New Oriental Education & Technology Group Inc. (NYSE:EDU) Looks Just Right

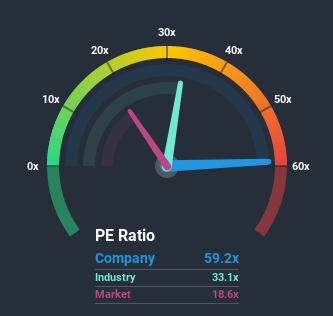

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 18x, you may consider New Oriental Education & Technology Group Inc. (NYSE:EDU) as a stock to avoid entirely with its 59.2x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With its earnings growth in positive territory compared to the declining earnings of most other companies, New Oriental Education & Technology Group has been doing quite well of late. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for New Oriental Education & Technology Group

Keen to find out how analysts think New Oriental Education & Technology Group's future stacks up against the industry? In that case, our free report is a great place to start.

Is There Enough Growth For New Oriental Education & Technology Group?

There's an inherent assumption that a company should far outperform the market for P/E ratios like New Oriental Education & Technology Group's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 73% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 50% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 36% per year over the next three years. With the market only predicted to deliver 13% per year, the company is positioned for a stronger earnings result.

With this information, we can see why New Oriental Education & Technology Group is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From New Oriental Education & Technology Group's P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of New Oriental Education & Technology Group's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for New Oriental Education & Technology Group with six simple checks will allow you to discover any risks that could be an issue.

If P/E ratios interest you, you may wish to see this free collection of other companies that have grown earnings strongly and trade on P/E's below 20x.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo News

Yahoo News