Quibi’s Jeffrey Katzenberg & Meg Whitman Detail “Clear-Eyed” Decision To Shut It Down

EXCLUSIVE: “There was no question that keeping us going was not going to have a different outcome, it was just going to spend a whole lot more money without any value to show for it,” Jeffrey Katzenberg told Deadline on Wednesday in his first interview after the decision to shut down Quibi just six months after getting it up and running. “So, out of respect for these people that put up this extraordinary amount of capital to do it, that’s irresponsible and we both felt we shouldn’t do it,” the former DreamWorks Animation boss added.

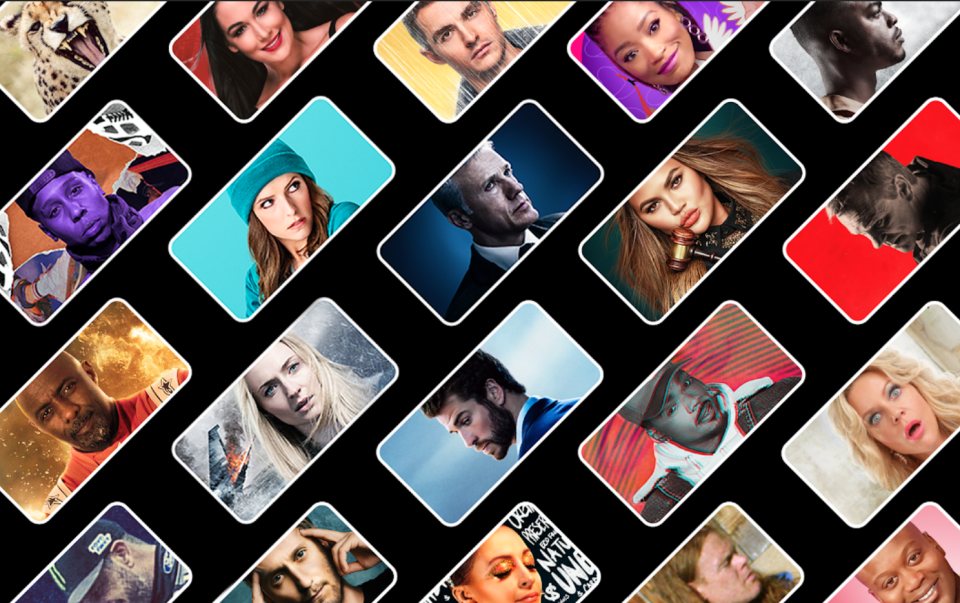

Initiated by Katzenberg more than two years ago and led by former eBay chief Meg Whitman, the ambitious mobile subscription-video platform had over $1.7 billion in investment from Disney, NBCUniversal, Sony Pictures, MGM, the entities now known as WarnerMedia and ViacomCBS, as well as Wall Street’s Goldman Sachs and JPMorgan Chase. With a premise of delivering original short-form programming via smartphones to an America on the go, the much-hyped and well-promoted Quibi app debuted in April, as the coronavirus pandemic kept millions at home in quarantine and lockdown.

With the long anticipated official announcement today, around $350 million still in the bank, and a virtual town hall meeting with most of Quibi’s 200-strong staff about to start, Katzenberg and CEO Whitman spoke with me about their decision. The longtime friends revealed what happened to their dream and how their years in the media industry helped them make the call to pull the plug. Katzenberg and Whitman also outlined their plan to bring the company in for its final landing and the hope there is someone out there to buy the assets.

DEADLINE: So Jeffrey, how does Quibi come to its end now?

KATZENBERG: There’s a wind-down that will take place over the next couple of months, Dominic. I think the first most important thing for us I would say…well, there’s two. In every decision that we make from today forward we need to do right by this incredible group of employees, these daring entrepreneurs who joined Meg and I on this adventure. We have a tremendous obligation to help them transition from us into whatever their next opportunity is going to be and I have to say there’s not a single one of them that isn’t going to land in some incredibly great situation.

But this is a tough time, we are in the middle of a pandemic and I think we want to be incredibly sensitive and most of all supportive of transitioning our employees and helping them with a good landing.

Equally important is to wind down the business in a way in which we’ll be able to return the max amount of money to our investors. We want to maximize the return to our investors here and those numbers are going to be sizeable. We are going to return a lot of money to them.

DEADLINE: When did the two of you make the decision to wind things down?

WHITMAN: We tried a lot of different things over the summer, whether it was payment-less free trial, 90-day free trial, 14-day free trial. We changed marketing around entirely to be more title marketing than platform marketing, which we made a lot of changes and we also you know, tried a completely different business model in Australia. And ultimately none of it really changed the fundamental answer, that we needed more capital and we needed more capital relatively soon.

And so I would say it’s just been a journey for Jeffrey and I as we’ve looked very clear-eyed at the data and said what’s the right thing to do. In order to get to scale we would have to raise more capital, a lot more capital and we would need to be raising it in the first part of next year. And we don’t think that we would have the data and the metrics to support another capital raise at that point.

Ultimately probably a couple weeks ago we said, you know, the right thing to do, the hard right but the right thing to do is to return cash to shareholders.

DEADLINE: Which is where you intend to see this conclude?

WHITMAN: Yes and make sure that we land this as well as we can. And I think for me it’s a bit of maturity.

DEADLINE: How do you mean?

WHITMAN: Most entrepreneurs just keep on going because they literally run out of money and we just didn’t think that was the right thing to do.

DEADLINE: In so far, that you could see, based on past experience, how this story was going to end?

WHITMAN: We did. We could see it really clearly after all the experimentation and pivots that we did over the summer and frankly into September.

DEADLINE: Jeffrey, Meg has pointed out some of the issues were cash flow, and certainly in this town in this climate, people aren’t spending oodles of money. But what about outside resources, a SPAC offer I heard about and others. Why wasn’t the environment there to make Quibi work financially?

KATZENBERG: Well, I think Meg has really addressed the internal part of your question, Dominic, in that we just were not scaling fast enough. You know, given the investment that we were making, the quality and the quantity of the content that we were doing, we needed to really come out of the starting gate in a very big way in order for this to work.

Now, how much of this was impacted by COVID will always be unknown.

DEADLINE: How so?

KATZENBERG: Well, everything about Quibi was designed to be on the go, in-between moments at a moment in time which no one was on the go and their in-between moments were on their couch, and suddenly we were competing for people’s attention in a way that we never conceived of or thought of.

To answer the rest of your question there which is, is that over these past three weeks we have aggressively looked at strategic partners, potential acquirers, additional funding and financing. Every one of those stones was turned, every one of them. I mean, every possible avenue, because the last thing in the world we wanted to do was shut down.

I mean, we loved doing what we’re doing.

We are proud of the work that our team is doing and we wanted to keep going but you know, as Meg said maybe it is the years of experiences here. There was no question that keeping us going was not going to have a different outcome, it was just going to spend a whole lot more money without any value to show for it. So, out of respect for these people that put up this extraordinary amount of capital to do it, that’s irresponsible and we both felt we shouldn’t do it.

DEADLINE: Was there pressure from the studios who invested?

KATZENBERG: We weren’t pressured by anybody about it one way or another…

WHITMAN: It was the right thing to do.

KATZENBERG: Yeah.

WHITMAN: Yeah, the right thing to do.

KATZENBERG: Meg has an expression that’s in our value proposition, which is the hard right versus the easy wrong. So, I would say this easily and comfortably fits into one of the fundamental tenants that we wanted to build Quibi on, do the hard right.

DEADLINE: In these hard times…

KATZENBERG: Well, yes and I think the big question will always be was it that the idea of a standalone streaming premium short form platform wouldn’t work, or is it that we got caught in a pandemic?

DEADLINE: What do you think?

KATZENBERG: I think Meg and I are agreed that it’s probably a mix of those two things, it’s some of each. We are not solely a victim of COVID but for sure it had a pretty extreme impact on how we conceived and launched the business.

DEADLINE: Meg, there’s going to be a lot of armchair punditry on the end of Quibi, that there were traditional and slower start-up methods you could have used and so on. But from your perspective in the chair, the real chair, what were some of the things that you think now, could have been different from the start?

WHITMAN: Yeah. Well, you’re right, Monday morning quarterback is usually easier.

Listen, we made very deliberate decisions. Here’s the good news, we didn’t do things without thinking about it. We thought about should we have living room apps and we said, you know what? We’re going to be mobile only because we really thought our use case was 7 in the morning ‘til 7 at night while you were on the go, so why would you need a living room app?

And so we thought about it and we said you know, in the prioritization of engineering tasks and engineering projects that wasn’t at the top of the list. Now right after we launched and the pandemic, within a couple of weeks we had AirPlay and Chromecast launched so that helped our living room access. But we thought about it.

DEADLINE: I guess the general POV from the cheap seats is that the big launch was a costly overstretch?

WHITMAN: Likewise we thought about did we want to do a soft launch or did we want to do a launch with a lot of attention around it. We said we think that’s the right thing to do because as Jeffrey said, we needed to…we were creating a whole new category so we needed a large number of people to think about it and a large number of people to try it, and they did. We had 600 thousand new users in the first week.

So I wouldn’t go back and change that. We thought about it and we did the right thing, even though we are where we are.

You can always go back and say woulda, coulda, shoulda but I think the good news is there isn’t much that people have brought up that we didn’t think about and consider. You might go back and redo, but we thought about it at the time and perhaps made a different decision.

DEADLINE: Jeffrey, you hold a considerable and I might add Emmy-winning library. I know that there has been discussions about selling the library. Where is that, and in terms of individual shows like for instance CBS with the renewed Most Dangerous Game, but then there’s this two-year window. How will all that be affected going forward? Will that window collapse if someone buys or takes back a property? Can they move forward with it instantly?

KATZENBERG: Well, I think those are things that will reveal themselves in time. I think these are all things that we are working through, Dominic. This is going really, really fast.

I think the first opportunity that we think will exist is for Quibi as a service and its content to continue on, on somebody else’s platform. That’ll be the first thing that we will want to explore with potential buyers. It is one of the big assets of the company; a hundred shows, an incredible development slate, and as you said some things that have been both big hits but also you know, critically acclaimed, award winning and critically acclaimed. So that library in its totality, the Quibi service in its totality, is going to be made available to potential buyers.

DEADLINE: Jeffrey, you mentioned development. What will be the status of that? Will shows continue to develop for production or is that going to pretty much hit the pause button?

KATZENBERG: Well, it’ll hit the pause button until we see if there is a home for the Quibi service. Our guess is, is that if there is a home for the service they will want to continue on you know, with the development and with the content that’s in the pipeline here. There’s a very, very full pipeline of content that we think is going to be very valuable.

Remember, we have 28 movies that are in the can here and that are I think really, really strong movies and titles with the biggest stars and incredible talent with them that are really great marquee shows. We have 28 movies available at a moment in time in which you know, there seem to be many platforms that are looking for content because of the impact of COVID.

DEADLINE: Both of you have been around a long time, you’ve been to a lot of rodeos before this We are seeing in the industry right now unprecedented change in the corner offices, in layoffs and restructurings and perhaps of the cinema-going experience. In that context, what insights, what battle scars would you offer to others who are looking around in what just seems to be a tumultuous time of endless change?

KATZENBERG: Change is hard, particularly when it’s at its extreme which our industry is certainly grappling with here. But that’s when the biggest opportunities reveal themselves, Dominic. So, as difficult as it may seem right now for the movie business, for the network business, for the studio business, it is the moment in which great, great successes and opportunities are going to come.

WHITMAN: To underscore what Jeffrey said, I think change begets opportunity. Every time there is a change in an industry, whether it’s the economic structure or the business models or it’s the creative process or delivery mechanisms, it signals opportunity and that’s one of the things we saw here that change signals opportunity. It didn’t work out for us but it doesn’t mean it won’t work out for existing players or other new players.

DEADLINE: What’s next?

WHITMAN: I do not know.

KATZENBERG: I’m going to Disneyland.

DEADLINE: You better ask Gavin Newsom about that, Jeffrey, it could be a few more weeks off…

KATZENBERG: I’m going. When he’s ready I’m ready. I’m going to Disneyland.

But, also, on the other side of it, Dominic, how often do you get to dream as big a dream, as big an idea as Meg and I did and honestly just get the opportunity to actually go and do it? I think that’s the thing that we are so grateful to our employees and to our investors and all of the partners that allowed Quibi to be and for us to have this amazing two-year journey building this thing that we’re so proud of.

More from Deadline

Best of Deadline

Coronavirus: Movies That Have Halted Or Delayed Production Amid Outbreak

Hong Kong Filmart Postponed Due To Coronavirus Fears; Event Moves Two Weeks Before Toronto

Sign up for Deadline's Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.

Yahoo News

Yahoo News