Northern Trust (NTRS) Q3 Earnings Miss, Fee Income Climbs

Northern Trust Corporation NTRS delivered third-quarter 2020 earnings per share of $1.32, missing the Zacks Consensus Estimate of $1.40, on lower revenues. Also, the reported figure declined 21.9% year over year. Results included certain one-time items.

Results were negatively impacted by lower net interest income, partly offset by rise in fee income. In addition, decline in net interest margin was a negative. Moreover, escalating operating expenses and provisions were major drags. However, rise in assets under custody and assets under management were driving factors.

Net income came in at $294.5 million, down 23.4% year over year.

Revenues Down, Costs Flare Up

Total revenues of $1.49 billion were down 3% year on year. The revenue figure, however, beat the Zacks Consensus Estimate of $1.48 billion.

On a fully-taxable equivalent basis, net interest income of $336.5 million declined 21%, year on year, mainly on lower net interest margin, partially negated by rise in average earning assets.

Net interest margin (NIM) came in at 1.03%, shrinking 58 basis points from the prior-year quarter. This decline chiefly reflects the impact of lower interest rates and a balance-sheet mix shift.

Consolidated Trust, Investment and Other Servicing Fees summed $1 billion, up 3% year over year.

Non-interest income climbed 3% from the year-ago quarter to $1.16 billion. Rise in trust, investment and other servicing fees, foreign-exchange trading income, treasury management fees, along with other operating income, led to this upsurge. Nevertheless, lower security commissions and trading income was on the downside.

Non-interest expenses flared up 6% year over year to $1.09 billion during the July-September period. This upswing mainly resulted from an elevation in compensation, employee benefits, equipment and software, along with other expenses. These were partly muted by lower outside service and occupancy expenses.

Assets Under Management and Custody

As of Sep 30, 2020, Northern Trust’s total assets under custody climbed 16% year over year to $10.1 trillion, while total assets under management increased 9% to $1.31 trillion.

Credit Quality: A Mixed bag

Total allowance for credit losses came in at $267.9 million, significantly up 110% year over year. Net recoveries were $0.4 million compared with the net recoveries of $0.6 million reported in the year-ago quarter.

Provision for credit losses was $0.5 million in the quarter as against the benefit of $7 million reported in the prior-year quarter. Nonetheless, non-accrual assets decreased 15% year over year to $98.9 million as of Sep 30, 2020.

Strong Capital Position

Under the Advanced Approach, as of Sep 30, 2020, Tier 1 capital ratio, total capital ratio and Tier 1 leverage ratio came in at 15.1%, 16.7% and 7.7%, compared with the 14.9%, 16.6% and 8.6%, respectively, witnessed in the prior-year quarter. All ratios exceeded the regulatory requirements.

Return on average common equity was 10.5% compared with the year-earlier quarter’s 14.9%. Return on average assets was 0.83% compared with the 1.31% witnessed in the year-ago quarter.

Our Viewpoint

Northern Trust put up a decent show during the September-end quarter. Growth in assets under custody and management, along with lower non-accrual assets, will likely continue. Though a rise in fee income is anticipated to act as a tailwind, escalating expenses and provisions might pose a threat to the company’s profitability. Furthermore, a fall in margin on low rates is a concern.

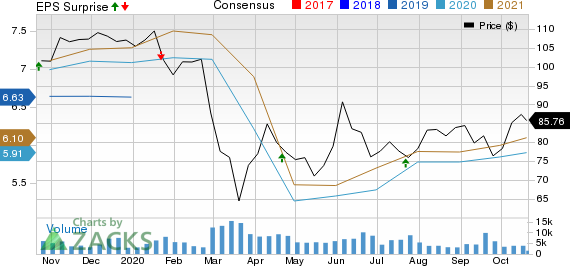

Northern Trust Corporation Price, Consensus and EPS Surprise

Northern Trust Corporation price-consensus-eps-surprise-chart | Northern Trust Corporation Quote

Currently, Northern Trust carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

Bank of New York Mellon Corporation’s BK third-quarter 2020 earnings per share of 98 cents surpassed the Zacks Consensus Estimate of 96 cents. The figure was 8.4% lower than the prior-year quarter’s level. Results primarily benefited from growth in asset balance. However, slightly lower revenues and rise in expenses were the undermining factors.

First Republic Bank FRC delivered a positive earnings surprise of 16.7% in the third quarter on solid top-line strength. Earnings per share of $1.61 surpassed the Zacks Consensus Estimate of $1.38. Additionally, the bottom line climbed 22.9% from the year-ago quarter. Results were supported by an increase in NII and fee income. Yet, higher expenses and elevated provisions were offsetting factors.

Regions Financial RF reported third-quarter 2020 adjusted earnings of 49 cents per share, surpassing the Zacks Consensus Estimate of 34 cents. Also, results compared favorably with the prior-year period earnings of 39 cents. Results were driven by higher revenues on increases in both NII and fee income. Furthermore, rise in deposit balances provided some respite. Notably, mortgage income and capital markets income were on an upswing. Nevertheless, higher provisions for credit losses and rise in expenses were undermining factors.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regions Financial Corporation (RF) : Free Stock Analysis Report

The Bank of New York Mellon Corporation (BK) : Free Stock Analysis Report

Northern Trust Corporation (NTRS) : Free Stock Analysis Report

First Republic Bank (FRC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo News

Yahoo News