Omeros'(NASDAQ:OMER) Share Price Is Down 35% Over The Past Three Years.

Want to participate in a short research study? Help shape the future of investing tools and earn a $40 gift card!

Many investors define successful investing as beating the market average over the long term. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. Unfortunately, that's been the case for longer term Omeros Corporation (NASDAQ:OMER) shareholders, since the share price is down 35% in the last three years, falling well short of the market return of around 36%. There was little comfort for shareholders in the last week as the price declined a further 7.4%.

See our latest analysis for Omeros

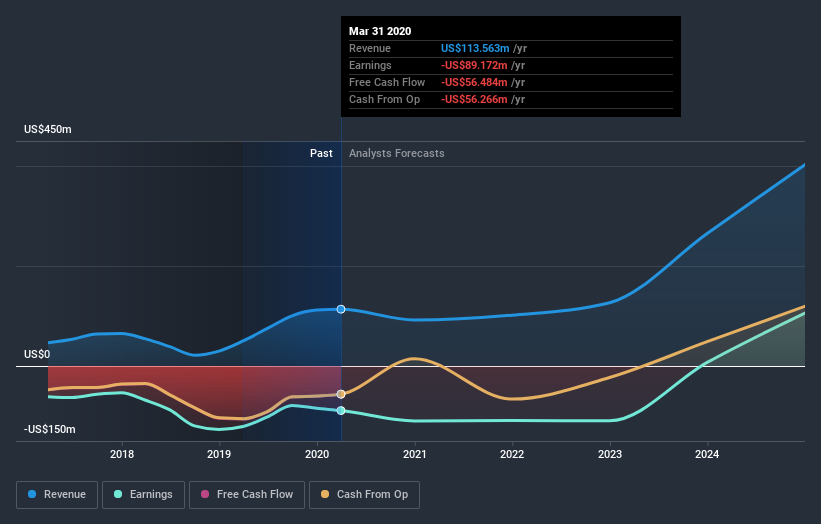

Given that Omeros didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, Omeros grew revenue at 30% per year. That is faster than most pre-profit companies. While its revenue increased, the share price dropped at a rate of 11% per year. That seems like an unlucky result for holders. It's possible that the prior share price assumed unrealistically high future growth. Still, with high hopes now tempered, now might prove to be an opportunity to buy.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Omeros shareholders are down 11% for the year, but the market itself is up 9.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 4.6% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Omeros better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Omeros (at least 1 which is concerning) , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo News

Yahoo News