Questor: this trust owns ‘the right supermarkets in the right places’ – and it yields 5.3pc

Pubs and restaurants, sadly, will bear the brunt of the Prime Minister’s latest tightening of coronavirus restrictions, which he announced on Tuesday.

Where will the money that we would have spent in bars and bistros go? To the supermarkets.

They filled the gap when eating out was banned entirely in the initial lockdown and will doubtless do the same now that pubs and restaurants have to close at 10pm.

“This year’s unprecedented growth in grocery demand was in a large part triggered by the shift in consumption from eating outside the home in restaurants to eating in the home,” according to Justin King, who led Sainsbury’s for more than a decade.

Writing before the latest measures were announced, he added: “I do not believe we will return to the pre-Covid levels of dining out any time soon and therefore I expect to see strong grocery demand continuing in the foreseeable future.”

A particular type of supermarket is especially suited to thrive in this new world, Mr King said. This type is the store that can cater both to shoppers who actually visit it and to those who order online and have their goods sent to them from that store, rather than from a centralised warehouse dedicated solely to online orders.

Mr King said: “This strict distinction between ‘bricks and mortar’ and online is a false one. The future model of grocery necessitates seamless customer service across all channels in which the customer chooses to shop.

“The vast majority of capacity growth [in online shopping] during the pandemic has come from Sainsbury’s, Tesco and Asda, which operate a largely ‘in-store pick’ model. Hence nearly all of that growth has come from ‘omnichannel’ supermarkets rather than centralised automated hubs.”

He said more than 80pc of online grocery orders were fulfilled from omnichannel supermarkets operating as a “last-mile hub for both online and offline sales”.

Mr King said the use of giant centralised warehouses might be economic when they were close to large cities such as London. But in other cases the extra cost of delivery from remote hubs would outweigh the efficiency gains of automation in the picking process, he said.

As a result, picking online customers’ orders in stores close to where those customers lived would in most cases be better.

“It’s clear the larger supermarkets operating a truly omnichannel operation with in-store pick capacity were best positioned to respond quickly to the pandemic,” Mr King said. “This further underpins the importance of having the right stores in the right locations to be successful in the grocery industry.”

We have quoted Mr King at such length because it is that idea of “having the right stores in the right locations” that lies at the heart of the strategy of an investment trust we tipped in the early stages of the pandemic, Supermarket Income Reit.

Mr King’s quotes appeared in the trust’s annual report – he is a senior adviser to its management company, Atrato Capital.

The trust has recently added Waitrose to its original tenant roster of Tesco, Sainsbury’s and Morrisons, and continues to focus on stores that are able to meet both online and in-person demand.

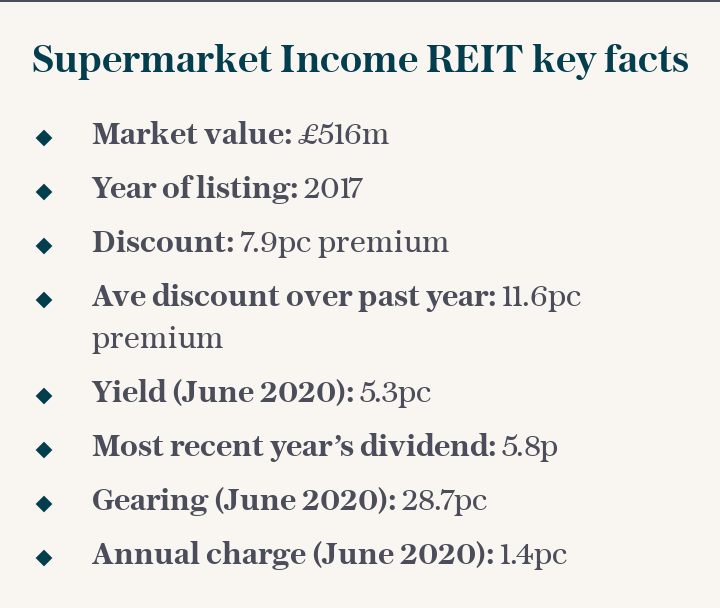

The fund has grown quickly in the past year: the value of its portfolio was £477m at its year end in June, compared with £231m a year previously, and since then it has announced plans to raise more money from shareholders to buy more assets. Private investors can take part via the PrimaryBid platform.

Sign up to our Business Briefing newsletter for a snapshot of the day's biggest business stories

Read Questor’s rules of investment before you follow our tips

Not only are its tenants financially solid but they are tied into long-term leases that involve “upward-only” inflation-linked rent increases.

As a result of this, and of the trust’s 100pc record of rent collection during the pandemic, it intends to increase this year’s dividend in line with inflation (on the RPI measure, normally more generous than the CPI) to 5.86p from 5.8p in the year to June.

At last night’s share price of 109p the new divi would give a yield of 5.3pc while the premium to net asset value is 7.9pc. Such a high yield, based on a secure and rising income stream, appears strikingly attractive to Questor when Bank Rate is 0.1pc. A strong hold.

Questor says: hold

Ticker: SUPR

Share price at close: 109p

Update: Temple Bar

This trust has announced its new manager. We will report in more detail next week.

Read the latest Questor column on telegraph.co.uk every Sunday, Tuesday, Wednesday, Thursday and Friday from 6am.

Yahoo News

Yahoo News