NextEra Energy (NEE) Q3 Earnings Beat, Sales Lag Estimates

NextEra Energy, Inc. NEE reported third-quarter 2020 adjusted earnings of $2.66 per share, which beat the Zacks Consensus Estimate of $2.65 by 0.4%. The reported earnings were also up 11.3% from $2.39 per share in the prior-year quarter. The year-over-year improvement in earnings was due to strong performance across all businesses despite the challenges created by the COVID-19 outbreak and an extremely active hurricane season.

On a GAAP basis, the company recorded earnings of $2.50 per share, up 38.1% from $1.81 reported in the year-ago quarter.

Total Revenues

For the third quarter, NextEra Energy’s operating revenues were $4,785 million, which lagged the Zacks Consensus Estimate of $5,606 million by 14.6%. The reported revenues were also down 14.1% year over year.

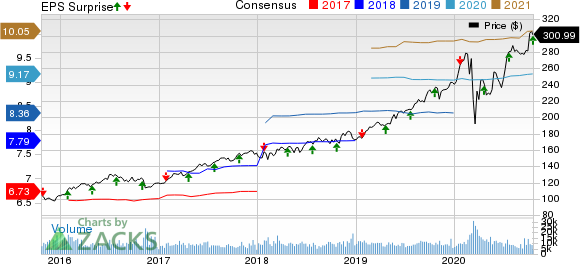

NextEra Energy, Inc. Price, Consensus and EPS Surprise

NextEra Energy, Inc. price-consensus-eps-surprise-chart | NextEra Energy, Inc. Quote

Segment Results

Florida Power & Light Company (FPL): Revenues from the segment amounted to $3,455 million, down 1.03% from the prior-year figure of $3,491 million. The segment’s earnings came in at $1.54 per share, up 10% from $1.40 recorded in the prior-year quarter.

Gulf Power Company (Gulf Power): Total segment revenues amounted to $404 million, down 8.2% from the year-ago figure. This segment’s earnings per share totaled 18 cents for the reported quarter, up 12.5% from the year-ago level.

NextEra Energy Resources: Revenues from the segment amounted to $953 million, down 43.1% from the prior-year quarter. Quarterly earnings from the segment came in at $1.12 per share, up 16.7% from 91 cents in the year-ago quarter.

Corporate and Other: The segment’s operating loss for the reported quarter was 18 cents compared with a loss of 8 cents per share in the year-ago period.

Highlights of the Release

NextEra Energy’s arm, Gulf Power is making smart capital investments and continues to progress well. The Plant Crist coal-to- natural gas conversion and associated natural gas lateral are expected to be completed later this year, in turn supporting NextEra Energy's coal phase-out strategy and commitment to remain a clean energy leader.

During third-quarter 2020, FPL's average number of customers increased nearly 80,000 from the prior-year period.

Interest expenses for the quarter were $208 million, down 72.1% from the year-ago period.

NextEra Energy Resources expanded the contracted renewables backlog by adding 2,200 megawatts of renewable projects during the third quarter.

Financial Update

NextEra Energy had cash and cash equivalents of $1,961 million as of Sep 30, 2020 compared with $600 million on Dec 31, 2019.

Long-term debt as of Sep 30, 2020 was $42.79 billion, up from $37.54 billion on Dec 31, 2019.

Cash flow from operating activities for the first nine months of 2020 was $6.63 billion compared with $6.24 billion in the comparable prior-year period.

Guidance

NextEra Energy recently increased financial expectations and extended long-term growth outlook. The company expects 2020 and 2021 earnings in the range of $2.18-$2.30 and $2.40-$2.54, respectively. Its earnings are expected to grow at a compound annual rate of 6-8% per year through 2023, off a 2021 base. As a result of a 4-for-1 stock split, which is going to be effective from Oct 27, 2020, the company has updated its earnings guidance.

The company expects to increase dividend by 10% each year through 2022, subject to approval of the board of directors.

NextEra Energy’s unit, Energy Resources currently aims to add 15,500-19,800 MW of renewable power projects to its portfolio within the 2019-2022 time frame.

Zacks Rank

Currently, NextEra Energy carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

American Electric Power AEP is scheduled to announce second-quarter 2020 results on Oct 22. The Zacks Consensus Estimate for its earnings per share for the to-be-reported quarter is pegged at $1.44.

FirstEnergy Corporation FE is scheduled to report third-quarter 2020 results on Nov 2. The Zacks Consensus Estimate for its earnings for the quarter to be reported is pegged at 75 cents per share.

Dominion Energy D is scheduled to report third-quarter 2020 results on Nov 5. The Zacks Consensus Estimate for its earnings for the quarter to be reported is pegged at $1.05 per share.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FirstEnergy Corporation (FE) : Free Stock Analysis Report

American Electric Power Company, Inc. (AEP) : Free Stock Analysis Report

Dominion Energy Inc. (D) : Free Stock Analysis Report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo News

Yahoo News