People are starting to get seriously worried about the looming crisis in Portugal

REUTERS/Jose Manuel Ribeiro

Two big issues in Europe are dominating economic thinking: the UK's decision to leave the European Union, and Italy's litany of problems, including an ongoing banking crisis and a referendum that could topple the government.

However, there is another issue that is flying under the radar. Portugal.

Portugal's economy has long been a source of some concern for European policymakers, but the risks surrounding the country are now beginning to crystallise and reach a wider audience, as an ongoing banking crisis — not quite equal to the one in Italy, but significant nonetheless — and a generally sclerotic economy, dominate people's thinking in the Iberian state.

Numerous banks, international organisations, and economic research firms, including HSBC, Brown Brothers Harriman, and the IMF have already warned about the fragile state of Portugal's banks and its wider economy. Barclays however, has been the most vocal in its commentary about the huge issues facing the country.

Barclays analysts sum up the big problems facing Portugal in a research note, and provide a series of charts to illustrate just how bad those problems are. Here is a key extract from Barclays about the country's banking system:

"Several Portuguese banks are also in need of immediate attention. In addition to the sale of Novo Banco, the bigger and more pressing issue is the resolution of problem loans in the largest deposit-taker Caixa Geral.

As a result of sizeable bank recapitalisation needs (c.EUR7.5bn), fiscal slippages and a worsening macro-economic outlook, we believe the funding needs for the Portuguese Treasury will be larger than the authorities currently estimate. The need for another programme for Portugal is a serious risk."

Barclays notes that a material slowing in the wider Portuguese economy is on its way, saying: "We are expecting Portuguese growth to decelerate further post-Brexit both this year and next. We forecast investment and private consumption to slow materially, pushing 2016 growth down to 0.7% and 2017 to 0.3%."

Here is the chart:

REUTERS/Jose Manuel Ribeiro

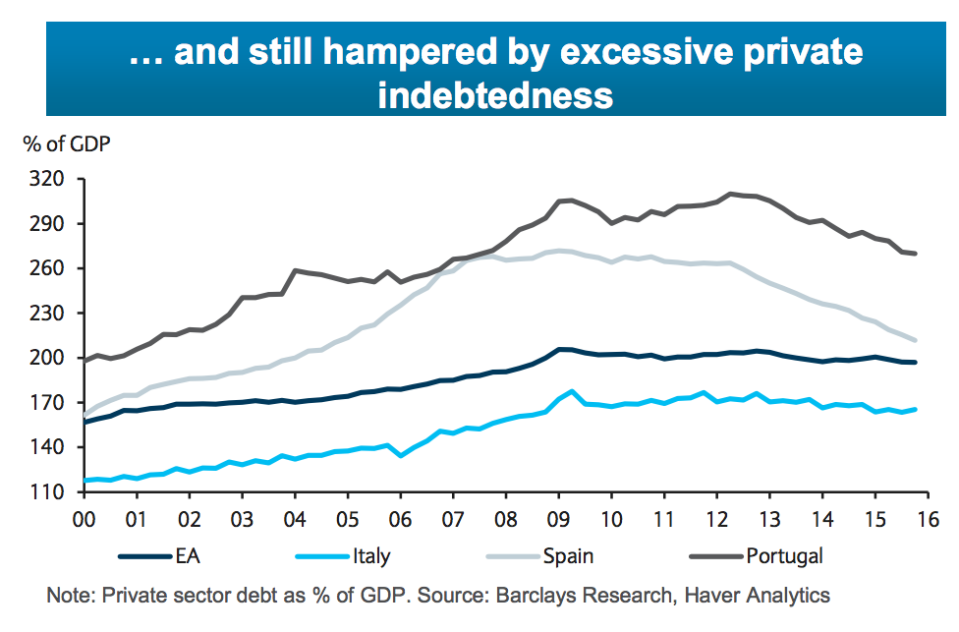

The country also has massive problems with indebtedness. Barclays again:

"We expect public debt to increase from 130% of GDP in 2015 to c.132% in 2016 and remain above 130% through 2020. We still think the government can achieve (and sustain) a primary fiscal balance slightly above 1% of GDP over the medium term, which would be sufficient for stable debt dynamics. However, even moderate shocks to the medium-term growth or fiscal parameters would place the debt-to-GDP ratio on an ever-increasing path."

REUTERS/Jose Manuel Ribeiro

As Business Insider's Elena Holodny noted earlier in July, Portugal's economic performance has been less than stellar since the government exited its bailout program in 2014. However, all of these considerations do not include another potentially damaging event for the Portuguese economy — a possible fine from the European Commission.

Both Portugal and Spain dodged fines for breaking EU-mandated targets for deficit reduction after Jean-Claude Juncker intervened to delay any fines. The fines had been delayed until the completion of the Spanish general election in June.

However, now that is out of the way, Portugal could get slapped with a hefty fine for running a 4.4% budget deficit in 2015. The EU target set for the country was just 2.7%. Any fine would be another huge blow to the delicate state of Portugal's finances.

NOW WATCH: Everyday phrases that even smart people say incorrectly

See Also:

Investment banking interns earn 20% more than the average Londoner

This Peter Thiel-backed startup just took a major step toward replacing your bank

SEE ALSO: Italy isn't the only European country with 'a systemic banking crisis'

DON'T MISS: Portugal is Europe's next looming economic disaster

Yahoo News

Yahoo News