Over 100 rural areas in the UK are 'cash point deserts' without a single ATM

More than 100 rural areas in the UK are "cash point deserts" without a single ATM, research shows for the first time.

The study by consumer watchdog Which? found a total of 123 postcode districts with a combined population of 110,935 people did not appear to contain a single ATM.

A further 116 postcode districts appear to have just one ATM, 37 of which charge a fee. In total there are around 2,900 postcode districts in the UK.

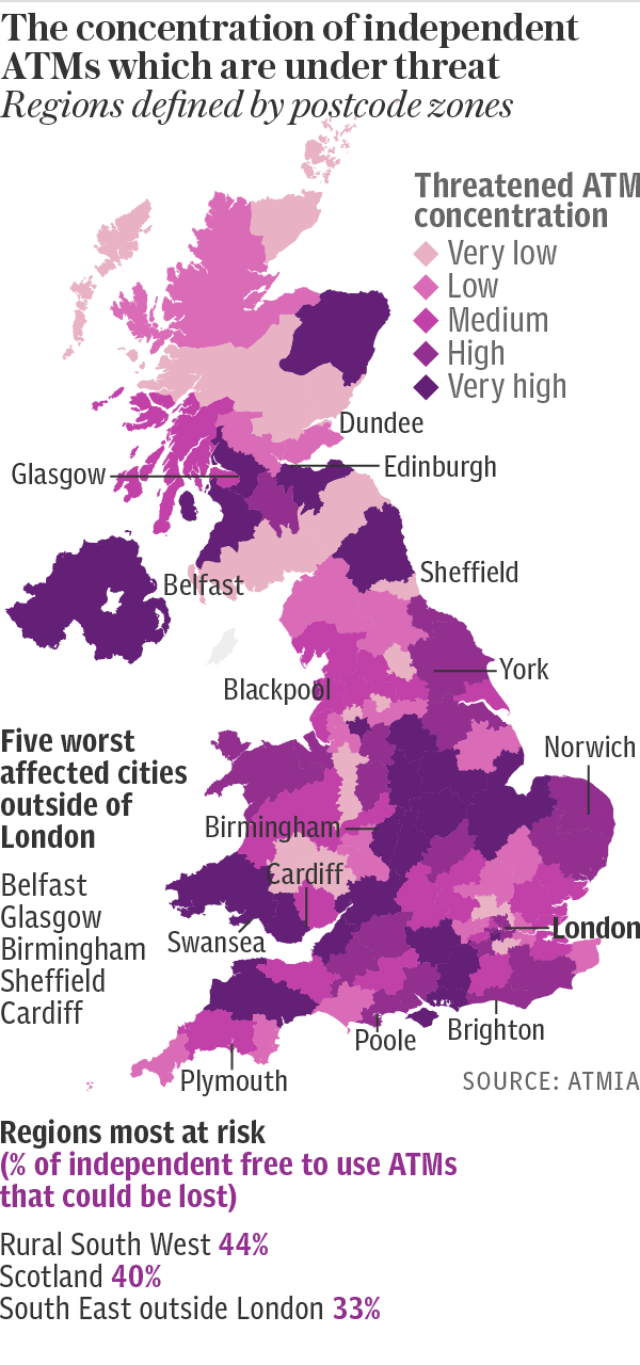

The findings come days before Britain's biggest cash machine network Link is due to announce whether it will go ahead with plans to reduce the fee paid to its ATM providers by 20 per cent over the next four years.

Experts have warned the move will decimate the number of free cash points, with one in five predicted to disappear from Britain's high streets within four years, according to the ATM industry body.

Meanwhile Conservative MP Nicky Morgan, who is chairman of the Treasury Select Committee, urged regulators to be ready to intervene if necessary to prevent Link's plans from harming consumers' access to cash.

Which? found postcode district PE32 in Norfolk, which is home to more than 15,000 people, to be the most populated "cash point desert". Speaking to the Daily Telegraph village locals said they faced a six mile drive to the nearest cash point.

TA7 in Somerset, TN27 in Kent, NR16 in Norfolk and YO13 in North Yorkshire were also among the worst affected locations, Which? said.

Gareth Shaw, Which? Money Expert said: “Reducing the free-to-use ATM network would hit consumers who rely on access to cash machines hard.

“These proposals could place a strain on communities across the UK that are already struggling to access the cash they need following mass bank closures. The financial regulator must intervene to avoid this situation getting worse.”

Mike Cherry, national chairman at the Federation of Small Businesses, said: “This new research shows that the UK’s cash machine network is already failing small businesses, particularly in rural areas and tourist hotspots where cashflow is absolutely vital to local growth. If funding for cashpoint providers is cut, things could rapidly go from bad to worse.

“What’s really worrying about LINK’s proposals is that it’s the cash machine providers with a majority share of the remote ATM market that are most concerned about a potential drop in funding. As is so often the case, it will be rural small businesses that are hit hardest by inadequate investment."

Yahoo News

Yahoo News