The Morrison government is no longer fixated on a surplus – but for how long?

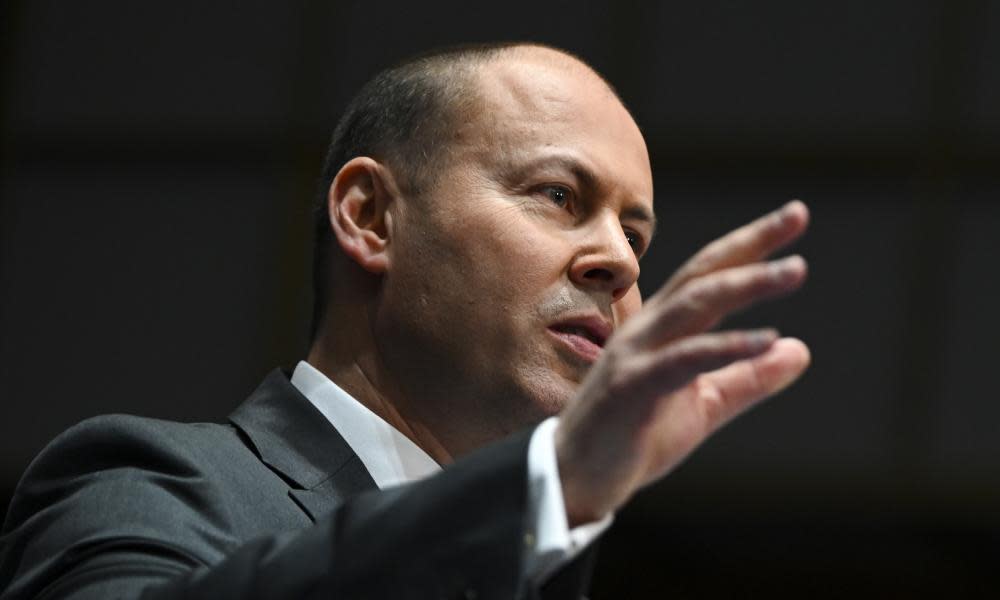

Last week, ahead of the coming federal budget, the treasurer Josh Frydenberg outlined his vision for the recovery. He trumpeted the need for stimulus and an abandonment of “austerity”. But we should not get too carried away believing that there has been a revolution of economic thought within the government – little looks to have changed.

Whenever a recession hits, every treasurer and prime minister becomes a Keynesian. The bald reality is that the private sector collapses in a recession and unless the public sector steps in to the breach, that recession could turn into a depression.

And so it was not altogether surprising to hear the treasurer last week tell the audience of the Australian Chamber of Commerce that the government was ditching its previous fiscal strategy of returning the budget to surplus.

Related: Queensland renters left in the cold as end of eviction moratorium and jobkeeper cuts collide

Not only would that be the worst approach to the current crisis, it is also impossible given the collapse in revenue.

And so the treasurer instead announced a fiscal strategy that would come in a series of “phases”, the first of which involves three aspects.

The first of these involves allowing “the automatic stabilisers to work freely to support the economy”.

Given the government had to increase the jobseeker payments with a bonus to enable the automatic stabilisers to work, with any luck this means the government intends to keep the $300 bonus payment for longer than is currently in place.

The second aspect is to continue “temporary, proportionate and targeted fiscal support, including through tax measures, to leverage private sector jobs and investment”.

The addition of “including through tax measures” is an interesting aspect given they are rarely temporary or targeted.

Finally, the treasurer suggested the first phase will include the government pushing ahead “with structural reforms that position the economy for the jobs of the future and which improve the ease of doing business”.

That is a lot of guff that means making industrial relations more “flexible” (for which there is a distinct lack of evidence of it leading to any productivity improvements) and bringing forward income tax cuts designed to flatten the tax rate and give high income earners a massive tax cut.

So let us not get carried away. This is the Liberal party’s version of Keynes – high-end tax cuts, company tax breaks and reducing regulations to give companies a massive barraging advantage over employees.

The treasurer then set a timetable for this phase saying he expects it “to remain in place until the unemployment rate is comfortably back under 6%”.

This last bit is somewhat curious.

Already the Grattan Instituted has taken issue with the reference of 6% unemployment as being far too high.

Now we could quibble and point out he said “comfortably under 6%”, but that in itself is a weird phrasing. Why not say “comfortably around 5.5%”, or “comfortably near 5%”, or even “comfortably returned to where it was prior to the crisis”.

The reality is 6% unemployment is a very high number – above what was even reached during the GFC:

Given the pre-Covid median rate since 2003 (which was when the unemployment rate first went below 6% this century) is 5.3%, “comfortably below 6%” sounds rather a bit too early to be shutting off the stimulus.

But the problem is not just that level of unemployment; it is using that as a measure at all.

Related: Delay in tax evasion crackdown is costing the taxpayer billions

Such a focus ignores the issue of underemployment that has been dominant for the past five years.

The last time the unemployment rate was 6% was in September 2015 and the underemployment rate was 8.6%. Just before the Covid crisis, the unemployment rate had fallen to 5.1%, but the underemployment rate was still at 8.6%:

Focusing on unemployment ignores the shift towards part-time work and also is subject to changes in the participation rate that can disguise the true health of the economy.

If we look at the employment rate, we see that even periods with a 5.8% unemployment rate are times where the percentage of adults in a job is well below the long-term median – and well below where we were prior the virus:

Why not aim to get back close to where we were before the virus – a period which was hardly gangbusters – before caring about the budget balance?

An even better measure would be looking at hours worked per capita. Just prior to the virus we were at the long-term median level – a level well above that which has occurred with an unemployment rate around 6%:

What is revealing from this measure is just how far the level of hours worked has fallen in the past decade. So weak has been the growth of hours worked that the low point of the GFC is now seen as a good result.

Looking at male hours of work shows even more brutally how weak it is to just aim for comfortable below 6% unemployment rate:

For many years it has been obvious that unemployment hides much of what is going on.

The government is adopting a Keynesian mantra for now, but clearly its ambition is to turn off the stimulus tap as soon as it can and return to the pre-Covid belief that a budget surplus defines a good economy.

As such there is little change in its outlook and little sense that the government is all that concerned about improving on the state the economy was in even before the virus – an economy of weak wages growth, flat household incomes and the lowest productivity growth ever recorded.

Yahoo News

Yahoo News