Questor: this is the best coronavirus stock, says the virologist who became a fund manager

If you want to identify the stock best placed to benefit from the race to find a coronavirus vaccine, there are few better people to ask than Bianca Ogden: she may now be the manager of a healthcare fund but she used to be a virologist.

Her choice of Covid vaccine winner is BioNTech, a German company that has a possible vaccine in phase three trials and hopes, along with its partner, Pfizer, the US drugs giant, to have approval from regulators by October.

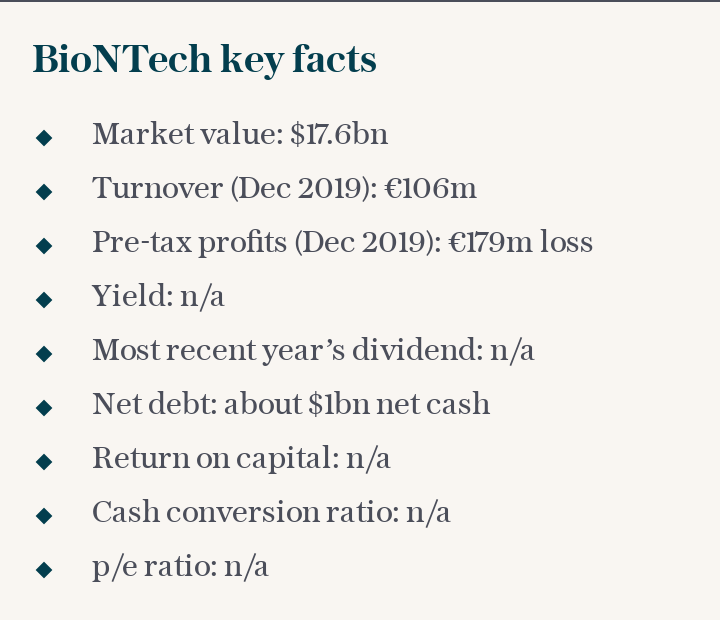

If the vaccine works it could produce revenues during the pandemic phase in the region of $3bn (£2.3bn) and $1.5bn a year thereafter, which would in Ms Ogden’s opinion more than justify the firm’s current valuation of about $16.3bn.

Ms Ogden, who runs the Platinum International Health Care fund from Australia but is German herself, told Questor about the almost accidental way in which she came to invest in the firm.

“I cold-called BioNTech one time when I was visiting my family nearby in Germany and by chance it was doing a funding round – it was not a quoted company at the time – and they asked me if I wanted to take part,” she said. “I really liked the husband and wife team in charge of the firm [Ugur Sahin and Özlem Türeci] and the scientific way in which they went about things.”

Sign up to our Business Briefing newsletter for a snapshot of the day's biggest business stories

Read Questor’s rules of investment before you follow our tips

Before coronavirus came along it was BioNTech’s innovative approach to treating cancer that caught her eye. But that same approach can be applied equally to viruses.

“A virus is a foreign body but so is cancer,” she said. “What should happen is that the immune system recognises viruses or cancerous cells and gets rid of them. But cancer has a mechanism to trick the immune system. With a vaccine against a disease or a cancer vaccine you want to teach the immune system what to look out for,” Ms Ogden said.

“You show the body an identikit picture or dossier of the foreign body, which activates the body’s plan for dealing with it.”

In the case of coronavirus the identikit picture relates to the spikes on the virus’s surface that we have all seen in pictures. These spikes are made of a specific protein, as are the “signature” molecules of cancers.

So when scientists want to show the immune system one of those identikit pictures of what it should target, the aim is to produce something that replicates the protein from the foreign body. What makes BioNTech different is that it doesn’t try to make these proteins itself: it gets the body to make them instead.

“Making proteins is complex – they tend to come in a variety of shapes and it’s hard to get them exactly right,” Ms Ogden said. “But if you use the molecule that tells the body how to make the protein you want, you avoid that problem. And that molecule, called mRNA, is easier for a drugs company to make than a protein. You get the human body to be the protein manufacturing site.”

BioNTech specialises in selecting which mRNA to make and how to make it. In time it hopes to be able to select and produce mRNA coded for the signature cancer proteins from an individual patient – so-called “personalised cancer vaccines”.

“It has the technology platform for this, which includes a database of the genetic makeup of tumours,” Ms Ogden said. “As investors we look for big leaps in technology. There are lots of diseases caused by a lack of a protein or a faulty protein and mRNA therapeutics could get the body to make the correct one.

"There is the potential for the mRNA platform to disrupt existing methods and become a significant new means to treat diseases.” BioNTech’s Covid-19 vaccine takes the form of mRNA.

“The value of this company is in the vaccine and the realisation that mRNA is going to be a viable drug technology,” Ms Ogden said. “If it works, it is absolutely going to change the vaccine industry.”

She said valuing a company such as BioNTech was something of an “art form” but significant sales were possible if its coronavirus vaccine received approval. “A valuation of five times sales is normal for a good growth company,” she said. “But because of the wider potential of the mRNA platform in the long term the company’s value could double.”

Questor says: buy

Ticker: Nasdaq: BNTX

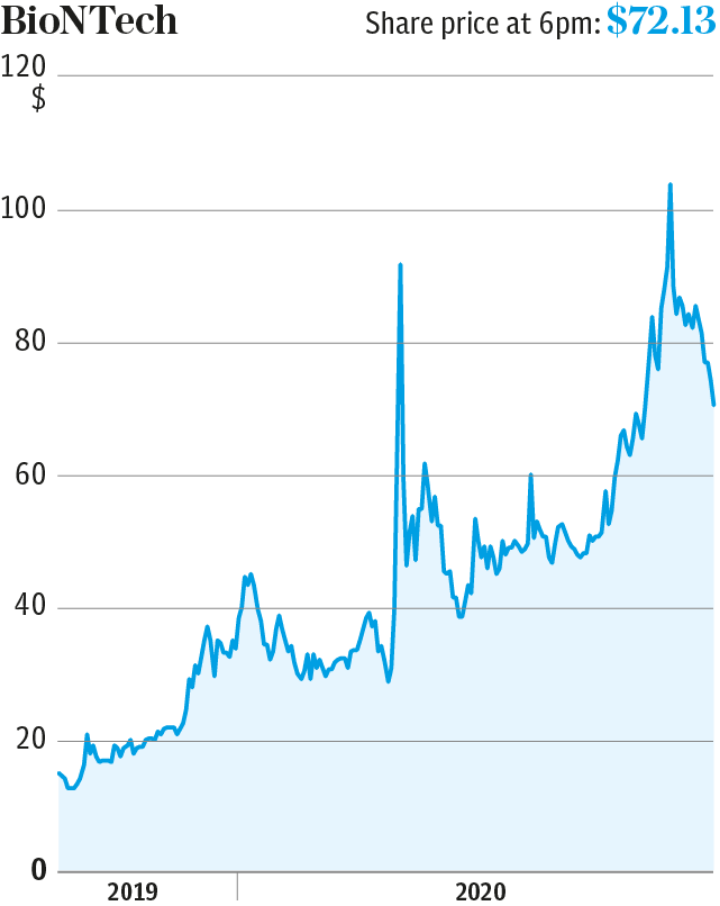

Share price at close: $68.45

Read the latest Questor column on telegraph.co.uk every Sunday, Tuesday, Wednesday, Thursday and Friday from 6am.

Yahoo News

Yahoo News