How Much Did PlayAGS'(NYSE:AGS) Shareholders Earn From Share Price Movements Over The Last Year?

This week we saw the PlayAGS, Inc. (NYSE:AGS) share price climb by 25%. But that's not enough to compensate for the decline over the last twelve months. During that time the share price has sank like a stone, descending 59%. Some might say the recent bounce is to be expected after such a bad drop. It may be that the fall was an overreaction.

See our latest analysis for PlayAGS

PlayAGS wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

PlayAGS' revenue didn't grow at all in the last year. In fact, it fell 23%. That looks pretty grim, at a glance. The share price drop of 59% is understandable given the company doesn't have profits to boast of. Fingers crossed this is the low ebb for the stock. We don't generally like to own companies with falling revenues and no profits, so we're pretty cautious of this one, at the moment.

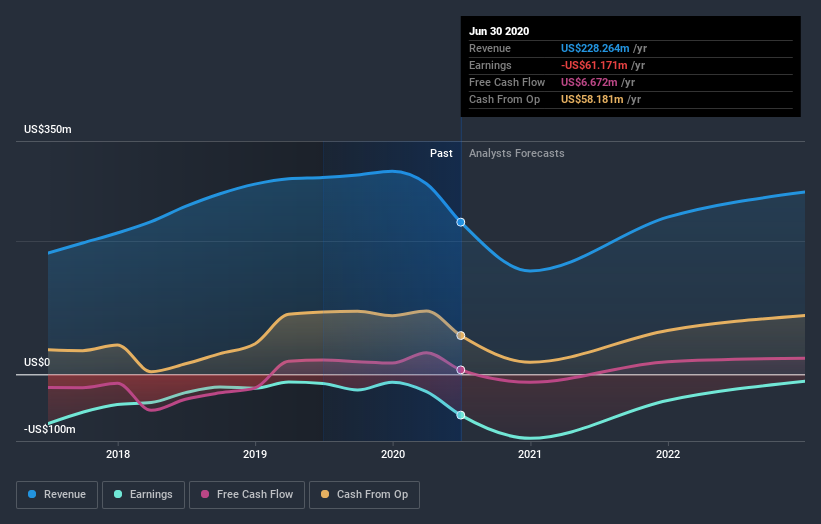

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. This free report showing analyst forecasts should help you form a view on PlayAGS

A Different Perspective

While PlayAGS shareholders are down 59% for the year, the market itself is up 19%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Putting aside the last twelve months, it's good to see the share price has rebounded by 15%, in the last ninety days. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. It's always interesting to track share price performance over the longer term. But to understand PlayAGS better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with PlayAGS , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo News

Yahoo News