Questor: how the maker of Tasers is turning itself into an ‘Amazon for police forces’

Google is one; Hoover is another: products whose ubiquity turns them into verbs. Today we look at a third: Taser.

Admittedly, the company that makes these non-lethal weapons changed its name in 2017 to Axon, but its most famous product remains part of the language.

The significance from a business point of view, as Google and no doubt Hoover before it demonstrate, is that when your name is synonymous with the product in the public’s mind, you are very unlikely to have serious competition – or any at all.

So it is with Taser.

“You’re firing a dart on a wire – it has to work but it has to be non-lethal. The company has a key patent. There is no competition – you never hear of another one,” said Ben Rogoff, who holds Axon in his Polar Capital Technology investment trust.

Ironically though, Mr Rogoff became interested in the company only when it started to pair the Taser weapon with a product on which it does not enjoy anything like a monopoly.

Sign up to our Business Briefing newsletter for a snapshot of the day's biggest business stories

Read Questor’s rules of investment before you follow our tips

“Body-worn cameras were the key to the decision to buy the stock,” Mr Rogoff said. “Disputes over the use of Tasers were costing American police departments $2bn (£1.6bn) a year. Bodycams can provide the evidence needed to settle disputes and save the police money. If bought alongside bodycams, Tasers are less controversial and therefore more likely to be bought themselves.”

So Axon sells Tasers and bodycams as a package. In fact is it moving towards renting the package rather then selling it.

“The company wants to move to a recurring revenue model, which reduces the risk that it will lose a police department’s business if its funding is cut,” Mr Rogoff said.

He said the data from the bodycams was stored in the “cloud” – indeed it is the cloud that makes the routine use of the cameras possible – and Axon was looking for ways to use that data profitably.

“Over time you hope to be able to get value from the footage – value both for the company and for the police,” said Mr Rogoff.

“Axon is trying to turn police officers’ cameras into record management tools – if you can find a way to take data from the cameras and use it to generate the records that police departments need to keep, you could reduce costs. It’s all about modernising these departments, many of which currently use antiquated IT systems.”

The firm also offers one software package that collates evidence and another that helps “first responders” by providing them with real-time data on incidents and feeding images from their cameras back to control rooms.

Sales of the firm’s software should benefit from the “network effect”, Mr Rogoff said: “Police departments will copy each other. What starts as a tricky sell ends up as the default.”

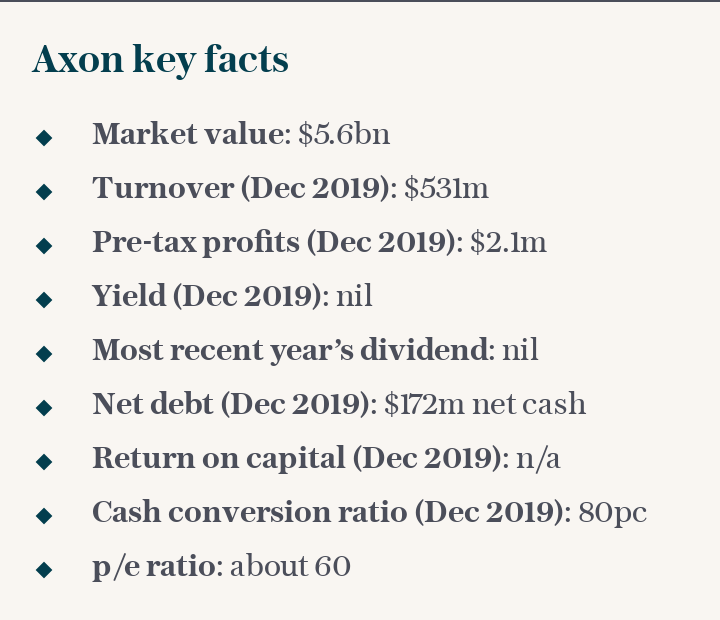

The group’s revenues are currently growing at a rate in the high teens, although Mr Rogoff said it could rise to the mid-20s if software sales picked up as he hoped.

What about profits? They depend on margins, about which Mr Rogoff had this to say: “Right now you want Axon to grow – it’s a story to be judged on sales growth. If you know that a customer, once on board, will stick with you for a decade or more it’s better to get them signed up than worry about what margin they will make for you now.

"What counts is what margins are at maturity. This is how Amazon has worked. You have to believe that Axon can get to peer-like margins of more than 20pc. You almost never get to see the highest growth and the highest margins at the same time.”

He said this made the price-to-earnings ratio “no good” as a means to value the stock.

“It typically trades a bit like a software company – it looks expensive relative to earnings because it is investing aggressively,” he said. “But its dispatch software will be in place forever and if it can sell its new record-keeping software I think it is undervalued. The shares have not fully participated in the most recent strong run in tech stocks.”

Axon looks well on the way to dominating the market for making police forces more modern and efficient. If it succeeds the rewards for investors should be great, although many years’ patience may be needed.

Questor says: buy

Ticker: NASDAQ: AAXN

Share price at 6pm: $88.33

Read the latest Questor column on telegraph.co.uk every Sunday, Tuesday, Wednesday, Thursday and Friday from 6am.

Yahoo News

Yahoo News