‘Progressive’ taxation is bad for everyone. The Tories must not fall into that trap

The idea of “progressive” taxation is so widely accepted by politicians that it goes almost completely unchallenged. The orthodoxy dictates that tax should fall more heavily on those further up the income scale, meaning the richer someone is, the more tax they pay.

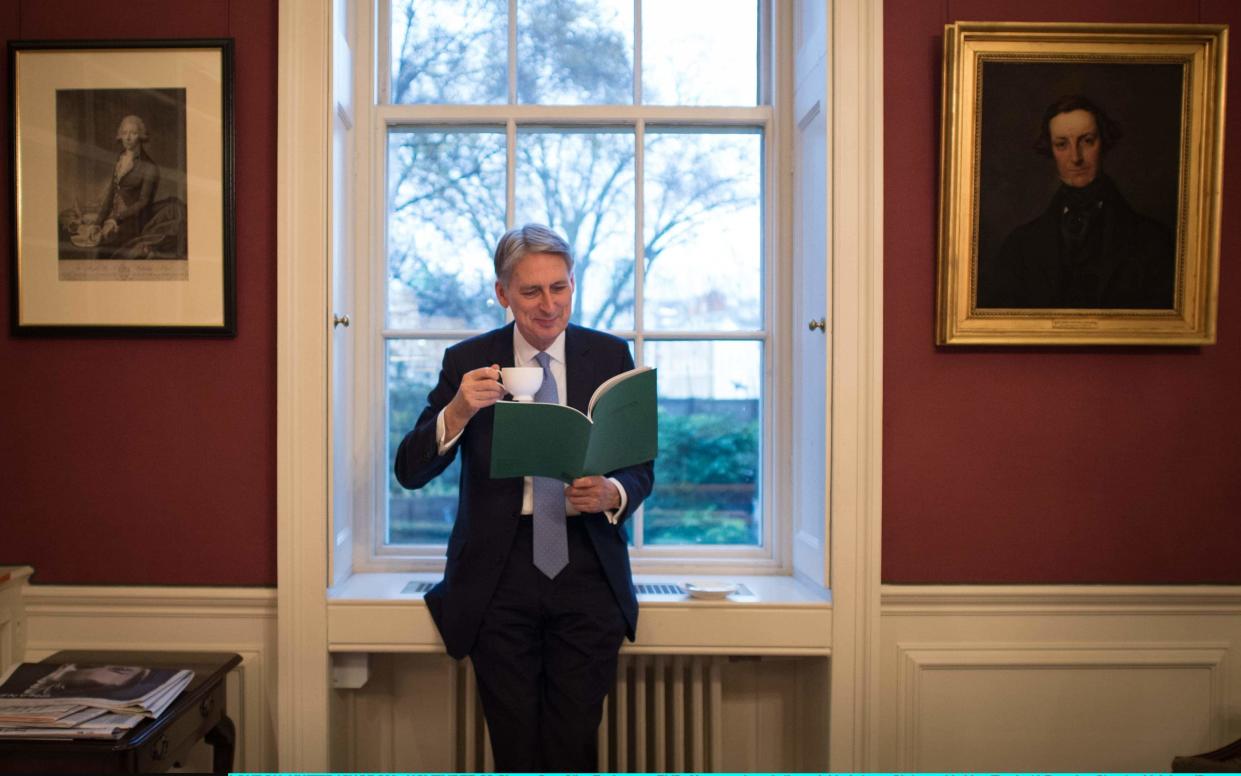

Many Conservatives have been ardent believers in this orthodoxy, backing policies that put a greater burden on higher earners and then boasting about it: George Osborne and more recently Philip Hammond have drawn attention to how much more tax “rich” people are paying.

The Tory acceptance of progressive taxation has contributed a great deal to the striking figures we publish today, revealing that those with the highest incomes are now paying more tax than ever before – even the Seventies, when Labour waged war on wealth and success. One number in particular deserves attention from Conservatives: 3.6 million people earning more than £50,000 now pay the equivalent of 62 per cent of all income tax.

Chart: The richest in society are shouldering a larger tax burden than ever

Those people are earning more than the average salary, sometimes many times more. But are they “rich”? Someone earning, say, £55,000, paying a mortgage and supporting a family in London or the South East, will certainly not feel rich. Yet in both policy and rhetoric, politicians, Tories included, often treat them as if they were vastly wealthy, ceaselessly trying to suck more and more of their income into higher tax bands.

This is wrong. People in the higher income brackets earn what they do because of their efforts and their talents; it is simply absurd that any politicians, but especially Conservatives, should punish them for that. A true Tory tax policy would reward those who earn more, not least in order to encourage others to do the same.

The richest 1pc more than twice as much income tax as the poorest 50pc

This is why the dogma of “progressive” taxation must be challenged. Allowing someone to keep more of their income gives them an incentive to earn more; higher taxes do the opposite. Cutting the tax burden on all of Britain’s earners, rich and poor alike, would encourage enterprise and create more wealth for all.

That should always be the approach of a Conservative government, but today the need is unusually great. Donald Trump is preparing to boost the US economy still further with large tax cuts. The tide is turning against penalising success through taxation. The Conservatives must do more to reward and encourage effort and industry. The best way to do that is to cut taxes – for everyone.

Yahoo News

Yahoo News