PG&E (PCG) to Report Q3 Earnings: What's in the Offing?

PG&E Corporation PCG is scheduled to report third-quarter 2020 results on Oct 29, before market open.

In the last reported quarter, the company delivered an earnings surprise of 51.47%.

Moreover, the bottom line surpassed the Zacks Consensus Estimate in two of the trailing four quarters and missed in the remaining two. The four-quarter earnings surprise is 10.68%, on average.

Let’s see how things have shaped up prior to this announcement.

Factors Under Consideration

During most part of the third quarter, major parts of California experienced warmer-than-normal temperatures. In particular, during August and September, California ranked the warmest on record for maximum temperatures. This might have resulted in higher electricity demand leading to increased household expenditure on cooling, which is likely to have boosted PG&E’s top line in the third quarter.

The Zacks Consensus Estimate for third-quarter revenues of $4.81 billion indicates a rise of 8.6% from the year-ago quarter’s reported figure.

As anticipated by the company, several large wildfires took place in California throughout the third quarter. To this end, it is imperative to mention that at the onset of the quarter, PG&E funded an amount of $5.4 billion in cash for the Fire Victim Trust established to satisfy the claims of individual wildfire victims and others. The company also paid other wildfire claims and settlements to insurance companies. This is likely to have escalated the company’s operations and maintenance expenses, in addition to the wildfire-related costs incurred during the quarter.

Further, its overall cost structure is expected to have escalated due to the prolonged economic impact of the COVID-19 pandemic on the company's operations. Such expenses might have had an adverse impact on the company’s performance during the soon-to-be-reported quarter.

The Zacks Consensus Estimate for PG&E’s third-quarter earnings is pegged at 24 cents per share, suggesting a 78.4% plunge from the year-ago quarter’s reported figure.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for PG&E this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. But that is not the case here as elaborated below.

Earnings ESP: PG&E has an Earnings ESP of +0.69%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: The company carries a Zacks Rank #4 (Sell).

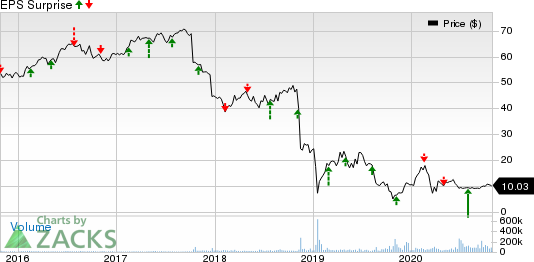

Pacific Gas Electric Co. Price and EPS Surprise

Pacific Gas Electric Co. price-eps-surprise | Pacific Gas Electric Co. Quote

Stocks to Consider

Here are some players from the Utilities sector that have the right combination of elements to post an earnings beat in the to-be-reported quarter.

The Southern Company SO is set to release third-quarter earnings on Oct 29. It has an Earnings ESP of +0.54% and a Zacks Rank #3, presently. You can see the complete list of today’s Zacks #1 Rank stocks here.

CMS Energy CMS is set to release third-quarter earnings on Oct 29. It has an Earnings ESP of +0.15% and a Zacks Rank #3, currently.

Pinnacle West Capital PNW is expected to release third-quarter numbers soon. It has an Earnings ESP of +0.98% and a Zacks Rank of 3, currently.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.5% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Southern Company The (SO) : Free Stock Analysis Report

CMS Energy Corporation (CMS) : Free Stock Analysis Report

Pinnacle West Capital Corporation (PNW) : Free Stock Analysis Report

Pacific Gas Electric Co. (PCG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo News

Yahoo News