More UK women investing in buy-to-let properties

The number of women investing in buy-to-let properties in the UK has increased slightly to almost half the total, a new study has found.

Women now account for 47% of the 2.5 million buy-to-let investors in the UK up from 46% the year before, narrowing the gender gap in the investment class, according to the research by London estate agents Ludlowthompson.

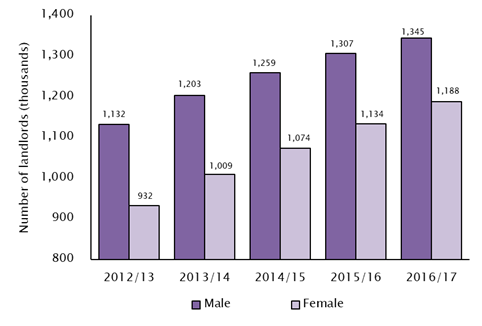

The number of female residential property landlords rose by 5% to 1.2 million for the 2016/17 tax year, up from 1.1 million the previous year, according to the latest available HMRC data.

The narrowing of the gender gap in buy-to-let investment reflects how property has become an increasingly popular investment among women Ludlowthompson said.

The company cited research from Kings College London that suggests that women are generally less likely to make high-risk investments. The relatively transparent business model, regular pay-outs, and low price volatility associated with buy-to-let property as opposed to shares has contributed to the rise in popularity of the asset class among women.

The narrowing of the gender gap among buy-to-let investors stands in contrast to the gender split across other asset classes such as cryptocurrency where women represent just 8.5% of investments, and stocks and shares ISAs where women account for only 43%, owning 957,000 shares ISAs compared with 1.2 million men.

Read more: Millions of UK women dream of turning their 'side hustle' into a full-time career

Stephen Ludlow, chairman of Ludlowthompson, said: “The buy-to-let sector has a reputation of providing stable, long-term returns. Whilst some investors have become distracted by more speculative investments, buy-to-let continues to build increasing interest amongst investors who value income and long-term growth.

“It may not be long before we see a 50/50 gender split amongst buy-to-let investors, which is significant given the much wider gaps in other asset classes, such as equities.”

Yahoo News

Yahoo News