The Novanta (NASDAQ:NOVT) Share Price Is Up 802% And Shareholders Are Delighted

For many, the main point of investing in the stock market is to achieve spectacular returns. And highest quality companies can see their share prices grow by huge amounts. For example, the Novanta Inc. (NASDAQ:NOVT) share price is up a whopping 802% in the last half decade, a handsome return for long term holders. And this is just one example of the epic gains achieved by some long term investors. Better yet, the share price has risen 11% in the last week. But this might be partly because the broader market had a good week last week, gaining 6.7%.

It really delights us to see such great share price performance for investors.

See our latest analysis for Novanta

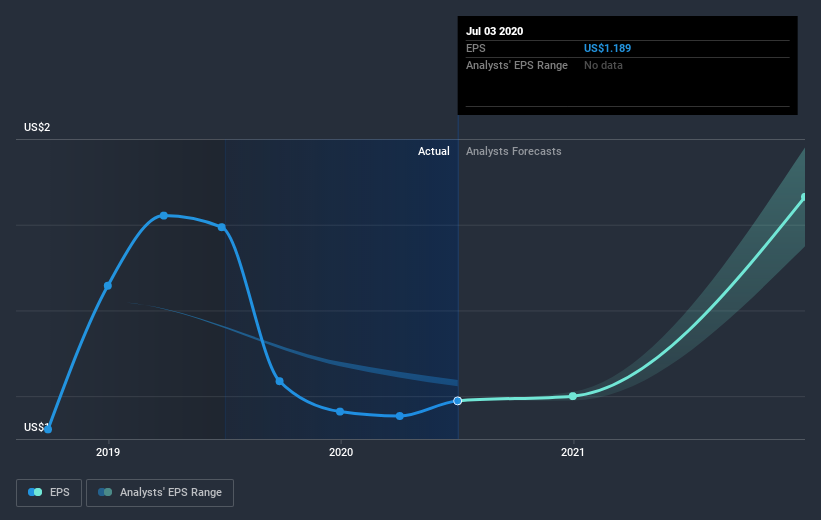

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last half decade, Novanta became profitable. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

It's nice to see that Novanta shareholders have received a total shareholder return of 51% over the last year. However, that falls short of the 55% TSR per annum it has made for shareholders, each year, over five years. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for Novanta that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo News

Yahoo News