , Josh Salisbury

A planned rise in alcohol duty was among the measures put on ice by the Chancellor in the Commons on Friday.

In a mini-budget that put tax cuts front and centre, Kwasi Kwarteng announced that an increase in duty rates for beer, cider, wine and spirits would be cancelled.

Alongside an 18-month transitional measure for wine duty, he also said he would extend draught relief to smaller kegs to help support smaller breweries.

The Scotch Whisky Association praised the move by the Chancellor, saying the Government had “delivered".

“The duty freeze will not only support our sector, but the hospitality industry and the wider economy," it said.

Govt ‘totally out of touch with public’, says Davey

15:40 , Daniel Keane

Liberal Democrats leader Sir Ed Davey said the Chancellor's mini budget address demonstrated that the Government was "totally out of touch" with the general public.

Speaking on College Green on Friday, Sir Ed said the fact the pound had dipped to a 37-year low against the dollar during Kwasi Kwarteng's speech to the House of Commons also indicated that global investors were "very worried" about the Government's new economic strategy.

He said: "This budget shows how the Conservatives are totally out of touch with people. Millions of families and pensioners are struggling with soaring bills on energy, on food, on mortgages, and it looks like the Conservatives either don't get it or don't care.

"We needed a plan to help people, and this isn't a plan for our economy."

He added: "It looks to me like investors around the world are very worried about this economic package, whether it's the currency markets with the pound falling, whether it's the cost of Government borrowing, which has gone up on the back of this, I think people are signalling no confidence in the Conservatives.

"So, it's not just members of the public who are struggling who feel that the Government is out of touch, it's international investors also."

Former Tory minister brands tax cuts ‘wrong'

15:53 , Daniel Keane

Conservative former cabinet minister Julian Smith has said the Chancellor's decision to hand a "huge" tax cut to the wealthy was "wrong".

"In a statement with many positive enterprise measures this huge tax cut for the very rich at a time of national crisis and real fear and anxiety amongst low-income workers and citizens is wrong," he tweeted.

Watch: Chancellor’s mini budget at a glance

16:10 , Daniel Keane

Kwarteng rejects suggestion that his economic plan is ‘gamble'

16:28 , Daniel Keane

Kwasi Kwarteng rejected the suggestion his economic announcement in Parliament on Friday was "a gamble".

During a visit to Berkeley Modular Housing Factory in Ebbsfleet, Kent on Friday, he told reporters: "It's not a gamble.

"What is a gamble is thinking that you can keep raising taxes and getting prosperity, which was clearly not working.

"We cannot have a tax system where you are getting a 70-year high, so the last time we had tax rates at this level before my tax cuts was actually before her late majesty had acceded to the throne.

"That was completely unsustainable and that's why I'm delighted to have been able to reduce taxes across the piste this morning."

Nearly two-thirds believe Kwarteng’s tax cuts will benefit the rich more

16:50 , Daniel Keane

Nearly two thirds of people think Kwasi Kwarteng's tax cuts will benefit the rich more, according to a YouGov survey.

Of around 9,400 adults surveyed, 63% said the changes will help wealthier people more, 3% said poorer people and 9% think both groups will benefit equally.

More than half of respondents (52%) said the Chancellor's measures will be not very or not at all effective at growing the British economy, while only 19% replied very or fairly effective.

Asked about the impact on people's lives, 28% said they will end up worse off, 34% said the changes will make no difference, and 19% said they will end up better off.

Market response to budget unprecedented, says former head of Treasury

17:04 , Daniel Keane

Lord Nick Macpherson, the former head of the Treasury, said he would not remember a fiscal intervention triggering such a strong response from the market.

He said: “I worked on some 60 fiscal events over 31 years. I can't remember any generating as strong a market reaction as to today's. The £ is currently down over 3% v $, 1.8% v € and 2.5% v ¥. And the cost of borrowing up 40bp at short end and 20bp at long end.”

I worked on some 60 fiscal events over 31 years. I can't remember any generating as strong a market reaction as to today's. The £ is currently down over 3% v $, 1.8% v € and 2.5% v ¥. And the cost of borrowing up 40bp at short end and 20bp at long end. #justsaying https://t.co/EeVWcWAscB

— Nick Macpherson (@nickmacpherson2) September 23, 2022

This is a good day for the UK, says Chancellor

17:25 , Daniel Keane

Kwasi Kwarteng said Friday was a "very good day for the UK".

The Chancellor told reporters in Kent: "I think it's a very good day for the UK, because we've got a growth plan.

"We're very, very upbeat about what we can do as a country. We were facing low growth and we want a high-growth economy and that's what this morning was all about."

Pressed on the fairness of tax cuts across the board, he said: "The Prime Minister campaigned for the leadership on the basis that we were going to reduce taxes and that's exactly what we've done."

Former US Treasury chief criticises mini budget

17:51 , Daniel Keane

A former US Treasury secretary has sharply criticised Chancellor Kwasi Kwarteng's economic policies, warning the pound may sink past parity with the US dollar.

Larry Summers told Bloomberg: "It makes me very sorry to say, but I think the UK is behaving a bit like an emerging market turning itself into a submerging market...

"There's nothing in the pattern of market response in the UK that suggests anything but fear rather than confidence in the policy approaches being taken.

"It would not surprise me if the pound eventually gets below a dollar if the current policy path is maintained."

Watch: US Business Activity Shrinks Again in September

18:11 , Daniel Keane

Chris Philp: ‘We’re going to make this country an economic success'

19:17 , Matt Watts

The Chief Secretary to the Treasury has dismissed warnings that the pound could fall to parity with the US dollar as “absurd”.

Chris Philp was asked whether the Government would have to resign in this scenario, which economists have warned is possible after the Chancellor’s tax-cutting mini-budget.

He told BBC Radio 4’s PM programme: “I’m not gonna get into frankly slightly absurd hypothetical speculation.

“We only came into office two-and-a-half weeks ago.

“We’ve got a job to do … We’re going to make this country an economic success.”

Mr Philp, who has been a Government minister for several years, was earlier ridiculed after claiming Kwasi Kwarteng’s announcement had pushed up the value of the pound, moments before it dived to a 37-year low.

‘Markets will see that the Government has a “credible and responsible” economic plan’ says Philp

19:27 , Matt Watts

The markets will see that the Government has a “credible and responsible” economic plan, the Chief Secretary to the Treasury has said.

Chris Philp was asked about markets’ spooked reaction to Kwasi Kwarteng’s mini-budget, as the pound dived to a fresh 37-year low.

He told BBC Radio 4’s PM programme: “I think when the Chancellor sets out his medium-term fiscal plan, which includes getting debt to GDP falling, then I think markets and others will see that we have a credible and responsible plan”.

He also insisted the Government has a “plan” to drive up GDP by 1% on current forecasts every year.

“I have every confidence that the objective we set out, the extra 1%, will be delivered. We’re not hoping, we’ve got a plan to do it.”

Mr Philp rejected the idea that the Government has abandoned the cautious approach to the public finances taken by previous Tory administrations.

Kwarteng admits that UK is ‘technically’ in a recession

19:59 , Daniel Keane

The Chancellor has admitted that the UK is now "technically" in recession, though he thinks his tax-cutting measures will ensure the dip is "shallow".

Kwasi Kwarteng told the BBC: "Technically, the Bank of England said that there was a recession, I think it'll be shallow and I hope that we can rebound and grow."

Pressed on whether he was acknowledging there was a recession, he said: "I'm not acknowledging that, no no, I said that there is technically a recession.

"We've had two quarters of very little, negative growth and I think these measures are going to help us drive growth."

He also insisted a recession was not "inevitable"

Watch: Summers Calls UK Fiscal Policy ‘Naive Wishful Thinking’

20:34 , Daniel Keane

That’s all from us

21:14 , Daniel Keane

Thanks for following our live coverage.

Yahoo News

Yahoo News