Mobile sales drive unexpected UK e-commerce growth

BI Intelligence

This story was delivered to BI Intelligence "E-Commerce Briefing" subscribers. To learn more and subscribe, please click here.

Online retail sales in the UK topped £133 billion in 2016, beating expectations with a 16% jump from 2015, according to the latest e-Retail Sales Index from Capgemini and IMRG.

The uptick, which was 5% higher than the firms initially forecast, marks a trend reversal after online retail sales growth in the UK has decelerated in recent years.

That high growth was chiefly driven by a sharp rise in retail sales made on smartphones. In December 2016, e-commerce sales via smartphones rose 47% year-over-year (YoY), compared with a 3% decline in tablet sales YoY. Smartphone sales made up 54% of online sales from mobile devices that month, compared with 39% of sales in December 2015. These December increases helped fuel a 16% YoY increase in online retail sales during the critical holiday shopping season from November 13 to December 24.

This increase in mobile sales indicates that mobile is fast becoming the No. 1 online sales channel for UK retailers, according to Bhavesh Unadkat, Capgemini’s principal consultant in retail customer engagement design. One of the key contributing factors to the growth in sales from smartphones has been the introduction of smartphones with bigger screens:

Capgemini and IMRG’s index shows that retail sales from smartphones have spiked when new smartphone models with bigger screens hit the market. This was exemplified with the iPhone 6 Plus in 2014 and Samsung’s Galaxy S7 Edge last year.

A PayPal survey of smartphone users last year found that small screen sizes are the biggest challenge to mobile commerce growth, as they make it hard for shoppers to navigate websites and enter payment information.

The index report predicted that UK e-commerce sales would grow 14% in 2017. Capgemini’s Unadkat said that artificial intelligence (AI) and chatbots would be key areas of focus for retailers in the coming year. Tools like AI voice assistants and chatbots in mobile apps and mobile messaging platforms could help eliminate the screen size pain point by introducing more voice capabilities that minimize the need to manually type in product names, payment credentials, and shipping information. That will make these tools an important part of retailers’ mobile strategies going forward.

Millennials and younger consumers are becoming larger parts of the key spending demographic. As a result, mobile devices like smartphones and tablets are quickly becoming consumers' primary computing device. But for retailers, that poses a key challenge: Users are spending considerable time shopping on mobile, but making relatively few purchases.

As a result, social networks, payment processors and card networks, and retailers themselves, are all developing solutions that make it easier for users who shop on mobile to begin to buy on mobile, and then channeling funds into products that incentivize users to do so.

By presenting options like on-site buy buttons, single-click checkout, financing services, and unified offline-to-online commerce experiences, various brands are beginning to convert desktop shoppers to mobile. But mobile wallets are beginning to take hold, and if they can successfully combine multiple features that ease barriers to mobile purchasing into one payment platform, they could hold the ticket to retailer success in increasing mobile purchases.

Jaime Toplin, research associate for BI Intelligence, Business Insider's premium research service, has compiled a detailed report on mobile checkouts that predicts how e-commerce will change and m-commerce will grow, explains why users are shopping, but not buying, on mobile devices, looks at how stakeholders are looking to attract these users, and shows how products like mobile wallets could be game-changing in terms of mobile retail.

Here are some key takeaways from the report:

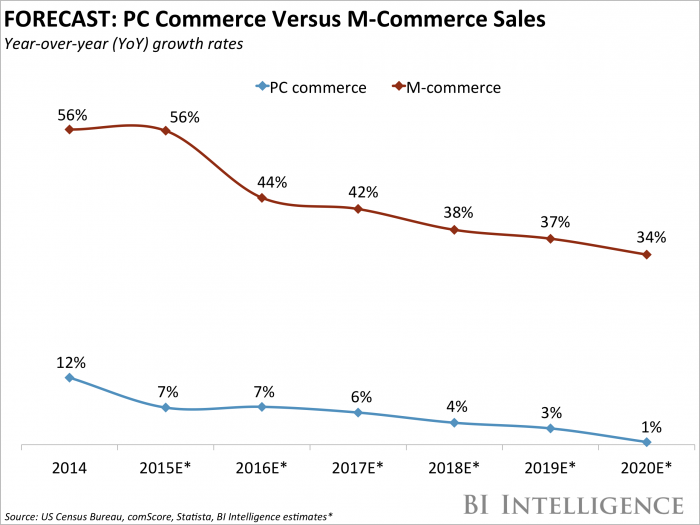

E-commerce and m-commerce are on the rise. In 2014, mobile comprised 11.6% of the US' $303 billion in e-commerce sales. BI Intelligence forecasts that by 2020, mobile will account for 45% of the $632 billion in total e-commerce sales.

Users are spending the majority of their commerce-related browsing time in browsers rather than apps. In order to increase m-commerce conversion rates, retailers should be focused on browser-based solutions, which attract a wider audience than the loyal shoppers who download apps.

If they move into the browser, mobile wallets like Apple Pay and Android Pay could drive an increase in m-commerce. That's because they provide a more streamlined experience to users than any of the other proposed solutions. However, it'll be hard for them to catch on fully if they remain focused solely on apps and in-store payments.

In full, the report:

Forecasts the rising percentage of mobile commerce amidst an expanding e-commerce landscape.

Provides data showing why users are spending most of their time on mobile devices, but most of their dollars on PC.

Explains the barriers to mobile buying from a consumer-facing perspective.

Explores how stakeholders are trying to solve these problems and increase mobile purchasing.

Describes the role that mobile wallets like Apple Pay and Android Pay could play in increasing mobile purchasing in both the browser and the app.

To get your copy of this invaluable guide, choose one of these options:

Subscribe to an ALL-ACCESS Membership with BI Intelligence and gain immediate access to this report AND over 100 other expertly researched deep-dive reports, subscriptions to all of our daily newsletters, and much more. >> START A MEMBERSHIP

Purchase the report and download it immediately from our research store. >> BUY THE REPORT

The choice is yours. But however you decide to acquire this report, you’ve given yourself a powerful advantage in your understanding of mobile checkouts.

See Also:

Yahoo News

Yahoo News