Playing politics? Chinese tourism under scrutiny as Lunar New Year nears

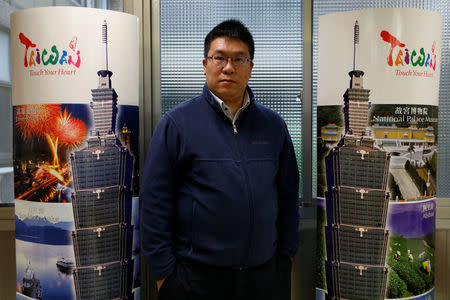

By Brenda Goh and Muyu Xu SHANGHAI/BEIJING (Reuters) - With 6 million Chinese tourists expected to travel abroad over the Lunar New Year break, China's Jan. 27 to Feb. 2 holiday is crucial for Taiwan tour agency operator Li Chi-yueh, who relies on mainland visitors for a third of his revenue. But Li's hopes are not high this year, after the number of mainland tourists plummeted 36 percent since President Tsai Ing-wen took power in May. Though Tsai says Taiwan wants peace with China, Beijing suspects she seeks formal independence. "China uses its sightseeing tourists as a diplomatic weapon," said Li, owner of Taipei-based Chung Shin Travel Service, who has been representing Taiwan's tour operators to lobby Tsai to improve ties with Beijing. "There's a lot of concern that the industry won't survive if we carry on like this." The concern is not confined to Taiwan - tour operators and government officials elsewhere in Asia say they fear China is using its increasingly high-spending tourists as a lever to pressure or reward its neighbours. A government official from South Korea - which has irked China by agreeing to let the United States deploy an anti-missile system - said Chinese and Korean tour companies had told him the China National Tourism Administration (CNTA) had instructed Chinese agencies to cut tours to South Korea by at least 20 percent between November and February. The official calculated that thousands of potential travellers were lost after eight applications to add charter flights between the countries in January and February were rejected without explanation. "This is not a win-win situation - it is mutually disadvantageous. But what can we do? As far as defence is concerned, we have no room to compromise," said the official, declining to be named due to the sensitivity of the matter. Chinese companies told him the measure was designed to cut an excessive number of low-quality, low-priced tours for Chinese tourists visiting Korea, the official said. The CNTA did not respond to Reuters' requests for comment. The number of Chinese tourists visiting South Korea inched up 1.8 percent on year in November, versus a 70.2 percent increase in August and a 22.8 percent rise in September. That was the worst since August 2015, when arrivals slid 32 percent after a Middle East Respiratory Syndrome outbreak. In early November, the United States said it would deploy the anti-missile system battery in South Korea within eight to 10 months. POLITICAL UNCERTAINTY China has not said it is seeking to limit tourists to South Korea or Taiwan to express displeasure at political disputes. Earlier this month, when asked about the limiting of charter flights over Lunar New Year, China's Foreign Ministry said it did not understand the details of the situation but that cooperation and exchanges between the two countries needed to "have a basis in public opinion". For Taiwan, China has said it was natural that Chinese tourists were choosing not to visit Taiwan at a time of political uncertainly. By contrast, the Philippines and Malaysia are enjoying strong spurts in growth of Chinese tourism as Beijing removes travel warnings and eases visa rules. Chinese tourist arrivals between March and December in Malaysia jumped 83 percent from a year earlier. Both countries have been moving diplomatically closer to Beijing in recent months. Malaysian Prime Minister Najib Razak returned from a November state visit with about $34 billion in deals, prompting criticism at home that he was "selling off" his country. The Philippines, historically at odds with Beijing over territorial disputes in the South China Sea, has seen its President Rodrigo Duterte make overtures to China at the expense of traditional ally United States since he was elected in May 2016. The number of tourists visiting the Philippines from China rose 40 percent in the first 10 months of 2016 compared with the previous year. Chinese tourists are the world's highest overseas spenders. They are expected to spend $210 billion abroad this year, Euromonitor data shows, double the amount Chinese firms spent on overseas mergers and acquisitions in 2016. "UNWELCOME" Mainland travel companies Reuters spoke to acknowledged that traveller numbers to some countries were changing, but declined to comment on whether they had received government directives to discourage particular destinations. "Travellers are voting with their feet. They are choosing to go the country that will make them happy and avoid the country that might make them feel unwelcome," said Xu Xiaolei, chief brand officer at China Youth Travel Service (CYTS), one of China's top three state-owned travel companies. "Of course political and diplomatic matters are also under our consideration, as tourism is part of diplomacy in many ways. But demands of tourists are always the core principle when designing our travel packages." Shanghai Spring International Travel Service, parent of Spring Airlines, told Reuters its tours to Taiwan had become less frequent and had halved in size, without saying when. Its tour groups to South Korea have shrunk by 20 percent. Chinese tourists were "turning to other destinations that are more friendly in terms of travel environment" because of "well-known" reasons, Shanghai Spring International said. Chinese flag carrier Air China said travellers were visiting new destinations in Europe and Southeast Asia. "As an airline we make our route arrangements according to market demand," said Luo Yang, head of marketing. Mercy Ma, a translator who plans to visit Cambodia with her family over the Lunar New Year break, said political events in Turkey and Thailand had deterred her from visiting those countries, but she paid less attention to other countries' ties with China. Taiwan was, in fact, a destination she had long wanted to visit, but was crimped by visa restrictions. "We had been prepared to go to Taiwan, but then found out that there were quite a bit of restrictions, so we eventually decided against it." (Additional reporting by Christian Shepherd and Ben Blanchard in BEIJING, JR Wu in TAIPEI, Neil Jerome Morales and Enrico Dela Cruz in MANILA, Nataly Pak in SEOUL, Praveen Menon and Liz Lee in KUALA LUMPUR and SHANGHAI Newsroom; Editing by Ryan Woo and Alex Richardson)

Yahoo News

Yahoo News