Op-ed: Predatory payday lending is getting worse, and Congress needs to act

Ronnie Newman is the national political director at the American Civil Liberties Union (ACLU).

As COVID-19 continues unabated in a wide swath of the country, the racial implications and economic consequences of the pandemic grow ever more pronounced.

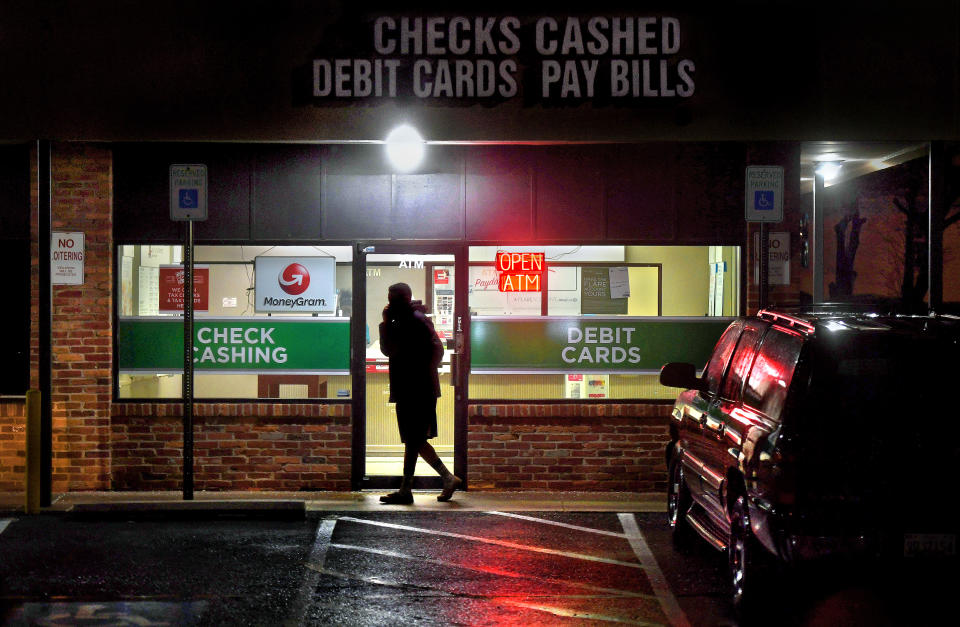

Millions of people — disproportionately people of color — are out of work, face eviction, and are struggling to make ends meet and put food on the table. And as banks clamp down on credit and loans, it’s no surprise that predatory payday lenders are seeing this as an opportunity to bring customers in the door.

Payday loans have long been marketed as a tool for lower-income individuals and families to get access to quick cash. In return, payday lenders charge triple-digit interest on loans of a few hundred dollars, secured by access to the borrower’s bank account. The requirements for these loans are much looser than for a traditional loan, often requiring only proof of income and ID to obtain the loan.

Read more: Payday loans: What you need to know

Payday loans are marketed as a way to close gaps in income. But within these loans are high costs and terms that create a cycle of debt that typically puts families in a worse financial position.

In states like Nebraska, the average annual percentage rate for payday loans is more than 400%. This is true for the vast majority of states that do not limit payday lending interest rates. The average APR for a personal loan, meanwhile, is just under 10% — or 40 times lower than that of a payday loan.

Families are routinely devastated by the high cost of payday loans. The interest and fees can quickly grow out of control, and many borrowers opt for another payday loan to cover those costs and other household expenses. This practice leads to a vicious cycle, where families needing just a few hundred dollars to make ends meet find themselves trapped in the predatory grip of payday lenders and cannot escape.

The negative consequences of the predatory tactics of payday lenders fall disproportionately on communities of color, where payday lending stores are located in higher numbers. Combined with the discrimination in banking that locks people of color out of access to traditional credit and loans, payday lending is a recipe for economic disaster in marginalized communities.

Payday lending has proven to make existing racial inequalities in the economy even worse and contributes to the wealth gap in this country. Families struggle to build wealth and save for the future because these predatory institutions take advantage of already historically marginalized communities.

Because they witnessed how payday lenders targeted military communities and left families in financial ruin, Congress and the Department of Defense imposed a 36% cap on interest rates for active-duty military service members. Sixteen states and Washington, D.C.have also limited payday lenders from charging outrageous fees and interest, either capping the rate or banning payday lending altogether.

Nebraskans have the chance this year to vote on putting an end to exploitative interest and fees on payday loans. Nebraskans for Responsible Lending, a coalition of groups including the ACLU of Nebraska, aims to cap interest on payday loans at 36%, matching the rate of many other states and the DOD. But even if Nebraska becomes the 17th state to limit interest on payday loans, 33 states will still allow triple-digit interest on these loans.

The Veterans and Consumers Fair Credit Act, introduced in Congress last year, would cap payday loan interest rates at 36 percent for all consumers. But the measure stalled and has not advanced since it was introduced last November.

Our lawmakers have a responsibility to protect all consumers from these predatory loans. That’s why Congress must act to extend the cap that applies to active-duty military to cover all Americans.

From there, Congress can also pass legislation such as the Jobs and Neighborhoods Act, and strengthen more traditional financial institutions that serve Americans, especially communities of color.

Ending predatory lending against citizens who are struggling financially, communities of color, veterans, and other marginalized groups won’t bring every family out of poverty or immediately fix the economic damage caused by the pandemic. But it will ensure that no family in the U.S. is taken advantage of and forced to accept unreasonable loan costs to make ends meet.

Protecting consumers against predatory lending is an economic justice and racial justice issue, and Congress needs to take note.

Ronnie Newman is the national political director at the American Civil Liberties Union (ACLU).

Read the latest financial and business news from Yahoo Finance

Yahoo News

Yahoo News