Netflix is winning the battle against geo-fence evaders (NFLX)

BII

This story was delivered to BI Intelligence "Digital Media Briefing" subscribers. To learn more and subscribe, please click here.

Netflix appears to be winning in its crackdown against virtual border hoppers, as a number of prominent unblocking companies that once allowed Netflix subscribers to watch content restricted in certain countries have thrown in the towel, CBC reports.

These unblocking companies use virtual private networks (VPNs) that allow users to mask their IPs so that it appears like they’re surfing the internet from a specific location. This helps users protect their privacy, and gives them access to the full range of Netflix’s catalog. Netflix CEO

Reed Hastings had said in the company’s Q1 2016 earnings that VPN users were inconsequential to the company’s bottom line, but cracking down does have a number of strategic implications nonetheless:

It appeases broadcasters and content-providers. These companies already fret about partnering with a subscription streaming company that is disrupting their industry. Stamping out on border hoppers helps Netflix’s negotiations with these content suppliers. For example, Netflix’s recent deal with CBS to stream Star Trek content in all countries but the US and Canada may not have gone through if Netflix couldn’t guarantee CBS exclusivity over the content in North America.

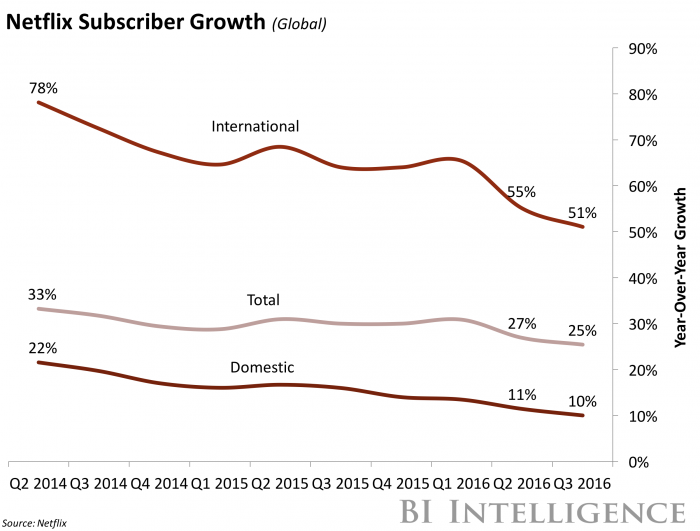

It could dent Netflix's international ambitions. The company’s catalog is much smaller in countries like the UK and Australia than in the US. Circumventing geo-restrictions using VPNs provides an impetus for international users to sign up for Netflix even if their local catalog underwhelms. Without VPN access, these users could cancel their Netflix subscriptions in favor of local services with more extensive catalogs, or piracy.

It relates to Netflix’s goal of eliminating geo-restrictions. The company wants to have a universal catalog accessible across all territories, as reiterated by Neil Hunt, its chief product officer, at CES. This is part of why the company is so focused on creating Netflix originals. Owning its content means that it doesn't have to enter geo-restricted licensing negotiations with third-party broadcasters. And localized content like its Narcos original series can turn into international sensations.

It helps Netflix amass user data that can be monetized. Many people use VPNs as a security measure to hide their data and prevent companies from abusing users' privacy. On the other hand, companies can offer this data to advertisers, or use it to improve their own products. For Netflix, this could involve creating content that's more specifically caters to users' preferences. The company recently stated that its goal is to release at least one piece of content per month that caters to each individual subscriber.

Over the last few years, there’s been much talk about the “death of TV.” However, television is not dying so much as it's evolving: extending beyond the traditional television screen and broadening to include programming from new sources accessed in new ways.

It's strikingly evident that more consumers are shifting their media time away from live TV, while opting for services that allow them to watch what they want, when they want. Indeed, we are seeing a migration toward original digital video such as YouTube Originals, SVOD services such as Netflix, and live streaming on social platforms.

However, not all is lost for legacy media companies. Amid this rapidly shifting TV landscape, traditional media companies are making moves across a number of different fronts — trying out new distribution channels, creating new types of programming aimed at a mobile-first audience, and partnering with innovate digital media companies. In addition, cable providers have begun offering alternatives for consumers who may no longer be willing to pay for a full TV package.

Dylan Mortensen, senior research analyst for BI Intelligence, has compiled a detailed report on the future of TV that looks at how TV viewer, subscriber, and advertising trends are shifting, and where and what audiences are watching as they turn away from traditional TV.

Here are some key points from the report:

Increased competition from digital services like Netflix and Hulu as well as new hardware to access content are shifting consumers' attention away from live TV programming.

Across the board, the numbers for live TV are bad. US adults are watching traditional TV on average 18 minutes fewer per day versus two years ago, a drop of 6%. In keeping with this, cable subscriptions are down, and TV ad revenue is stagnant.

People are consuming more media content than ever before, but how they're doing so is changing. Half of US TV households now subscribe to SVOD services, like Netflix, Amazon, and Hulu, and viewing of original digital video content is on the rise.

Legacy TV companies are recognizing these shifts and beginning to pivot their business models to keep pace with the changes. They are launching branded apps and sites to move their programming beyond the TV glass, distributing on social platforms to reach massive, young audiences, and forming partnerships with digital media brands to create new content.

The TV ad industry is also taking a cue from digital. Programmatic TV ad buying represented just 4% (or $2.5 billion) of US TV ad budgets in 2015 but is expected to grow to 17% ($10 billion) by 2019. Meanwhile, networks are also developing branded TV content, similar to publishers' push into sponsored content.

In full, the report:

Outlines the shift in consumer viewing habits, specifically the younger generation.

Explores the rise of subscription streaming services and the importance of original digital video content.

Breaks down ways in which legacy media companies are shifting their content and advertising strategies.

And Discusses new technology that will more effectively measure audiences across screens and platforms.

Interested in getting the full report? Here are two ways to access it:

Subscribe to an All-Access pass to BI Intelligence and gain immediate access to this report and over 100 other expertly researched reports. As an added bonus, you'll also gain access to all future reports and daily newsletters to ensure you stay ahead of the curve and benefit personally and professionally. » START A MEMBERSHIP

Purchase & download the full report from our research store. » BUY THE REPORT

See Also:

Yahoo News

Yahoo News